Comment on Randall Wray on ‘How To Pay For The War’*

Blog-Reference and

Blog-Reference (Link)

Randall Wray puts the issue into perspective: “I’m going to talk about war, not peace, in relation to our work on the Green New Deal ― which I argue is the big MEOW — moral equivalent of war ― and how we are going to pay for it. So I’m going to focus on Keynes’s 1940 book ― How To Pay for the War …” and “Our analysis (and the MMT approach in general) is in line with J. M. Keynes’s approach. Keynes rightly believed that war planning is not a financial challenge, but a real resource problem.” and “We’ve timed our GND to be completed by 2030. We have 10 years to make Keynes’s vision become reality. The alternative is annihilation.”

What Randall Wray has not grasped, though, is that Keynes got macroeconomics wrong and because of this, Keynesianism and its derivatives up to MMT are scientifically worthless. So, in order to avoid annihilation, the proto-scientific garbage of macroeconomics has to be fixed first.#1

Macroeconomic foundations

The production-consumption economy is defined by the following set of macroeconomic

axioms:#2 (A0) The elementary configuration of the economy consists of the household and the business sector which in turn consists initially of one giant fully integrated firm.

(A1) Yw=WL wage income Yw is equal to wage rate W times working hours. L, (A2) O=RL output O is equal to productivity R times working hours L, (A3) C=PX consumption expenditure C is equal to price P times quantity bought/sold X.

Under the conditions of market-clearing X=O and budget-balancing C=Y

w in each period, the price as the dependent variable is given by

P=W/R. The price is determined by the wage rate W, which takes the role of the nominal numéraire, and the productivity R. This is the macroeconomic

Law of Supply and Demand.

The focus is here on the nominal/monetary balances. For the time being, real balances are excluded, i.e. it holds X=O. L is set at full employment.

The condition of budget balancing, i.e. C=Y

w, is now skipped. The monetary saving/ dissaving of the household sector is defined as S≡Y

w−C. The monetary profit/loss of the business sector is defined as Q≡C−Y

w. Ergo

Q≡−S.

The balances add up to zero. The mirror image of household sector saving S is business sector loss −Q. The mirror image of household sector dissaving (-S) is business sector profit Q.

Q≡−S is the elementary version of the macroeconomic

Profit Law.

With additional sectors, the complete macroeconomic

Profit Law is given by

Q≡Yd+(I−S)+(G−T)+(EX−IM). It is here reduced to Q=(−S)+(G−T) which says that profit Q is determined by the household sector’s and government sector’s deficit spending.

Scenario_0

With employment L and wage rate W given, wage income is Y

w=100 monetary units [e.g. trillion $]. Productivity R and output O remain constant throughout. Consumption expenditures C are equal to wage income, i.e. C=Y

w. As a consequence, the profit of the business sector is zero. The household sector consumes the whole output. The required stock of transaction money is provided by the central bank and is here left out of the picture.

Scenario_1 War with full taxation

The government needs part of the current output O in period t=1. The need is legitimate and undisputed, e.g. war. The government taxes the wage income, i.e. T=10. Disposable income is reduced from 100 to 90. The households reduce consumption expenditures in lockstep from 100 to C

h=90. The government fully spends the income tax of 10 units, that is, total consumption expenditures C=Ch+G remain unchanged and the market-clearing price P remains constant. Both, the household sector and the government sector fully consume their respective shares of output O

h and O

g, i.e. O=O

h+O

g. The real war consumption Og is fully paid for by taxes. The government’s budget is balanced, i.e. G=T. The household sector’s budget is balanced, i.e. C

h+T=Y

w. In real terms, the households pay Og for the war effort, in nominal terms T.

In period 2, the war is over and income tax is again zero, and everything else is like in the initial scenario_0.

Scenario_2 No taxation, household sector saving, government deficit spending

The government imposes no income tax. The household sector reduces consumption expenditures voluntarily from 100 to C

h=90 in period 1. Through saving of 10 units the household sector’s current deposits at the central bank increase. At the same time, the government spends G=10 and takes up overdrafts at the central bank. Both sides of the central bank’s balance sheet are equal. Households’ deposits = government’s overdrafts. Total consumption expenditures, i.e. C=C

h+G, and the market-clearing price P remain unchanged. The government runs a deficit, i.e. G−T=10 with T=0. Profit is zero because of G−T=S.

The war is over in period 2 and no changes happen in periods 2, 3, 4. The households keep the deposits and the government keeps the overdrafts. Interest payments are left out of the picture. The household sector’s financial assets are equal to the public debt. Seen in isolation, the household sector is wealthier after the war. This, of course, is an illusion that stems from ignoring the public debt which is psychologically nobody's debt.

In period 5 the government is supposed to pay back the overdrafts. The wage income of Y

w=100 is taxed with T=10 units. Disposable income is reduced to 90. The government uses the 10 units of income tax to reduce its overdrafts at the central bank to zero. At the same time, the household sector dissaves 10 units, i.e. reduces its deposits to zero. Consumption expenditures C are then equal to disposable income 90 plus dissaving 10, i.e. C=100. The balance sheet of the central bank at the end of period 5 is again zero as in the initial period. Deposits (= money) and overdrafts are destroyed, i.e. reduced to zero.

What actually happens in scenario_2 in comparison to scenario_1 is that the taxation for the war is shifted from period 1 to period 5. In real terms, there is NO difference at all. Real consumption of the household sector is in both cases reduced in period 1. In other words, the taxes are paid in period 5 with a saving of 10 units from period 1. That’s all if the interest rate is zero. The whole exercise amounts to an indefinite tax deferment.

