#Economics#FailedFakeScience#Economists#StupidOrCorruptOrBoth

— E.K-H (@AXECorg) November 6, 2023

In economics, messing up the foundational concepts has kept everything firmly at the proto-scientific level for 200+ years.

Profit, income, and the Humpty Dumpty Fallacyhttps://t.co/yG5vkVJrnd pic.twitter.com/GIUYTsRvsQ

This blog connects to the AXEC Project which applies a superior method of economic analysis. The following comments have been posted on selected blogs as catalysts for the ongoing Paradigm Shift. The comments are brought together here for information. The full debates are directly accessible via the Blog-References. Scrap the lot and start again―that is what a Paradigm Shift is all about. Time to make economics a science.

November 6, 2023

Occasional Xs: Clueless economists / Profit (XV)

July 30, 2022

Occasional Tweets: Humpty Dumpty ― economic methodology in a nutshell

#Economics#FailedScience#FakeScience#Economists#StupidOrCorruptOrBoth

— E.K-H (@AXECorg) July 30, 2022

The Humpty Dumpty methodologyhttps://t.co/Fk1s6Wgrur pic.twitter.com/OwZI1uXvwc

December 28, 2021

Occasional Tweets: Again and again ― the "profit is part of income" idiocy

Since Adam Smith economists get the foundational economic concepts #Profit and #Income wrong. Note that income is a #Flow and profit is a #Balance and #Economists are too stupid to understand the categorical difference.⇒https://t.co/mGL31nniSI pic.twitter.com/EeXTj25HKd

— E.K-H (@AXECorg) December 28, 2021

August 4, 2021

Occasional Tweets: Flow-Balance-Inconsistency ― inscription on the gravestone of economics

#Economics#FailedScience#FakeScience#Economists#StupidOrCorruptOrBoth

— E.K-H (@AXECorg) August 4, 2021

The Flow-Balance-Inconsiststency invalidates all micro- and macroeconomics of the last 200+ years.

The GDP-death-blow for the economics professionhttps://t.co/QJycQUh0Uj pic.twitter.com/ySKW1UxqSy

March 15, 2021

Occasional Tweets: Proof of MMT's inconsistency

The foundational #MMT #SectoralBalances equation is provably false. Because the #MacroFoundations are false, the whole approach is scientifically worthless. For the proof see

— E.K-H (@AXECorg) March 15, 2021

Proving Bill Mitchell wrong ― burying MMT for goodhttps://t.co/ZiXO1tFHHp pic.twitter.com/BC80QB71uE

- Political fraud and the silence of academia

- MMT: fraudsters united

- MMT: The new Center of the Universe of political fraud

- A less than 320 words explanation of why MMT is a fraud

- Macro ignorance: Why Simon Wren-Lewis does not come to grips with the plain MMT-fraud

- Economics: The greatest scientific fraud in modern times

- MMT is an economic policy fraud

- MMT’s virtue-signaling distracts from failure/fraud

- MMT: From science to agenda-pushing to story-telling to fraud

- MMT: Not a joke but a fraud

- Deficit-spending, public debt, and macroeconomic profit/loss

- On the saying “We owe the debt to ourselves”

- Warren Mosler: scientific dilettante and political fraudster

- MMT is NOT bold policy but spineless fraud

- #PublicDeficitIsPrivateProfit #MMT #JustAnotherFraud

- The Magic Money Tree is real ― too bad that the magic is a fraud

- The Kelton-Fraud

- MMT: How mathematical incompetence helps the Kelton-Fraud

- Down with idiocy!

- The MMT fraud in slow motion, so that even economists can get it

- Wikipedia and the promotion of economists’ idiotism (I)

- Wikipedia and the promotion of economists’ idiotism (II)

- Rectification of MMT macro accounting

- The state of MMT? Stone-dead!

- MMTers: too stupid for simple math

- MMT and the magical profit disappearance

- MMT: The one deadly error/fraud of Warren Mosler

- Humpty Dumpty is back again

September 29, 2020

Economists’ scientific incompetence is worse than the plague

|

| Source: Michael Robert's Blog |

November 2, 2019

Macroeconomics and the vacuous History of Economic Thought

Own post and Blog-Reference and Blog-Reference on Nov 7

Napoleon is supposed to have said “History is a myth agreed upon.” or “History is a set of lies people have agreed upon”. This, of course, holds also for the History of Economic Thought.

Economics has been a scientific failure for 200+ years. The major approaches — Walrasianism, Keynesianism, Marxianism, Austrianism, and their derivatives — are mutually contradictory, axiomatically false, and materially/formally inconsistent. Yet, on top of the heap of proto-scientific garbage, George Akerlof tries to erect a false-hero memorial for MIT: “The primary public policy lesson of Keynesian economics ― that we now knew how to respond to economic downturns ― had been a hard-won fight. It had been fought for decades, with high stakes: nothing less than the maintenance of full employment, rather than lapses into Great Depression.” and “The great public policy question of the day ― how to fight underemployment ― had thus also been solved. This message, significantly homegrown at MIT, was revolutionary relative to the thinking of the early 1930s, when economists could reach no clear consensus regarding how to restore full employment.”

This is a clear case of auto-hypnosis which is the defining characteristic of economists and it traditionally finds expression in the self-propagation of economics as the Queen of Social Sciences.

