Comment on Paul Krugman on ‘A General Theory Of Austerity?’

Blog-Reference

Paul Krugman explains the world by second-guessing the motives of folks he does not agree with: “[The] bottom line is that austerity was the result of right-wing opportunism, exploiting instinctive popular concern about rising government debt in order to reduce the size of the state.” (See intro)

Krugman should know that ‘right-wing opportunism’ is not exactly a profound scientific argument: “Remember: occasionally, it may be an interesting question to ask why a man says what he says; but whatever the answer, it does not tell us anything about whether what he says is true or false.” (Schumpeter)

The very characteristic of the Austerity discussion is that the arguments of BOTH sides have no sound scientific foundation. In other words, they are provably false.

The title of Krugman’s post refers to Keynes’ General Theory. Keynes based macroeconomics on logically and conceptually defective foundations and neither Post Keynesians nor New Keynesians nor Anti-Keynesians have realized his foundational blunder since 1936.

Keynes defined the formal core of the General Theory as follows: “Income = value of output = consumption + investment. Saving = income − consumption. Therefore saving = investment.” (1973, p. 63)

This two-liner is defective because Keynes never came to grips with profit: “His Collected Writings show that he wrestled to solve the Profit Puzzle up till the semi-final versions of his GT but in the end he gave up and discarded the draft chapter dealing with it.” (Tómasson et al., 2010, p. 12)

Keynes had NO idea of the fundamental concepts of economics, viz. profit and income. Because profit is ill-defined the whole theoretical superstructure of macroeconomics is false, in particular, all I=S/IS-LM models.

Allais clearly identified Keynes’s major fault: “... mais son [Keynes’s] insuffisance logique ne lui a pas permis de résoudre les problèmes que son intuition lui avait fait entrevoir.” (1993, p. 70). In other words, Keynes stumbled upon the problems but could not solve them because of his logical insufficiency.

The correct relationship is given by Qre≡I−S (Allais, 1993, p. 69) Legend: Qre retained profit, S saving, I investment expenditures.

So, Keynes got it wrong 80 years ago and Allais got it right 23 years ago and Krugman did not check anything and is deep in the woods to this day (2014). The same holds for Wren-Lewis.#1

Because Keynesianism in all its variants is axiomatically false, the commonplace theory of employment is false by implication.#2 What is needed is NOT brain-dead political blather but the scientifically true general theory of profit, employment, and deficit spending. Don’t wait for Krugman, Wren-Lewis, and the rest of logical retards to deliver it.

Egmont Kakarot-Handtke

References

Allais, M. (1993). Les Fondements Comptable de la Macro-Économie. Paris: Presses Universitaires de France, 2nd edition.

Kakarot-Handtke, E. (2014). Mr. Keynes, Prof. Krugman, IS-LM, and the End of Economics as We Know It. SSRN Working Paper Series, 2392856: 1–19. URL

Keynes, J. M. (1973). The General Theory of Employment Interest and Money. London, Basingstoke: Macmillan.

Tómasson, G., and Bezemer, D. J. (2010). What is the Source of Profit and Interest? A Classical Conundrum Reconsidered. MPRA Paper, 20557: 1–34. URL

#1 I=S: Mark of the Incompetent

#2 The choice between Friedmanian pest and Keynesian cholera

Related 'How Keynes got macro wrong and Allais got it right' and 'Macroeconomics ― dead since Keynes' and 'From Keynes’ fatal blunder to the true economic model' and 'The general theory of scientific incompetence' and 'Keynes’ intellectual non-existence' and '#DeleteKeynes #ExpelAllKeynesians' and 'For details of the big picture see cross-references Keynesianism.

This blog connects to the AXEC Project which applies a superior method of economic analysis. The following comments have been posted on selected blogs as catalysts for the ongoing Paradigm Shift. The comments are brought together here for information. The full debates are directly accessible via the Blog-References. Scrap the lot and start again―that is what a Paradigm Shift is all about. Time to make economics a science.

September 30, 2016

A basket of scientific deplorables

Comment on Paul Krugman on ‘VAT of Deplorables’

Blog-Reference

Paul Krugman argues: “This says that if he [Trump] somehow becomes president, and decides to take the job seriously, it won’t help — because his judgment in advisers, his notion of who constitutes an expert, is as bad as his judgment on the fly.”

What exactly is an economic expert?

“In order to tell the politicians and practitioners something about causes and best means, the economist needs the true theory or else he has not much more to offer than educated common sense or his personal opinion.” (Stigum, 1991)

Economists have no true theory. Economics is a failed science. What economists have to offer is political opinion without sound scientific foundation.