If the government issues bonds with a volume of 10 units in period 2 the household sector’s deposits are reduced to zero and so are the government's overdrafts. The central bank’s balance sheet reduces to zero. The household sector holds bonds instead of deposits and the government switches overdrafts into bond liabilities. The central bank is out as an intermediary and there is a direct creditor-debtor relationship between the household and the government sector in the form of bonds or similar types of government securities.

The interest on bonds is taxed from the household sector and paid to the bondholders. There is a redistribution of disposable income as long as the public debt is rolled over. This redistribution is normally not for the benefit of WeThePeople but for the benefit of the Oligarchy. The lower the interest rate the smaller the redistribution from the ninety-nine-percenters to the one-percenters.

In period 4, the whole securitization transaction is exactly reversed. The government sector takes up 10 units of overdrafts and redeems the bonds. Accordingly, the household sector’s stock of bonds is reduced from 10 to zero and the deposits go up from zero to 10.

In period 5 the households are taxed, they dissave and the government fully repays the overdrafts.

In period 6 everything is again as it was in the initial period.

Scenario_2 fully replaces Ricardian Equivalence.

Scenario_3 No taxation, no saving, government deficit spending

The government spends G=10 on war but the households do NOT reduce consumption expenditures, i.e. C

h=100, and accordingly, their deposits are zero at the beginning and the end of period 1. The government takes up overdrafts at the central bank and spends these 10 units IN ADDITION to the households, so total consumption expenditures are now C=C

h+G=110. Since total output remains unchanged the market-clearing price now rises and the business sector makes a profit of Q=10 which is equal to the government’s budget deficit, i.e. G−T=10 with T=0. At the central bank, the business sector’s deposits are 10 and government overdrafts are also 10 at the end of period 1. The redistribution of current output O between the household and the government sector does not happen via the income tax or saving but via a one-off hike of the market-clearing price P. There is NO inflation.

In real terms, there is again NO difference between the scenarios. The difference compared to scenario_2 is that the business sector now has 10 units deposits instead of the household sector because the households do not save and the business sector makes a profit of 10 units. Business sector’s deposits = money = government’s overdrafts.

In the next period, the war is over, the government’s war spending stops, and the market-clearing price falls back to the initial level. The business sector can hold its deposits indefinitely and the government can keep its overdrafts indefinitely. Alternatively, the government sector can sell bonds to the business sector which takes the central bank out of the loop and establishes a direct credit relationship between the business sector and the government sector.

As long as the government does not tax the households, everything remains unchanged for an indefinite time. So, the whole issue of war financing can simply be pushed beyond the time horizon and forgotten. The trouble comes here in period 5 when the disposable income is reduced due to taxation from 100 to 90 and consumption expenditures fall also to 90 because now there is no dissaving. In this case, the market-clearing price falls and the business sector makes a loss of 10 units which reduces its deposits to zero. The one-off price hike of period 1 is reversed in period 5. Summed over all periods, macroeconomic profit is zero.

The government is now in the possession of 10 units of deposits from taxation which can be used to redeem the bonds/overdrafts. Everything is then again as it was in the initial period.

Comparison

In scenario_1, the households pay income tax in period 1 and NO credit relationships ensue. In scenario_2, the tax payment is deferred via saving in period 1 and dissaving in period 5. In scenario_3 we have instead of the saving/dissaving of the household sector profit in period 1 and loss in period 5. Summed over all periods profit and loss cancel out. In scenario_2, profit is zero over all periods.

In REAL terms and with an

interest rate of zero, there is absolutely NO difference between the scenarios. In real terms, the war is paid for in period 1 by the household sector. The significant difference is between the saving/dissaving scenario and the profit/loss scenario.

In the real world, a mixture of the three scenarios happens. The war is paid for in nominal terms by a combination of taxation, household sector saving, and government deficit spending.

Summary

From the perspective of WeThePeople scenario_1 is the best. It entails budget balancing. Scenario_2 brings additional taxes for the payment of interest on the public debt. From the perspective of the Oligarchy, scenario_3 is the best. This scenario produces the macroeconomic profit of the business sector. In other words, the MMT policy of deficit-spending/money-creation is the Oligarchy’s profit booster.

The households pay in real terms for the war through a reduction of real private consumption in period 1. In nominal terms, the question is how long is taxation deferred? The central bank can extend the deferment in principle until eternity by buying the government securities and keeping them on the asset side. Otherwise, the households are taxed for interest payments on the public debt in all eternity for the benefit of the Oligarchy.

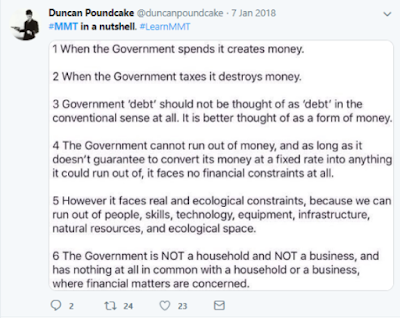

Neither in war nor in peace the MMT policy of deficit-spending/money-creation is ultimately in the interest of WeThePeople. When it comes to the debate about the Green New Deal ― allegedly the moral equivalent of war ― people should be aware that economists are scientifically incompetent or/and morally corrupt. The proof is in the actual distribution of financial wealth and the amount of public debt (about $22 trillion and counting). When MMTers talk about physical annihilation it should be realized that people live already for a long time in a state of deferred financial annihilation.

Egmont Kakarot-Handtke

*

New Economic Perspectives

#1 For the full-spectrum refutation of MMT see

cross-references MMT

#2

The canonical macroeconomic model

Related '

What comes first: eco-self-destruction or oeco-self-destruction?' and '

How to solve almost any problem' and '

The true nature of economists' confusion' and '

MMT and the Green New Deal: Where is the snag? (I)' and '

MMT and the Green New Deal: Where is the snag? (II)' and '

Stephanie Kelton sells children into debt slavery'.

***