And this is how MIT economists pulled off their PR stunt: “At the time, Paul Samuelson of MIT was the world’s most famous living economist, known for his Foundations of Economic Analysis and for his numerous articles, but especially for his bestselling introductory textbook. Its early editions began with macroeconomics based on the keystone ‘Keynesian cross’ diagram of Samuelson’s invention, which was the uncontested heart of macroeconomics at MIT.”#1

That much is correct, Samuelson started the economics textbook industry. Needless to emphasize economics textbooks are scientifically worthless to this day.#2, #3

And this is in detail how the hallucinatory scientific revolution happened: “As a reminder, the Keynesian cross plots income on the horizontal axis and expenditures on the vertical axis. Equilibrium occurs where income and expenditures are equal ― along a 45-degree line from the origin ― but this equilibrium could occur either as a ‘deflationary gap’ below full employment, or at full employment, or as an ‘inflationary gap’ above full employment. The analysis behind the figure explored the consequences of observing that, as Keynes had claimed, equilibrium income occurs where desired savings equals desired investment.”

The first methodological blunder was, of course, to apply the equilibrium concept. Samuelson failed to realize that equilibrium is a NONENTITY.#4, #5, #6, #7 The second fatal blunder was inherited directly from Keynes.

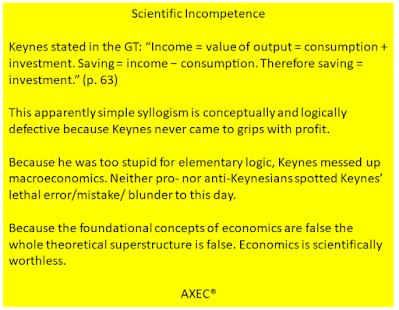

The formal basis of the General Theory is given with: “Income = value of output = consumption + investment. Saving = income − consumption. Therefore saving = investment.” (p. 63)

This elementary syllogism is conceptually and logically defective because Keynes did not come to grips with profit: “His Collected Writings show that he wrestled to solve the Profit Puzzle up till the semi-final versions of his GT but in the end he gave up and discarded the draft chapter dealing with it.” (Tómasson et al.)#8

Let this sink in: Keynes had no idea of macroeconomic profit.

Because the foundational concepts of profit/income are ill-defined the whole analytical superstructure of Keynesianism is provably false. Samuelson, though, did not realize that the Keynesian macrofoundations were fatally flawed, and neither did Post Keynesians, New Keynesians, and Anti-Keynesians to this day.#9, #10, #11

Practically this means that economic policy guidance has NO sound scientific foundations since Adam Smith. Economists bear the intellectual responsibility for the social devastation of economic crises.#12

Because both Walrasian microfoundations and Keynesian macrofoundations are defective the so-called Keynesian-Neoclassical Synthesis is provably false, in particular, all IS-LM models #13, #14, and all Phillips-Curves #15, #16 (except the original one) are proto-scientific garbage.

This, of course, is not the conclusion of George Akerlof. The standard excuse for permanent failure is that economists are struggling scientists and prone to error and neglect like anybody else: “The Keynesian-neoclassical synthesis that had emerged by the early 1960s put constraints on macroeconomics. Foremost, it divorced macroeconomists from working on financial stability. Luckily, after the crash of 2008, the prior work of finance economists has been belatedly acknowledged, and the subfield of macro stability has also emerged as quite possibly the most vibrant research frontier in economics.”

The general public appreciates the humbleness of what it is told are Nobel-worthy scientific geniuses.#17 These repeating We-were-a-bit-wrong-then-but-now-we-are-vibrantly-on-the-right-track confessions are part of the PR stunt called economics. The fact of the matter is: economics is NOT science but political agenda-pushing and economists are NOT scientists but clowns and useful idiots in the political Circus Maximus.#18

The History of Economic Thought, including the History of Macroeconomic Thought#19, is a fake from Adam Smith onward to George Akerlof and beyond. All this stuff ends up with absolute necessity at the Flat-Earth Cemetery.

Egmont Kakarot-Handtke

* George A. Akerlof, What They Were Thinking Then: The Consequences for Macroeconomics during the Past 60 Years, Journal of Economic Perspectives Vol. 33

#1 “The Keynesian cross diagram is a formulation of the central ideas in Keynes’ General Theory. It first appeared as a central component of macroeconomic theory as it was taught by Samuelson in his textbook, Economics: An Introductory Analysis.” (Wikipedia)

#2 The father of modern economics and his imbecile kids

#3 To this day, economists have produced NOT ONE textbook that satisfies scientific standards

#4 Equilibrium and the violation of a fundamental principle of science

#5 There is NO such thing as supply-demand-equilibrium

#6 What Keynes really meant but could not really prove

#7 Proof of the inherent instability of the market economy

#8 Keynes ― the poster boy for the weakness of the economist’s mind

#9 The elementary production-consumption economy is for a start defined by three macroeconomic axioms (Yw=WL, O=RL, C=PX), two conditions (X=O, C=Yw) and two definitions (Qm≡C−Yw, Sm≡Yw−C). Legend: Yw wage income, W wage rate, L employment, O output, R productivity, C consumption expenditures, P price, X quantity bought/sold.

From these macrofoundations follows the market-clearing price P=W/R (1), which defines the core of inflation/deflation theory, and the average amount of fiat money M=κYw (2).

It always holds Q≡−S (3), in other words, the business sector’s surplus = profit equals the household sector’s deficit = dissaving and, vice versa, the business sector’s deficit = loss equals the household sector’s surplus = saving. This is the most elementary form of the macroeconomic Profit Law. Eq. (3) refutes the Keynesian I=S. For the elementary investment economy holds Q≡I−S. Saving and investment are NEVER equal, neither ex-ante nor ex-post.

