Blog-Reference

To this day, economists have no clue of what their subject matter is. While the sciences have specialized, economists follow the Renaissance ideal of the Homo Universalis.#1 Accordingly, they dabble in psychology, sociology, political sciences, geopolitics, law, history, anthropology, social philosophy, philosophy, theology, pedagogic, biology/ evolution, climatology, and whatnot.

People become progressively aware that in all these disciplines economists have not contributed anything of scientific value: “While he [Todd Zywicki] overdid it a bit he argued with some good reason that most legal decisions in the US relying on claimed behavioral economics foundations, especially on matters involving credit and consumer finance issues, have been seriously flawed. They have either relied on misinterpretations or else mere assertions that have not been empirically demonstrated. He raised a point of more general interest in charging that there has been a problem of ‘citation cascades,’ where a string of decisions has been based on people citing other people in a cascade that eventually boils down to an initial claim that has no clear basis.”

This is not correct. Economics has a clear basis and it is given with the set of neo-Walrasian axioms: “HC1 There exist economic agents. HC2 Agents have preferences over outcomes. HC3 Agents independently optimize subject to constraints. HC4 Choices are made in interrelated markets. HC5 Agents have full relevant knowledge. HC6 Observable economic outcomes are coordinated, so they must be discussed with reference to equilibrium states.” (Weintraub)

Economists simply apply this set of behavioral assumptions or slight variants thereof or the subset of optimization-and-equilibrium to any question they come across. The tragicomedy is that this methodology has crushingly failed in their own field. Economists can to this day not tell how the price- and profit mechanism works or what profit is.#2, #3

The methodological blunder of economists and the ultimate reason why economics is one of the worst scientific failures of all times consists of defining economics as a social science.#4, #5

So, the definition of the subject matter has to be changed:

- Old (behavioral): Economics is the science that studies human behavior as a relationship between ends and scarce means which have alternative uses.

- New (systemic): Economics is the science that studies how the monetary economy works.

Egmont Kakarot-Handtke

#1 Wikipedia, Polymath

#2 Economists’ three-layered scientific incompetence

#3 Mental messies and loose losers

#4 Economics is NOT a social science

#5 For details of the big picture see cross-references Not a Science of Behavior

Related 'Dear philosophers, economics is a systems science'.

***

AXEC113o

***

REPLY to Barkley Rosser on Apr 22

Alone the titles of your posts ‘Can Nudging Become A New Road To Serfdom?’ or ‘Anniversary of Yeshua bin Yusuf dying on a cross’ tell everybody that you never understood what science is all about.

The dabbling of economists in Psychology, Sociology, Political Sciences, Geopolitics, Law, History, Anthropology, Social Philosophy, Philosophy, Theology, Pedagogic, Biology/ Evolution, Climatology, etcetera has never been anything else than dilettantish overreach, nuisance, and nerviness. All the more so, because economists messed up their own field in all dimensions and never rose above the proto-scientific level.

The lethal blunder of the microfoundations approach does NOT lie in any specific behavioral assumption like constrained optimization or bounded rationality but in the methodological incompetence of economists to realize that NO way leads from the second-guessing of Human Nature/motives/behavior/action to the understanding of how the economic system works.#1, #2

ALL human-centered/behavioral approaches invariably crash against the methodological wall of the Fallacy of Composition. NO way leads from the assumption of profit maximization to the macroeconomic Profit Law.#3 And this explains why the microfoundations approach has been doomed to failure from the very beginning in the 1870s.

Behavioral economics or Vernon Smith’s market experiments is partial analysis and the results of partial analysis cannot, as a matter of methodological principle, be generalized. From Vernon Smith’s market experiments cannot be concluded that the market economy is a self-adjusting system.

The fact of the matter is that correct macrofoundational analysis proves that the market economy is unstable and that it will eventually break down.#4 You can do behavioral experiments until you are blue in the face but this will not yield any results as to how the market system works.

Microeconomics has always been the playground of microbrains.#5

***

Wikimedia AXEC121i

***

REPLY to Barkley Rosser on Apr 23

You are off track. The point at issue is NOT the market experiments of Vernon Smith and others but that the subject matter of economics is ill-defined.

Imagine a physicist is asked to figure out how the universe works and after some time he comes back and says: The universe is much too large, not of direct relevance to our daily lives, and ultimately incomprehensible, so I have analyzed the molehills in my front garden — with surprising results.

If you want to understand the universe it is of no use to thoroughly examine molehills and if you want to understand the economy it is of no use to second-guess Human Nature/ motives/behavior/actions.

Macro is about the economic universe and micro is about mole-psychology-sociology. Behavioral economists are unable to look beyond their molehill horizon. But the methodological fact of the matter is that NO amount of molehill research ever leads to the understanding of how the universe works and NO way leads from the understanding of human behavior to the understanding of how the market economy works.#1, #2

This explains why the microfoundations approach has failed. However, from textbook to peer review to the fake Nobel, economists still cling to their false methodology: “It is a touchstone of accepted economics that all explanations must run in terms of the actions and reactions of individuals.” (Arrow)

After 150+ years of methodological blunder, it is time for the Paradigm Shift from bottom-up to top-down.#3 Hitherto accepted economists are no longer accepted.

***

REPLY to Barkley Rosser on Apr 25

Akerlof’s AEA address is a fine compilation of the multiple idiocies of microfounded macroeconomics. Just take the microfounded = behavioral Phillips Curve and the macrofounded = structural Phillips Curve.#1

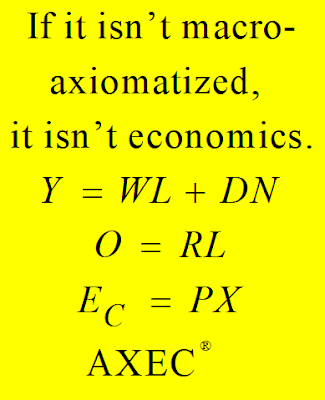

The microfoundations = behavioral approach is a scientific lemon since Jevons/Walras/ Menger but you have not realized it to this day. Methodologically it holds: If it isn’t macro-axiomatized, it isn’t economics.

Behavioral economics has never been more than rather trivial folk-psychology/folk-sociology, i.e. an overreach of incompetent economists who do not understand since 200+ years the very basics of their own subject matter.#2, #3