Paul Krugman still applies IS-LM* and this proves that his scientific judgment is “as bad as his judgment on the fly”.

Egmont Kakarot-Handtke

* See ‘Mr. Keynes, Prof. Krugman, IS-LM, and the End of Economics as We Know It’

Blog-Reference

Paul Krugman argues: “This says that if he [Trump] somehow becomes president, and decides to take the job seriously, it won’t help — because his judgment in advisers, his notion of who constitutes an expert, is as bad as his judgment on the fly.”

What exactly is an economic expert?

“In order to tell the politicians and practitioners something about causes and best means, the economist needs the true theory or else he has not much more to offer than educated common sense or his personal opinion.” (Stigum, 1991)

Economists have no true theory. Economics is a failed science. What economists have to offer is political opinion without sound scientific foundation.

Paul Krugman still applies IS-LM* and this proves that his scientific judgment is “as bad as his judgment on the fly”.

Egmont Kakarot-Handtke

* See ‘Mr. Keynes, Prof. Krugman, IS-LM, and the End of Economics as We Know It’

September 29, 2016

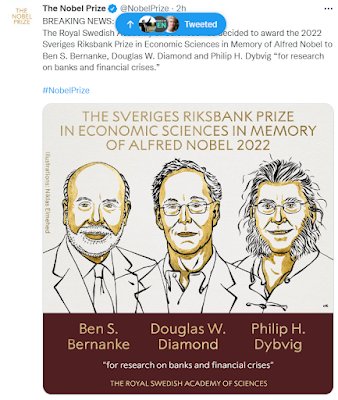

The real problem with the economics Nobel

Comment on Lars Syll on ‘The Nobel factor — the prize in economics that spearheaded the neoliberal revolution’

Blog-Reference and Blog-Reference on Oct 3 and Blog-Reference on Oct 10 and Blog-Reference on Jun 8, 2017, adapted to context

Lars Syll argues that the economics Nobel is politically biased: “... the prize was thought to take advantage of the connection with the true Nobel prizes and spearhead a market-oriented neoliberal reshaping of the world.” (See intro)

This is a minor problem, the real problem is in the title: “Bank of Sweden Prize in Economic Sciences in Memory of Alfred Nobel”.

The keyword is Science[s]. Why not simply “Bank of Sweden Prize in Economics”? The original title clearly communicates the claim that economics is a science. This claim is as old as Adam Smith/Karl Marx.

Science is well-defined by the criteria of formal and material consistency: “Research is, in fact, a continuous discussion of the consistency of theories: formal consistency insofar as the discussion relates to the logical cohesion of what is asserted in joint theories; material consistency insofar as the agreement of observations with theories is concerned.” (Klant, 1994)

Neither orthodox nor heterodox economics satisfies the criteria of formal and material consistency. It is a provable fact that neither Walrasianism, nor Keynesianism, nor Marxianism, nor Austrianism is materially/formally consistent.

Accordingly, economics is not a science (or sciences) but what Feynman famously called a cargo cult science.

The Bank of Sweden is legitimized to award prizes to whoever it wants and to push any political agenda it wants. The Bank, though, is NOT legitimized to declare economics as science well knowing that economics has not lived up to scientific standards since the founding fathers.

The scientific community has to see to it, firstly, that the word ‘sciences’ is eliminated from the “Bank of Sweden Prize in Economic Sciences”. The general public has to be informed that the 200-year-old claim and the actual state of economics do not match and that ALL economic policy guidance, i.e. independently of political orientation, lacks a sound scientific foundation. It follows, secondly, that economists have to be expelled from the scientific community. It follows, thirdly, that organizations like AEA, Royal Economic Society, Verein für Socialpolitik etcetera refrain from speaking in the name of science.

The real problem with the Bank of Sweden Prize is that it may give rise to a claim for damages in the case of severe depression/unemployment which is ultimately caused by provably false economic theory.

Egmont Kakarot-Handtke

Related 'Swedish muddle' and 'Swedish economists — what’s that?' and 'Economics: the simple logic of failure' and 'Scientists and science actors' and 'The economist as stand-up comedian' and 'Economists: the Trumps of science' and 'When fake scientists call out on fake politicians' and 'The economics Cargo Cult Prize' and 'Economics is NOT a science of behavior' and 'As Napoleon said: don’t listen to economists' and 'Why does Heterodoxy not abolish the fake Nobel?' and 'Legitimacy lost' and '10 steps to leave cargo cult economics behind for good' and 'The trouble with economics prizes' and 'Links on the Economics Nobel'. For details of the big picture see cross-references Failed/Fake Scientists.