#10 Economics for Economists

#11 Keynes’s Missing Axioms

#12 Econogenics in action

#13 The IS-LM macro imbeciles

#14 Mr. Keynes, Prof. Krugman, IS-LM, and the End of Economics as We Know It

#15 Keynes’ Employment Function and the Gratuitous Phillips Curve Disaster

#16 Links on the Phillips Curve

#17 Scrap the EconNobel

#18 There is NO such thing as “smart, honest, honorable economists”

#19 Wikipedia History of macroeconomic thought

Related 'Failed economics: The losers’ long list of lame excuses' and 'Why Post Keynesianism Is Not Yet a Science' and 'Cross-references: Kalecki' and 'Squaring the Investment Cycle'.

You say: “And thus has what to do with this thread, Egmontt? Not a damn ed thing, near as I can tell, and you have bored us with this stuff previously numerous times.”

Time to face reality. The readers of EconoSpeak are tired of your kill-and-dump murder stories (Bin Laden, Khashoggi, Al-Baghdadi). You may be bored reading that macroeconomics is proto-scientific garbage since Keynes. However, it is certainly a sensation for the EconoSpeak audience to learn that your whole academic cohort got the elementary algebra of macro wrong. From this, one may conclude that your foreign policy comments, too, are worth even less than a fart.

I=S ⇒ false macro algebra ⇒ Keynes et al.

Q≡I−S ⇒ correct algebra.

The formal proof has been given in the References which were not uploaded because of space restrictions at EconoSpeak. See #9.

You say: “You have just confirmed that I am right and verified that you are mathematically incompetent and innumerate. There is no algebra problem here. The issue is simply one of competing definitions.”

When confronted with a clear-cut true/false question, the swampies of economics always take the emergency exit of ‘That’s just a matter of definition’. This is excuse No. 26 from my 54-item compilation of economists’ brain-dead methodological blather: “The issue is largely definitional and, as Lewis Carroll pointed out, everyone is entitled to his own definitions. (Blinder)”#1 This is the Humpty Dumpty Fallacy.#2 Definitions have to be consistent. The methodological fact of the matter is that the definitions of profit/income/ saving have been inconsistent for 200+ years.

You say: “So, Egmont, as I have pointed out here on numerous occasions, the US National Income and Product Accounts (NIPS), whose practices are imitated in nearly all nations now, defines investment and savings in a way that I=S, simply by definition.”

Keynes’ I=S rests on the premise “Income = value of output”#3 which is provably false because it implies that macroeconomic profit is zero which is obviously NOT the case. So I=S is NOT true “simply by definition” but empirically false. Q≡I−S is materially and formally correct. The remaining question is whether economists are too stupid for elementary algebra or whether they intentionally let profit disappear from the sectoral balances equations.#4-#10

I am well aware of the practice of NIPS accounting and I have shown in detail where it goes wrong.#11 See, in particular, section 1.9 Cooked transaction recording.

As a fake scientist, you do not address the clear-cut challenge [I=S ⇒ false, Q≡I−S ⇒ true) but appeal to authority (NIPS) and the majority (nearly all nations).

From the fact that all national accountants define things “in a way that I=S, simply by definition” does NOT logically follow that I=S is true but that all national accountants are either stupid or corrupt or both.

What is known for 2300+ years ― except to economists ― is: “The only way to arrive at coherent languages is to set up axiomatic systems implicitly defining the basic concepts.” (Schmiechen)

The methodological fact of the matter is that both microeconomic axioms and macroeconomic axioms are materially/formally inconsistent and this explains why economics is not more than incoherent blather and why the “Bank of Sweden Prize in Economic Sciences in Memory of Alfred Nobel” is a fraud.

Economics has NEVER been anything else than brain-dead political agenda-pushing and your Al-Baghdadi post just proves it again.

#1 Failed economics: The losers’ long list of lame excuses

#2 Humpty Dumpty is back again

#3 “Income = value of output = consumption + investment. Saving = income − consumption. Therefore saving = investment.” (GT, p. 63)

#4 Wikipedia and the promotion of economists’ idiotism (II)

#5 The monetary circuit and how economists got it wrong

#6 Why economists know nothing

#7 Substandard reasoners

#8 Economists’ proto-scientific methodology

#9 Mental messies and loose losers

#10 How to get out of the swamp of ignorance

#11 The Common Error of Common Sense: An Essential Rectification of the Accounting Approach

You say: “So, Egmont, as I have pointed out here on numerous occasions, the US National Income and Product Accounts (NIPS), whose practices are imitated in nearly all nations now, defines investment and savings in a way that I=S, simply by definition.”

I say: “I am well aware of the practice of NIPS accounting and I have shown in detail where it goes wrong.#11 See, in particular, section 1.9 Cooked transaction recording.”

I conclude: “From the fact that all national accountants define things “in a way that I=S, simply by definition” does NOT logically follow that I=S is true but that all national accountants are either stupid or corrupt or both.”

You conclude: “Sorry, but this is definitional, and you do not have the rght to imposee your defnition on others, …”

I do not impose anything on anybody, I just bury macroeconomics from Keynes to Hicks to Samuelson to Akerlof to Krugman#1 to Barkley Rosser, including the peer-reviewed economic journals and textbooks of the last 80+ years, at the Flat-Earth-Cemetery.

