To the question ‘How are you going to pay for it?’ MMT has the answer ‘By deficit-spending/money-creation’. #1 Or in the jargon of MMT: “MMT explains how Monetary sovereign govs actually work. As currency issuers they do not use money, they issue it. They can never run out and can’t go broke, bankrupt or default. Taxes are not revenue, they’re needed to create demand for the currency.” (@KynarethNoBaka)

Proper economic analysis tells one that deficit-spending/money-creation amounts to stealth taxation of WeThePeople. MMT is scientifically deficient; that is to say, MMT policy guidance has NO valid scientific foundations. So, first of all, MMT storytelling has to be replaced with proper economic analysis.

For a start, one needs a description of the elementary production-consumption economy. This economy is constructed from scratch with the following set of macroeconomic axioms: (A0) The objectively given and most elementary configuration of the economy consists of the household sector and the business sector which in turn consists initially of one giant fully integrated firm. (A1) Yw=WL wage income Yw is equal to wage rate W times working hours L, (A2) O=RL output O is equal to productivity R times working hours L, (A3) C=PX consumption expenditure C is equal to price P times quantity bought/sold X.

Under the conditions of market-clearing X=O and budget-balancing C=Yw in each period, the price as the dependent variable is given by P=W/R. This is the macroeconomic Law of Supply and Demand. For the graphical representation of the analytical starting point, see AXEC31. #2

Saving/dissaving of the household sector is defined as S≡Yw−C, and profit/loss of the business sector is defined as Q≡C−Yw. It always holds Q≡−S, in other words, the business sector’s surplus = profit equals the household sector’s deficit = dissaving, and vice versa, the business sector’s deficit = loss equals the household sector’s surplus = saving. This is the most elementary form of the macroeconomic Profit Law. Under the initial condition of budget-balancing, i.e., C=Yw, macroeconomic profit Q is zero.

Now we consider two cases: (i) government spending = taxes and (ii) full deficit-spending, i.e., zero taxes.

(i) The government spends the amount G, which becomes the wage income of public employees, i.e., G=Yg. This income is fully spent, i.e., Cg=Yg. The wage income Yw is taxed, which reduces disposable income Ywd≡Yw−T. The disposable income is fully spent, i.e., Cwd=Ywd. If the government’s budget is balanced, i.e., G=T, total income is Ywd+Yg=Yw, and total consumption expenditures are Cwd+Cg=C, and this boils down to C=Yw as in the initial case. The market-clearing price remains unchanged. What happens in real terms is that the part of real output O of the wage income receivers is reduced because they can buy less with their reduced disposable income. The difference O−Owd is bought by the public employees with their income Yg. Government spending and taxation lead to a redistribution of the unchanged period output O. Total employment increases, but everything else ― total income, total expenditures, price ― remains unchanged. The economy as a whole increases output depending on what the government employees do, i.e., providing public services, going to war, planting trees, etc.

(ii) The government spends the amount G, which becomes the wage income of public employees, i.e., G=Yg, but taxes are zero, i.e., the public deficit D≡G−T is equal to government spending G. The government gets the amount G from the Central Bank in the form of overdrafts. This increases deposits in the CB’s balance sheet by the same amount. Deposits at the CB are fiat money.

Total disposable income, i.e., Ywd≡Yw−T plus Yg, is now higher than in case (i) because of T=0. And because all income is spent, total consumption expenditures are also higher, i.e., C=Cw+Cg=Yw+Yg. Under the condition of market-clearing, i.e., X=O, the price increases P=(Cw+Cg)/O. Deficit spending on current production causes a one-off price hike (NO inflation) and the business sector ends up with macroeconomic profit Q=G.

In real terms, the part of the output that goes to the wage income receivers is reduced through the price increase. The remaining part of O−Ow goes to the receivers of government income.