Immediately following Great souls’ methodology

Economics is a failed science. Walrasianism, Keynesianism, Marxianism, and Austrianism are contradictory and axiomatically false. See The real problem with the economics Nobel.

In order NOT to mislead the general public, the word 'Sciences' has to be deleted from the “Bank of Sweden Prize in Economic Sciences in Memory of Alfred Nobel”.

Blog-Reference and Blog-Reference on Oct 3 and Blog-Reference on Oct 10 and Blog-Reference on Jun 8, 2017, adapted to context

Lars Syll argues that the economics Nobel is politically biased: “... the prize was thought to take advantage of the connection with the true Nobel prizes and spearhead a market-oriented neoliberal reshaping of the world.” (See intro)

This is a minor problem, the real problem is in the title: “Bank of Sweden Prize in Economic Sciences in Memory of Alfred Nobel”.

The keyword is Science[s]. Why not simply “Bank of Sweden Prize in Economics”? The original title clearly communicates the claim that economics is a science. This claim is as old as Adam Smith/Karl Marx.

Science is well-defined by the criteria of formal and material consistency: “Research is, in fact, a continuous discussion of the consistency of theories: formal consistency insofar as the discussion relates to the logical cohesion of what is asserted in joint theories; material consistency insofar as the agreement of observations with theories is concerned.” (Klant, 1994)

Neither orthodox nor heterodox economics satisfies the criteria of formal and material consistency. It is a provable fact that neither Walrasianism, nor Keynesianism, nor Marxianism, nor Austrianism is materially/formally consistent.

Accordingly, economics is not a science (or sciences) but what Feynman famously called a cargo cult science.

The Bank of Sweden is legitimized to award prizes to whoever it wants and to push any political agenda it wants. The Bank, though, is NOT legitimized to declare economics as science well knowing that economics has not lived up to scientific standards since the founding fathers.

The scientific community has to see to it, firstly, that the word ‘sciences’ is eliminated from the “Bank of Sweden Prize in Economic Sciences”. The general public has to be informed that the 200-year-old claim and the actual state of economics do not match and that ALL economic policy guidance, i.e. independently of political orientation, lacks a sound scientific foundation. It follows, secondly, that economists have to be expelled from the scientific community. It follows, thirdly, that organizations like AEA, Royal Economic Society, Verein für Socialpolitik etcetera refrain from speaking in the name of science.

The real problem with the Bank of Sweden Prize is that it may give rise to a claim for damages in the case of severe depression/unemployment which is ultimately caused by provably false economic theory.

Egmont Kakarot-Handtke

Related 'Swedish muddle' and 'Swedish economists — what’s that?' and 'Economics: the simple logic of failure' and 'Scientists and science actors' and 'The economist as stand-up comedian' and 'Economists: the Trumps of science' and 'When fake scientists call out on fake politicians' and 'The economics Cargo Cult Prize' and 'Economics is NOT a science of behavior' and 'As Napoleon said: don’t listen to economists' and 'Why does Heterodoxy not abolish the fake Nobel?' and 'Legitimacy lost' and '10 steps to leave cargo cult economics behind for good' and 'The trouble with economics prizes' and 'Links on the Economics Nobel'. For details of the big picture see cross-references Failed/Fake Scientists.

Immediately following Great souls’ methodology

***

COMMENT and COMMENT on 'Oliver Hart, Laureate in Economic Sciences' on Dec 13Economics is a failed science. Walrasianism, Keynesianism, Marxianism, and Austrianism are contradictory and axiomatically false. See The real problem with the economics Nobel.

In order NOT to mislead the general public, the word 'Sciences' has to be deleted from the “Bank of Sweden Prize in Economic Sciences in Memory of Alfred Nobel”.

***

Twitter 2019 Oct 8

Twitter 2019 Oct 8

Twitter 2020 Nov 28

Richard S.J. Tol, 2020, Rise of the Kniesians: The professor-student network of Nobel laureates in economics

Twitter Jan 30, 2022

Twitter Oct 10, 2022 What the EconNobel rewards ― not science to be sure

Twitter Oct 15, 2020

Sticky prices or sticky brains?

Comment on David Glasner on ‘Price Stickiness Is a Symptom not a Cause’

Blog-Reference and Blog-Reference on Sep 30

The discussion between Nick Rowe and David Glasner suffers from the obvious fact that they have no common and well-articulated model of the economy at the back of their minds. The arguments are drawn either from the Walrasian general-equilibrium-theory pool or from the Keynesian monetary-theory-of-production pool. What makes the discussion surreal is that both Walrasianism and Keynesianism are known to be failed approaches.