#1 Mr. Keynes, Prof. Krugman, IS-LM, and the End of Economics as We Know It

June 5, 2019

Controlled demolition of MMT ― an exercise in elementary logic

Blog-Reference and Blog-Reference (Link)

Randall Wray analyses the current situation in Japan: “From the MMT perspective, what Japan needs is a good fiscal stimulus, albeit one that is targeted. Japan has three ‘injections’ into the economy: the fiscal deficit (which has fallen from 7% of GDP to about 5% over the past few years ― still a substantial injection), the current account surplus, and private investment. But what it needs is stronger growth of domestic consumer demand ― which would also stimulate investment directed to home consumption.”

This recommendation is based on the “sectoral balance perspective”. This perspective is clearly defined by the sectoral balances equation which is given by (I−S)+(G−T)+(X−M)=0. The very characteristic of the MMT balances equation is that it does not contain the balance of the business sector, i.e. profit/loss. Accordingly, the word profit does not appear once in Randall Wray’s post. An economic model without profit, though, is like Hamlet without the prince or physics without the concept of energy.

The question is why does macroeconomic profit not appear in the sectoral balances equation? The short answer is because economists in general, and MMTers, in particular, are scientifically incompetent.

What MMT policy guidance lacks is the underlying true macroeconomic theory. Here it is.#1, #2

The elementary production-consumption economy is defined with this set of macroeconomic axioms: (A0) The economy consists of the household and the business sector which, in turn, consists initially of one giant fully integrated firm. (A1) Yw=WL wage income Yw is equal to wage rate W times working hours. L, (A2) O=RL output O is equal to productivity R times working hours L, (A3) C=PX consumption expenditure C is equal to price P times quantity bought/sold X.

Under the conditions of market-clearing X=O and budget-balancing C=Yw in each period, the price as the dependent variable is given by P=W/R. The elementary production-consumption economy is shown on Wikimedia.#3

|

| Elementary production-consumption economy |

The focus is here on the nominal/monetary balances. For the time being, real balances are excluded, i.e. it holds X=O. The condition of budget balancing, i.e. C=Yw, is now skipped. The monetary saving/dissaving of the household sector is defined as S≡Yw−C. The monetary profit/loss of the business sector is defined as Q≡C−Yw. Ergo Q≡−S.

The balances add up to zero. The mirror image of household sector saving S is business sector loss −Q. The mirror image of household sector dissaving (-S) is business sector profit Q. Q≡−S is the elementary version of the macroeconomic Profit Law.

It is the definition of macroeconomic profit, i.e. Q≡C−Yw, where the logical blunder of MMT sneaks in. A definition ≡ is a one-way operator: a new variable (= definiendum) is introduced as a relationship of variables that are given by the axioms (= definiens).#4 While in an equation y=x−z it is possible to bring z to the left side, i.e. y+z=x, this is NOT admitted in a definition. The case is analogous to the prohibition of division through 0.

The operator ≡ defines a one-way relationship, the operator = defines a two-way relationship. The methodological failure of economists consists of not keeping these logical relationships properly apart.

Macroeconomic profit has above been defined as a relationship of axiomatic variables, i.e. Q≡C−Yw. Now, the representative economist comes along and performs the inadmissible operation Q+Yw≡C and introduces one more definition, i.e. Q+Yw≡national income≡NI. This reduces to NI≡C which is an improper definition because it applies TWO terms for the same thing, i.e. the terms “national income NI” and “consumption expenditures C” are interchangeable. This is like saying the words “apple” and “orange” apply to the same thing. So, the definition of “national income NI” is redundant, leads to economic gobbledygook, and therefore has to be cut off with Occam’s Razor.

The same holds for the investment economy. Profits for the two sub-sectors are given by Qc≡C−Ywc and Qi≡I−Ywi. Total profit Q is defined as the sum of sub-sectoral profits, i.e. Q≡Qc+Qi≡C+I−Yw. GDP is defined as GDP≡C+I, so Q≡GDP−Yw. The definition of GDP is admissible but the definition of national income NI≡Q+Yw is inadmissible. Therefore, NI≡GDP, or Keynes’ Income = value of output (GT p. 63), is economic gobbledygook. It leads to I=S and IS-LM and all the other falsehoods of After-Keynesian macroeconomics.

The axiomatically correct sectoral balances equation reads (I−S)+(G−T)+(X−M)−(Q−Yd)=0.#5, #6

Ramifications: The Wray Curve, the Kelton See-Saw#7, the Krugman Cross#8, and the rest of MMT is proto-scientific garbage.

Egmont Kakarot-Handtke

* New Economic Perspectives

#1 True macrofoundations: the reset of economics

#2 The canonical macroeconomic model

#3 Wikimedia AXEC31 Elementary production-consumption economy

#4 Wikipedia Definition

#5 Wikipedia and the promotion of economists’ idiotism (I)

#6 Wikipedia and the promotion of economists’ idiotism (II)

#7 Stephanie Kelton What Happens When the Government Tightens its Belt?

#8 Scott Fullwiler The Sector Financial Balances Model of Aggregate Demand

Related 'Accounting for dummies' and 'The Common Error of Common Sense: An Essential Rectification of the Accounting Approach' and 'How the Intelligent Non-Economist Can Refute Every Economist Hands Down' and 'Humpty Dumpty is back again' and 'The Humpty Dumpty methodology' and 'Is Nick Rowe stupid or corrupt or both?' and 'Profit, income, and the Humpty Dumpty Fallacy' and 'Mad but true: 200+ years after Adam Smith economists still have no idea what profit is' and 'Keynesians ― terminally stupid or worse?'. For details see also cross-references Accounting and cross-references MMT.

