Blog-Reference and Blog-Reference

Barkley Rosser reports: “In the mid-90s the US grew better than it had previously, and in the middle of the decade there was an important moment regarding policy. There was no inflation directive but Fed Chair Greenspan was facing a de facto such directive based on central Fed estimates that there was a known ‘natural rate of unemployment (= NAIRU)’ that must not be passed. As it was then Fed Gov Janet Yellen in the mid 90s convinced Greenspan not to raise interest rates partly because of a paper by her husband, Noblelist George Akerlof.”

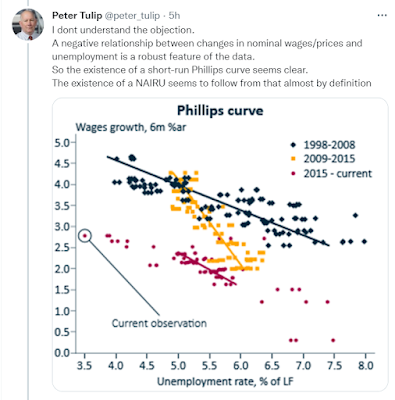

The NAIRU Phillips Curve is the centerpiece of standard employment theory. Economists get employment theory wrong for 200+ years now. This has dire consequences for economic policy and ultimately for WeThePeople.

“In order to tell the politicians and practitioners something about causes and best means, the economist needs the true theory or else he has not much more to offer than educated common sense or his personal opinion.” (Stigum)

Economists do not have the true theory. By consequence, economic policy guidance has NO sound scientific foundations. This holds from Adam Smith onward to the policy of the Federal Reserve.

The NAIRU Phillips Curve has always been proto-scientific garbage.#1 The correct (macrofounded, systemic, behavior-free, testable) employment theory boils down to the structural-systemic Phillips Curve which is shown on Wikimedia.#2

From the macroeconomic Employment Law follows:

(i) An increase in the expenditure ratio ρE leads to higher employment L.

(ii) Increasing investment expenditures I exert a positive influence on employment.

(iii) An increase in the factor cost ratio ρE≡W/PR leads to higher employment.

The complete Employment Law contains in addition profit distribution, the public sector, and foreign trade.

Item (i) and (ii) cover the familiar arguments about aggregate demand/deficit spending. The factor cost ratio ρF as defined in (iii) embodies the macroeconomic price mechanism. The fact of the matter is that overall employment INCREASES if the average wage rate W INCREASES relative to average price P and productivity R. Or, the other way round, overall employment DECREASES if the average price P INCREASES relative to average wage rate W with productivity R unchanged. Roughly speaking, price inflation is bad for employment, and wage inflation is good.

This is the exact opposite of what standard economics teaches: “We economists have all learned, and many of us teach, that the remedy for excess supply in any market is a reduction in price. If this is prevented by combinations in restraint of trade or by government regulations, then those impediments to competition should be removed. Applied to economy-wide unemployment, this doctrine places the blame on trade unions and governments, not on any failure of competitive markets.” (Tobin)

The testable Employment Law tells one that the best policy to stabilize employment on a high level is price inflation of zero and wage inflation equal to productivity increases. The 2 percent inflation target has always been political idiocy.

Egmont Kakarot-Handtke

#1 For details of the big picture see cross-references Employment/Phillips Curve

#2 Wikimedia AXEC36 Structural-systemic Phillips Curve

***

REPLY to Barkley Rosser on Jul 31Continuing your theatrical performance you exclaim: “Oh, Egmont, in the end you say all this is empirically testable, but you simply do not cite a single empirical test that has been done, …”

From Samuelson’s bastard ‘Phillips’ Curve to the NAIRU ‘Phillips’ Curve economists got employment theory wrong.#1, #2, #3

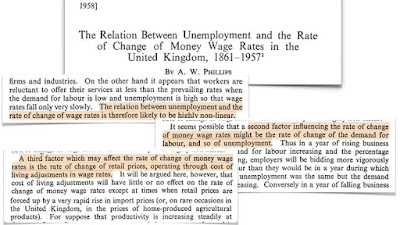

There were tons of tests of these misspecified curves but there never was a test of the correct structural-systemic Phillips Curve for the simple reason that economists had no idea of it.#4 More specifically, economists never realized that the macroeconomic relationship between employment and (average) wage rate is positive despite the fact that this is what the original Phillips Curve said based on “more than a century’s worth of data for the United Kingdom” (Phillips).

Because economists without exception tested misspecified ‘Phillips’ Curves it is impossible for anyone to cite a valid test. For the same reason, you cannot cite a single test that refutes the objective-structural-systemic-behavior-free-macrofounded Phillips Curve which implies the positive relationship between employment and wage rate of the empirically derived original Phillips Curve.#5

Note that Samuelson’s ‘Phillips’ Curve is a fake.#1 Phillips “had not made an explicit link between inflation and unemployment” (Ormerod). Phillips had empirically found a link between wage rate and unemployment that reappears in the structural-systemic Phillips Curve.

So, the original Phillips Curve delivers the strongest empirical support for the structural-systemic Phillips Curve that is available at the moment.

#1 NAIRU, wage-led growth, and Samuelson’s Dyscalculia

#2 NAIRU and the scientific incompetence of Orthodoxy and Heterodoxy

#3 NAIRU: an exhaustive dancing-angels-on-a-pinpoint blather

#4 Keynes’ Employment Function and the Gratuitous Phillips Curve Disaster

#5 Go! ― test the Profit and Employment Law

***

REPLY to Barkley Rosser on Aug 1You say: “… the original Phillips Curve was a negative relationship between the rate of unaemployment and the rate of change of wages, not the level of wages.”

Yes, indeed, and Samuelson messed the whole thing up: “The original curve was transformed by Samuelson with the simple formula: rate of inflation = rate of wage growth − rate of productivity growth (Samuelson and Nordhaus, 1998, p. 590); in our notation P'=W'−R'. This formula, according to Samuelson an ‘important piece of inflation arithmetic’, says that price inflation runs in tandem with wage inflation and that both have basically the same effect on employment respectively the rate of unemployment. The difference between the original and the bastard Phillips curve consists of a 1 percent productivity growth. This naïve arithmetical exercise led to the far-reaching policy conclusion that there exists an exploitable trade-off between inflation and unemployment.”#1 page 13, #2

The correct relationship between the rates of change is W'/P'R' which roughly says that an increasing wage rate W' increases employment/decreases unemployment and that price increases P' reduce employment/increase unemployment. This means that there is NO trade-off between inflation and unemployment, just the opposite. The complete formula is derived in #1.

The axiomatically correct structural-systemic Phillips Curve (i) refutes the Bastard/NAIRU Phillips Curve, (ii) contains NO methodological idiocies like rational expectations, (iii) consists exclusively of measurable variables, (iii) is testable.

From the fact that economists have not yet tested the correct curve follows only that economists are either stupid or corrupt or both. Of course, if you are NOT committed to scientific standards you are free to ignore the refutation and to stay at the proto-scientific level and to continue to mislead students and to give counter-productive policy advice and remain a hazard to your fellow citizens.

#1 Keynes’ Employment Function and the Gratuitous Phillips Curve Disaster

#2 NAIRU, wage-led growth, and Samuelson’s Dyscalculia