Blog-Reference and Blog-Reference

The failed scientist and applause troll, attention/reputation manager, political agenda pusher, crime hunter, academic busybody, storyteller, and falsifier of the history of economic thought Barkley Rosser takes the opportunity to erect the next false-hero memorial.

These are Barkley Rosser’s quality criteria: “But he was always further out on the edge of respectability, even though his career always looked respectable on the surface: a PhD from MIT under Robert Solow and holding positions at Yale, MIT, and Harvard since 1989, as well as regularly publishing in top journals from 1965 on.”

This translates into: During his academic career, he was most of the time either indirectly or directly on the payroll of billionaire-sponsors.#1

What about the contributions of real scientific worth?

“This famous paper reasonably argued that in a world of non-certainty regarding costs and benefits of environmental policies, the use of a tax versus a quantity control such as cap and trade depended on the relative slopes of the marginal cost and marginal damage functions. If the former is steeper then a price-oriented policy such as a tax is preferred whereas if the marginal damage function is steeper than a quantity-oriented policy such as cap and trade would be preferred.”

This translates into Martin Weitzman never realizing that Marginalism and the Totem-of-the-Micro are proto-scientific garbage since Jevons/Walras/Menger.#2

With all these credentials, Martin Weitzman was, of course, a worthy candidate for the faux Nobel: “Several of us here had long advocated that he share the first Nobel Prize to be given for environmental economics.”#3

Yes, obituaries have always been the best place to plant myths. And nobody does this better than Barkley Rosser, the promoter of fake science and suppressor of genuine science.

For the scientific community, it holds vis-a-vis all cargo cult scientists: RIP at the Flat-Earth Cemetery.

Egmont Kakarot-Handtke

#1 “MIT is giving Jeffrey Epstein’s tainted donation to a charity, but Harvard says it won’t do the same”. Twitter

#2 What is so great about cargo cult science? or, How economists learned to stop worrying about failure

#3 Links on the Economics Nobel

Related 'The Palgrave Dictionary ― a comprehensive collection of false-hero memorials' and 'Economics textbooks ― tombstones at the Flat-Earth-Cemetery' and '“I never learned maths, so I had to think” ― another false-hero memorial' and 'What comes first: eco-self-destruction or oeco-self-destruction?'.

***

REPLY to Barkley Rosser on Sep 1You say: “Egmont, your vacuous profit law is completely irrelevant to whether or not marginal social cost curves or marginal social damage curves regarding environmental problems are useful or meaningful concepts.”

The Profit Law is not at issue in the given context. What is at issue is the irrelevance of Marginalism which is already dead for 150+ years because it consists of plain NONENTITIES. So, the question “whether global warming is better addressed by using taxes or some kind of quantity control” is at the same level as How many angels can dance on a pinpoint?

Standard economics is based on these hardcore propositions: “HC1 economic agents have preferences over outcomes; HC2 agents individually optimize subject to constraints; HC3 agent choice is manifest in interrelated markets; HC4 agents have full relevant knowledge; HC5 observable outcomes are coordinated, and must be discussed with reference to equilibrium states.” (Weintraub)

This set is chock-full of NONENTITIES. The whole of Marginalism derives from the core behavioral assumption HC2 which is a NONENTITY like the Tooth Fairy or the Easter Bunny. From the Walrasian axioms, the triad SS-function―DD-function―equilibrium is derived. Leijonhufvud called this defective analytical tool Totem of the Micro/Totem of the Macro. Because there is NO such thing as supply-demand-equilibrium the whole of economics is vacuous.

It is plain to every person with more than two brain cells that any analysis that crosses an upward-sloping and a downward-sloping curve is proto-scientific idiocy. So, every economist who blunders about “relative slopes of the marginal cost and marginal damage functions” is either stupid or corrupt or both.

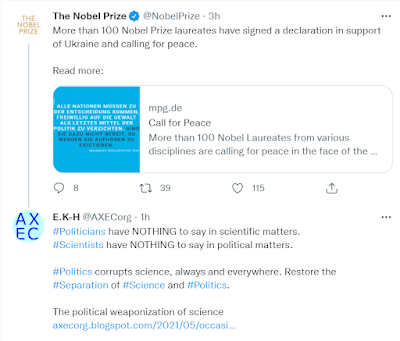

Global warming is an issue for scientists. It is generally known by now that economists are fake scientists, so they have NOTHING to contribute to the discussion. Actually, global warming is used by academic economists under the label of the Green New Deal to deceive WeThePeople.#1, #2 Instead of defunct microfoundations, MMTers apply macrofoundations that are dead since Keynes. Both microfoundations and macrofoundations are provably false, so economists have NOTHING to add to a scientific discussion.

If you were a scientist you would not push for the erection of false-hero memorials but instead, push for the end of the 200+ years of mob rule of incompetent scientists and political fraudsters.

#1 MMT and the Green New Deal: Where is the snag? (I)+(II)

#2 Bill Mitchell’s dishonorable discharge from the sciences

***

REPLY to Barkley Rosser on Sep 2“In order to tell the politicians and practitioners something about causes and best means, the economist needs the true theory or else he has not much more to offer than educated common sense or his personal opinion.” (Stigum)

The fact is that both microfounded and macrofounded economics are provably false. Economists do not know how the monetary economy works. There is no valid Employment-, Profit-, Distribution-, or Money Theory. So, economic policy guidance NEVER had sound scientific foundations since the days of Adam Smith.

The fact is that the so-called free market economy is on the life support of the State and Wall Street is on the life support of the Central Bank. Macroeconomic profit is in the main produced by public deficits. Financial wealth grows in lockstep with public debt. The Oligarchy, in turn, uses the opulent free lunches to corrupt what remains of the State’s legislative, executive, and judiciary institutions.

The proof has been given that economists are too stupid for the elementary math that underlies macroeconomics.#1 Because macroeconomics and microeconomics are materially/formally inconsistent economists have NOTHING to contribute to the solution of any problems between unemployment and global warming.

So, what is lacking in economics is the true theory. Economics is a scientific failure. This is bad enough. But then comes the absurdity on top of all the proto-scientific garbage which consists of rewarding fake scientists with the faux Nobel.#2

#1 Deficit cheerleaders ― the Oligarchy’s useful idiots, Aug 27

#2 Links on the Economics Nobel

***

REPLY to Barkley Rosser on Sep 5You say: “Let us get real. There is a very serious problem known as global warming. Do you deny that it exists?”

I say: Let us get real. There is a very serious problem in economics of scientific failure/fake/fraud. Do you deny that it exists?

You abuse an obituary to distract from the fact that economists have to this day no valid theory about how the economy works and that they are too stupid for the elementary math that underlies macroeconomics and that their policy guidance has no sound scientific foundations since Adam Smith. Instead, you portray economists as saviors of the planet and humanity.

Economics is not a science. Economists are incompetent scientists. Martin Weitzman was part of an institutional system that is rigged from textbooks to peer reviews to the faux Nobel. Do you deny that it exists and that you, too, are part of it?