May 24, 2019

Links on McKinsey’s A new look at the declining labor share of income in the United States

Distribution Theory is false because Profit Theory is false. After 200+ years, economists still have NO idea about the foundational magnitude of their subject matter. This holds for Walrasianism, Keynesianism, Marxianism, Austrianism, and MMT.

McKinsey* identifies as main drivers of the capital share by sector 1998-2002: Supercycles and boom-bust, Rising and faster depreciation, Superstar effects and consolidation, Capital substitution and automation, Globalization, and labor bargaining power.

The factors that explain the development of sectoral profits, though, do NOT explain the drivers of overall macroeconomic profit. They explain only the distribution of overall macroeconomic profit between the sectors.

The axiomatically correct macroeconomic Profit Law is given by Q≡Qm+Qn with Qm≡Yd+(I−Sm)+(G−T)+(X−M). This reduces to Qm≡−Sm+(G−T) which says that the main drivers of increasing macroeconomic Profit Qm have been in the past decades the increased deficit spending of the household sector (-Sm) and the government sector (G−T) which translates into an ever-growing private/public debt.

Distribution Theory and the concept of a wage/profit “share” is abysmal proto-scientific garbage since the founding fathers. See:

► There is NO such thing as a “labor share of income”

► Profit and the decline of workers’ nominal share (II)

► Profit and the decline of labor’s nominal share (I)

► Profit and distribution: a primer

► Profit and macrofoundations

► Rethinking the Profit Law

► Rethinking the Distribution

► Profit, income, and the Humpty Dumpty Fallacy

► Keynes, Lerner, MMT, Trump, etc. and exploding profit

► For details of the big picture see cross-references Profit

Egmont Kakarot-Handtke

* McKinsey Global Institute

May 3, 2019

Economics: The greatest scientific fraud in modern times

Blog-Reference and Blog-Reference and Blog-Reference

Taking Isaac Newton and Adam Smith as roughly simultaneous reference points, no one can fail to notice that economics has in the last 200+ years not risen above the proto-scientific level.

Needless to emphasize that economists do not run out of arguments to explain their obvious scientific failure. This is the classic excuse: “Years ago I heard Mr. Cobden say at a League Meeting that ‘Political Economy was the highest study of the human mind, for that the physical sciences required by no means so hard an effort.’” (Bagehot, 1885)#1 In other words, physics and the natural sciences are kids’ stuff but economics is the real challenge. Taking this into account, economists are second to none.

Ikonoclast reiterates the old refrain of economics as “separate and inexact science” (J. S. Mill): “When we are dealing with physical phenomena, the fundamental laws of the cosmos are independent of human understanding or modelling of them. No matter what you or I or any human thinks of the Laws of Thermodynamics or even whether we are ignorant of them, the fundamental phenomena follow a course which can be well modeled by those laws when those laws are mathematicized to permit accurate descriptions and empirically verifiable predictions. However, when it comes to socioeconomic phenomena, what we think and believe enter into the constructions and emergent outcomes of socioeconomic phenomena themselves (along with fundamental law effects also entering into the constructions and outcomes). At this level, any theory of the system enters into the system as a compounding or complicating element. Thence meta-theory (theory of the impact of theories on the system) will also enter into the system.”

In short, complexity, reflexivity, emergence/novelty, and ontological uncertainty are the ultimate reasons why economists have not produced much, if anything, of scientific value.

This, of course, is plain methodological nonsense. The simple fact of the matter is that economists are scientifically incompetent. The major approaches ― Walrasianism, Keynesianism, Marxianism, Austrianism ― are mutually contradictory, axiomatically false, materially/formally inconsistent and all got the foundational concept of the subject matter ― profit ― wrong. Economics is a mutual acceptance and stubborn repetition of provably false theories.#2, #3, #4 Economic policy guidance NEVER has had sound scientific foundations. Fidgetting with false theories in the public space, economists are a hazard to their fellow citizens.

Let us just pick macroeconomics as a pertinent example.#5 Keynes stated the formal foundations in the General Theory as follows: “Income = value of output = consumption + investment. Saving = income − consumption. Therefore saving = investment.” (p. 63)

This mathematically simple syllogism (Y=C+I, S=Y−C) is conceptually and logically defective because Keynes never came to grips with profit. “His Collected Writings show that he wrestled to solve the Profit Puzzle up till the semi-final versions of his GT but in the end he gave up and discarded the draft chapter dealing with it.” (Tómasson et al.)

Let this sink in: the economist Keynes NEVER understood the foundational concepts of his subject matter, i.e. profit and income.#6, #7

But it is worse: neither Keynesians nor Post-Keynesians nor New Keynesians nor Anti-Keynesians nor orthodox economists nor heterodox economists spotted Keynes’ blunder to this day.#8 Economists are simply too stupid for the elementary mathematics that underlies macroeconomics. Because the foundations are false the whole analytical superstructure of economics is proto-scientific garbage.

What economists do not understand to this day is that economics is NOT a social science and that they have to change the definition of their subject matter:

• Old definition, subjective-behavioral: Economics is the science which studies human behavior as a relationship between ends and scarce means which have alternative uses.

• New definition, objective-systemic: Economics is the science that studies how the monetary economy works.

Since the founding fathers, economics claimed to be a science. It is NOT, it is what Feynman called a cargo cult science.#9 Economists are NOT scientists but merely useful political idiots.#10 The fact is that there is NO greater fraud in the history of modern science than economics.