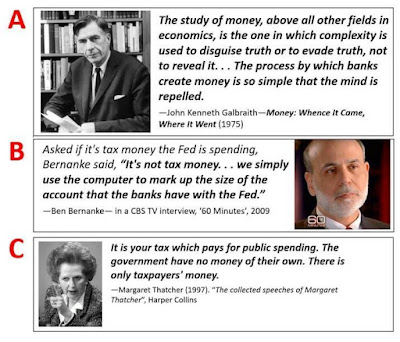

In real terms, there is NO difference for the household sector as a whole between the two cases. The economic fact of the matter is: either the budget is balanced, then WeThePeople pay for government spending through open taxation, or the government deficit-spends, then WeThePeople pay through stealth taxation, i.e., through an almost unnoticeable one-off price hike (NO inflation).#3, #4, #5

Because the macroeconomic Profit Law entails Public Deficit = Private Profit, the financial wealth of the Oligarchy grows in lockstep with public debt. For the overall profit of the business sector, it does NOT matter at all whether the deficit spending goes to the military, to government services, or to environmental protection.

So, the answer to the question Who pays? is always and everywhere: WeThePeople pay in real terms no matter whether the budget is balanced or money is created out of nothing. It does NOT matter at all whether deficit-spending/money-creation is caused by military or social spending. The axiomatically correct Profit Law says Public Deficit = Private Profit. It is deficit-spending per se that feeds the Oligarchy.

The additional economic damage for WeThePeople consists of interest payments on the public debt and the always-overlooked fact that the public debt has to be eventually redeemed.

Public deficit-spending/money-creation is a free lunch program for the Oligarchy. The fact is that the market economy has already, for a long time, been on the life support of the State. Profit is, in the main, produced by public deficits. The Oligarchy, in turn, uses the opulent free lunches to corrupt the State’s legislative, executive, and judiciary institutions in its favor.

MMT propaganda buries all distributional consequences of deficit-spending/money-creation under vacuous blather about the monetary sovereignty of the State. The fact of the matter is that the State is the profit producer for the Oligarchy.

The economically correct answer to Who pays? is in any case WeThePeople.

Egmont Kakarot-Handtke

#1 Examples from Twitter

a)

|

| Source: Twitter |

b)

|

| Source: Twitter |

c)

|

| Source: Twitter |

d)

|

| Source: Twitter |

e)

|

| Source: Twitter |

#2 Graphic AXEC31

#3 Exploding the Household Fallacy

#4 How to pay for the war and to be bamboozled by economists

#5 No MMT illusions! YOU are going to pay for it

* Note that there is a difference between spending on (i) consumption good output and (ii) investment good output. Obviously, this post deals with (i) and not with (ii). In the discussion about public debt, the two cases are often confounded. For more details see Squaring the Investment Cycle.

Related 'MMT: Redistribution as wellness program' and 'MMT, money creation, stealth taxation, and redistribution' and 'MMT, money printing, stealth taxation, and redistribution' and 'How MMT fools the ninety-nine-percenters' and 'MMT and the Green New Deal: Where is the snag? (I)' and 'MMT and the Green New Deal: Where is the snag? (II)' and 'The right and the wrong way to bring money into the economy' and 'Criminals and the monetary order' and 'MMT: A Trojan Horse for Labour courtesy of the Oligarchy' and 'Dear idiots, MMTers are Wall Street’s agenda pushers' and 'Mr. Wray goes to Washington' and 'MMT is an economic policy fraud' and 'Smart! How to make people fund their brain-washing'.

Related 'MMT: Redistribution as wellness program' and 'MMT, money creation, stealth taxation, and redistribution' and 'MMT, money printing, stealth taxation, and redistribution' and 'How MMT fools the ninety-nine-percenters' and 'MMT and the Green New Deal: Where is the snag? (I)' and 'MMT and the Green New Deal: Where is the snag? (II)' and 'The right and the wrong way to bring money into the economy' and 'Criminals and the monetary order' and 'MMT: A Trojan Horse for Labour courtesy of the Oligarchy' and 'Dear idiots, MMTers are Wall Street’s agenda pushers' and 'Mr. Wray goes to Washington' and 'MMT is an economic policy fraud' and 'Smart! How to make people fund their brain-washing'.

***

AXEC165a

***

Twitter Mar 28, 2021, Taxpayer's money, counterfeit money, and stealth taxation