Egmont Kakarot-Handtke

#1 Failed economics: The losers’ long list of lame excuses

#2 How the representative economist gets it wrong big-time

#3 Economic recommendations out of the swamp between true and false

#4 There is no soft science only soft brains

#5 Macroeconomics: Economists are too stupid for science

#6 The correct relationship reads in the elementary case Qm≡I−Sm with Qm as monetary profit.

#7 Except Allais see How Keynes got macro wrong and Allais got it right

#8 Marshall and the Cambridge School of plain economic gibberish

#9 The economics Cargo Cult Prize

#10 Throw them out! Orthodox and heterodox economists are unfit for science

Related 'Mad but true: 200+ years after Adam Smith economists still have no idea what profit is' and 'Just for the record: Economics is dead' and 'And the answer is NCND ― economics after 200+ years of Glomarization' and 'Economics: 200+ years of scientific incompetence and fraud' and 'From obscurity to enlightenment' and 'The zombie wars are over' and 'Crisis, cranks, and scientists' and 'Scientists do not predict' and 'Causality in economics' and 'Why economists have not been effective in economics' and 'Lacking the Midas touch of science' and 'Economists: just too stupid for counting' and 'When substandard thinkers dabble in science it is called economics' and 'A political stench is in the air' and 'Confused Confusers: How to Stop Thinking Like an Economist and Start Thinking Like a Scientist' and 'New economic thinking = old political fake' and 'The general theory of scientific incompetence' and 'A new curriculum for swampies?' and 'Real-World Economics: The sanctuary of stupidity and corruption' and 'Trust in economics as a science?' and 'Economists: scientists or political clowns?' and 'Knowledge is attainable ― even in economics' and 'Did economics fail? No! Yes, and everybody knows it!' and 'Econogenics in action' and 'How to make economics a science' and 'The inexorable Paradigm Shift in economics'. For details of the big picture see cross-references Failed/Fake Scientists and cross-references Paradigm Shift and cross-references Axiomatization.

***

Here we go:

You say: “I am sorry, but I am not gong to bother ‘intepreting’ Egmont. He does seem to have lost it calling you an ‘asshole.’ He is not usually that offensive.”

Indeed, but you are:

.........................................................................................................

rosserjb@jmu.edu said...

Anonymous Asshole,

Maybe you did not get it. If you start using a name, even if it is one that is made up, I shall stop "using profance language" in regard to you. As it is, I have already made it clear that I have nothing but utter contempt for people who lecture me on anything while identifying themselves as "Anonymous." Get it, asshole?

Oh, and few of my atudents come here, but those that do will probably accept how I am treating you. I do not speak this way in classes, where I do not deal with people lecturing me while hiding behind a veil of anonymity.

So now you can go and repeately fuck yourself until your bottom falls off. Have a nice day!

October 7, 2018 at 5:42 PM

.........................................................................................................

You say: “Right, I am surely too foolish and ignorant to understand your writing, other than the uncontrollable anger, so I will never bother to try again. (You are scary.) Bye, bye.”

What do you not understand?

(i) Barkley Rosser is a stupid/corrupt academic economist.

(ii) Barkley Rosser is not some unique lone nut exception but as representative economist part of a tight-knit institutional network of political economics (= agenda-pushing) that has overgrown and stifled theoretical economics (= science).

(iii) All this is common knowledge: “Veblen’s first job was at the University of Chicago, the university bought and paid for by John D. Rockefeller the classic robber baron, and leader of the leisure class. Rockefeller called the university ‘the best investment’ he ever made, since he intended to use it to advance the interests of his class and suppress opposition.”#1

(iv) What holds for Chicago can with some degree of confidence be generalized for the majority of Faculties of Business and Economics and the institutional superstructure from the ASSA Annual Meetings to the publishing houses.

(v) Accordingly, the purpose of economic journals and the peer-review process is not the promotion and dissemination of scientific knowledge as it is in the genuine sciences but attention/perception management, gatekeeping, and selection/promotion/positioning of future opinion leaders.

(vi) Prizes like the economics Nobel or the John Bates Clark Award are part and parcel of establishing scientific reputation and authority. These are tried and tested instruments of public relations/propaganda and have no scientific significance whatsoever.

(vii) Economics is a fake science beginning with economic textbooks#2 and ending with the faux Nobel.#3

(viii) Academic economics ― orthodox and heterodox, that is ― is beyond repair or reform or hope or rejuvenation, it can only be burnt to the ground like a termite-infested shack.

(ix) Needless to emphasize that (viii) is a metaphor for perplexed and clueless non-economists who have no chance of figuring out the actual state of economics and what the methodological term Paradigm Shift means in practice.

(x) Needless to emphasize that the current inhabitants of the rotten shack with the pretty scientific facade ― the retarded heirs of Adam Smith/Karl Marx ― are retired in a timely manner with all the academic honors.

There is nothing to fear for Barkley Rosser and trolls like you except perhaps that you will eventually be buried at the Flat-Earth-Cemetery in the section for political clowns.

#1 Veblen’s insights come back to haunt us

#2 To this day, economists have produced NOT ONE textbook that satisfies scientific standards

#3 The real problem with the economics Nobel

Just answer the simple scientific question which of the two macroeconomic sectoral balances equations is true, i.e. materially/formally consistent?

(a) (I−S)+(G−T)+(X−M)=0

(b) (I−S)+(G−T)+(X−M)−(Q−Yd)=0

You answer: “Depends on how you define and measure the variables, Egmont, obviously. And these variables have been defined and measured differently at different times by different entrities. So, they can both be true or not true depending.”

This is the Humpty Dumpty Fallacy,#1 the Pavlovian reflex of all swampies.#2 Popper called it immunizing stratagem.#3

Science is binary true/false with NOTHING in between. Non-science is the swamp between true and false where ‘nothing is clear and everything is possible’ (Keynes).#4 The swamp is the habitat of what Feynman called cargo cult scientists.#5

The correct answer to the question which of the two macroeconomic sectoral balances equations, i.e. (a) (I−S)+(G−T)+(X−M)=0 or (b) (I−S)+(G−T)+(X−M)−(Q−Yd)=0, is true is unequivocal and demonstrably (b). All variables in (a) and (b) are identical except for Q = macroeconomic profit and Yd = distributed profit. Eq. (a) lacks these two variables altogether and because of this, it is FALSE. This means, in turn, that both orthodox and heterodox macroeconomics is FALSE. So, economics is refuted on all counts.

As a professional economist at the age limit you have never known and still do not know the scientifically correct answer. It is pretty obvious that you have always been a fake scientist. This, though, was not a disadvantage, rather the opposite, because economics has always been a fake science.#6

Because economics is a fake science the Bank of Sweden Prize in Economic Sciences in Memory of Alfred Nobel is a fraud. Same for the John Bates Clark Award. Time to drain the swamp.#7

#1 Humpty Dumpty is back again

#2 And the answer is NCND ― economics after 200+ years of Glomarization

#3 Opinion, conversation, interpretation, blather: the economist’s major immunizing stratagems

#4 Lousy scientists

#5 What is so great about cargo cult science? or, How economists learned to stop worrying about failure

#6 Economics: The greatest scientific fraud in modern times

#7 Enough! Economists, retire now!

You say: “Yes, Egmont, we have seen you previously declare that taking account of retained earnings, what your petty equation does, is the most supremely important thing in economics. It is not remotely. It is an utterly trivial item that gets taken account of in current accounting practices.”

Yes, Barkley Rosser, distributed profits appear in National Accounting.#1 This, though, is NOT the point. So let us take distributed profits Yd out of the picture for a moment, i.e. Yd=0. Then, the all-decisive question reduces to:

Which of the two macroeconomic sectoral balances equations is true, i.e. materially/formally consistent?

(a) (I−S)+(G−T)+(X−M)=0

(b) (I−S)+(G−T)+(X−M)−Q=0

Let us go one step further and simplify by taking government and foreign trade out of the picture, i.e. G, T, X, M = 0.

Then we have

(a) (I−S)=0 or I=S,

(b) (I−S)−Q=0 or I−S=Q.

I=S is provably false since Keynes. So, all I=S/IS-LM models are false from Hicks onward to Krugman and beyond.#2, #3, #4

Economists have not realized this to this day. Neither the Nobel laureate Paul Krugman, nor the John Bates Clark Award winner Emi Nakamura, nor Lord Meghnad Desai, nor Professor Barkley Rosser, nor the rest of fake heroes.

Economics is proto-scientific garbage to this day because economists are too stupid for the elementary mathematics that underlies macroeconomics.

Time to give these scientifically incompetent folks a dishonorable discharge and to make economics, after 200+ years of capture by stupid/corrupt agenda pushers a.k.a. useful political idiots, a science worthy of the title.

#1 The Common Error of Common Sense: An Essential Rectification of the Accounting Approach

#2 Mr. Keynes, Prof. Krugman, IS-LM, and the End of Economics as We Know It

#3 Wikipedia and the promotion of economists’ idiotism (II)

#4 Rectification of MMT macro accounting

March 29, 2019

Dear idiots, government deficits do NOT fund private savings

Blog-Reference

D.T. Cochrane argues: “Changes in the financial assets of the government and the private sector mirror each other. Government debt equals private sector financial assets, by definition. When the government posts a deficit, the private sector’s financial assets increase. When the government posts a surplus, the private sector’s financial assets decrease. In other words, when the Canadian Taxpayers Federation hauls out their debt clock, showing the federal government’s increasing debt, they are also showing the private sector’s increasing financial wealth.”

This is not correct and the reason is that D.T. Cochrane is too stupid for the elementary mathematics that underlies macroeconomics.

Here is the correct macroeconomics in a nutshell.

(i) The elementary production-consumption economy is given by three macroeconomic axioms: (A1) Yw=WL wage income Yw is equal to the wage rate W times working hours. L, (A2) O=RL output O is equal to productivity R times working hours L, (A3) C=PX consumption expenditure C is equal to price P times quantity bought/sold X.

(ii) The focus is here on the nominal/monetary balances. For the time being, real balances are excluded, i.e. X=O.

(iii) The monetary profit/loss of the business sector is defined as Q≡C−Yw,

(iv) The monetary saving/dissaving of the household sector is defined as S≡Yw−C.

(v) Ergo Q≡−S.

The balances add up to zero. The mirror image of household sector saving S is business sector loss −Q. The mirror image of household sector dissaving (-S) is business sector profit Q. Q≡−S is the elementary version of the macroeconomic Profit Law.

To start, we have only two sectors: the household and the business sector. The surplus of the business sector, i.e. profit, is the exact mirror image of the deficit of the household sector, i.e. dissaving. The deficit of the business sector, i.e. loss, is the exact mirror image of the surplus of the household sector, i.e. saving.

Now, the government sector is brought into the picture.

The complete macroeconomic Profit Law is given by Q≡Yd+(I−S)+(G−T)+(X−M). In order to focus on the interactions between household, business, and government sector, it is here reduced to Q≡−S+(G−T). Legend: Q macroeconomic profit, S household sector saving, G government expenditures, T taxes, (G−T)>0 government deficit.

If the government’s budget is balanced, i.e. G=T, and if the households dissave then the business sector makes a profit, i.e. Q is positive.

If the government’s budget is balanced and the households save, i.e. S≡Yw−C>0, then the business sector makes a loss, i.e. Q is negative.

If the government’s budget deficit, i.e. (G−T)>0, is equal to the household sector’s saving, i.e. (G−T)=S, then macroeconomic profit Q is zero.

If the government’s deficit is greater than household sector saving, then the business sector makes a profit.

If the household sector’s saving is zero, i.e. S=0, and the government deficit is greater than zero, i.e. (G−T)>0, then it holds Q=(G−T), i.e. business sector profit equals government deficit, in other words, Public Deficit = Private Profit.

So, there are two limiting cases, (i) government deficit equals household sector saving, (ii) government deficit equals business sector profit.

There is NO such thing as ‘government deficit equals private saving’ or “government deficits fund private savings”.

Whether the term “private savings” is introduced because of terminological sloppiness or intentionally in order to hide the fact that a government deficit is a free lunch for the Oligarchy to the extent that the public deficit is greater than household sector saving. The word profit does not appear once in D.T. Cochrane’s article.

For the simplified case, i.e. Yd, (I−S), (X−M)=0, financial wealth of the Oligarchy is the exact mirror image of public debt (currently $22 trillion). In this limiting case, the (net) financial wealth of WeThePeople is exactly zero. The talk of “private” financial wealth obscures the distributional reality.

It holds in any case that MMT is either a blunder or a fraud and that MMTers are either stupid or corrupt.

Egmont Kakarot-Handtke

* The Conversation

Related 'The Kelton-Fraud' and 'Down with idiocy!' and 'MMT: Just another political fraud' and 'Stephanie Kelton’s legendary Plain-Sight-Ink-Trick' and 'MMT Progressives: The knife in the back of WeThePeople' and 'MMT and the magical profit disappearance' and 'MMT: fundamentally false' and 'Dear idiots, time to get saving and investment straight (II)' and 'Dear idiots, time to get saving and investment straight (I)' and 'Dear idiots, Marx got profit and exploitation wrong' and 'Dear idiots, government deficits do NOT cause inflation' and 'The clock runs down on economics'.

|

| Source: The Conversation |

The graph suffers from the Humpty Dumpty Fallacy. For details see Profit, income, and the Humpty Dumpty Fallacy and Down with idiocy!.

You say: “Your entire response has nothing to do with the issue raised here, which is the relationship between government debt and private sector wealth. The relationship described here is empirical fact, which you can confirm by following the data source for the graph.”

The title of your post reads: ‘How government deficits fund private savings’. My comment contains proof that this statement is false. The correct formulation should read: ‘How government deficits fund private profits.’

The macroeconomic Profit Law implies Public Deficit = Private Profit and NOT Public Deficit = Private Saving. From this follows, in turn, that the MMT policy of deficit-spending/money-creation benefits the Oligarchy and harms WeThePeople.

You are obviously unable to realize that MMT theory is refuted on all counts#1, #2 and that MMT policy is distributional infamy.

MMT claims that public deficits increase “private” financial wealth. This is not quite correct because, more specifically, public deficits increase the financial wealth of the one-percenters and NOT of the ninety-nine-percenters. The weasel word “private” obscures this distributional fact. The MMT policy of permanent deficit-spending/money-creation amounts to a permanent self-alimentation of the Oligarchy to the detriment of the ninety-nine-percenters.#3

Clearly, MMT is a scientific/social/political fraud. Obviously, you are part of it.

#1 Refuting MMT’s Macroeconomics Textbook

#2 For the full-spectrum refutation of MMT see cross-references MMT

#3 MMT = proto-scientific junk + deception of the 99-percenters

You say: “The word ‘profit’ does not appear in my article because I do not deal with the distribution within the private sector. So, once again, my argument is based on facts, which demonstrate given accounting identities.”

There is no such thing as the “private sector” there is the household sector and the business sector and both cannot be lumped together. This is the Humpty Dumpty Fallacy. The “private sector” is an MMT construct.

You have not realized that the MMT accounting identities are provably false because MMTers are too stupid for the elementary mathematics that underlies macroeconomic accounting.#1, #2

This is the false MMT sectoral balances equation: (I−S)+(G−T)+(X−M)=0. And this is the true equation (I−S)+(G−T)+(X−M)−(Q−Yd)=0. All variables are measurable with the precision of two decimal places. Therefore, the matter can be decided empirically.

The disappearance of profit in the mirror graph is the smoking gun proof that MMT deceives the general public.#3

#1 Wikipedia and the promotion of economists’ idiotism (II)

#2 See cross-references Accounting

#3 MMT and the magical profit disappearance

You say: “We’re done”

No. YOU are done. Your mirror graph is false. There are THREE sectors household, business, and government. So there should be THREE curves that show the balance of each sector. The balances are called saving/dissaving, profit/loss, and government deficit/surplus. In your graph, though, there are only TWO curves because you lump saving and profit together and call the sum private saving. Thus profit vanishes. This is the MMT deception. MMTers claim to benefit WeThePeople while the exact opposite is true.