The elementary Walrasian story of the market economy goes roughly as follows. There are different types of markets (basically product, labor, money, real assets, financial assets) which function according to what Leijonhufvud called the totem of economics, that is, supply-function-demand-function-equilibrium and interact such that under the ideal condition of full price flexibility in each market all markets clear. It has ALWAYS been admitted that in the real world conditions are not ideal. The claim is that this does not affect the benchmark function of the Walrasian model. The elementary story is backed up by general equilibrium theory which provides the formal proof of the existence of a market-clearing price vector.

The proof of the Walrasian story is worthless because its premises are false. Fact is that (i) the different market types work on DIFFERENT principles (2011), (ii) all three analytical elements of “the” market, i.e. supply function, demand function, equilibrium, are nonentities, (iii) the underlying behavioral assumptions are false.

In sum, the Walrasian story of the market economy is axiomatically false. The axioms are given with this set: “HC1 economic agents have preferences over outcomes; HC2 agents individually optimize subject to constraints; HC3 agent choice is manifest in interrelated markets; HC4 agents have full relevant knowledge; HC5 observable outcomes are coordinated, and must be discussed with reference to equilibrium states.” (Weintraub, 1985, p. 147)

Axiomatically false means that the theory/model is BEYOND repair and has to be fully REPLACED. The replacement of the axiomatic foundations is what methodologists call a paradigm shift. Nothing less will do.

Nick Rowe has not realized this and reiterates the Walrasian story with a new spin which is as senseless as adding epicycles to the geocentric model.

David Glasner is already enlightened: “Most of all, they represent an uncritical transfer of partial-equilibrium microeconomic thinking to a problem that requires a system-wide macroeconomic approach. That approach should not ignore microeconomic reasoning, but it has to transcend both partial-equilibrium supply-demand analysis and the mathematics of intertemporal optimization.” This crucial insight is beyond sticky Nick and others of the Walrasian ilk.

To rise above Walrasian and Keynesian drivel requires a Paradigm Shift from Walrasian microfoundations and Keynes’ flawed macrofoundations to entirely new macrofoundations (2014).#1 New macrofoundations deliver the materially/formally consistent general theory of profit, employment, interest, and money.

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2011). Primary and Secondary Markets. SSRN Working Paper Series, 1917012: 1–26. URL

Kakarot-Handtke, E. (2014). Objective Principles of Economics. SSRN Working Paper Series, 2418851: 1–19. URL

Weintraub, E. R. (1985). Joan Robinson’s Critique of Equilibrium: An Appraisal. American Economic Review, Papers and Proceedings, 75(2): 146–149. URL

#1 See also From Orthodoxy to Heterodoxy to Sysdoxy’ and ‘How to restart economics.

Immediately following A brief rectification employment theory.

Blog-Reference and Blog-Reference on Sep 30

The discussion between Nick Rowe and David Glasner suffers from the obvious fact that they have no common and well-articulated model of the economy at the back of their minds. The arguments are drawn either from the Walrasian general-equilibrium-theory pool or from the Keynesian monetary-theory-of-production pool. What makes the discussion surreal is that both Walrasianism and Keynesianism are known to be failed approaches.

The elementary Walrasian story of the market economy goes roughly as follows. There are different types of markets (basically product, labor, money, real assets, financial assets) which function according to what Leijonhufvud called the totem of economics, that is, supply-function-demand-function-equilibrium and interact such that under the ideal condition of full price flexibility in each market all markets clear. It has ALWAYS been admitted that in the real world conditions are not ideal. The claim is that this does not affect the benchmark function of the Walrasian model. The elementary story is backed up by general equilibrium theory which provides the formal proof of the existence of a market-clearing price vector.

The proof of the Walrasian story is worthless because its premises are false. Fact is that (i) the different market types work on DIFFERENT principles (2011), (ii) all three analytical elements of “the” market, i.e. supply function, demand function, equilibrium, are nonentities, (iii) the underlying behavioral assumptions are false.

In sum, the Walrasian story of the market economy is axiomatically false. The axioms are given with this set: “HC1 economic agents have preferences over outcomes; HC2 agents individually optimize subject to constraints; HC3 agent choice is manifest in interrelated markets; HC4 agents have full relevant knowledge; HC5 observable outcomes are coordinated, and must be discussed with reference to equilibrium states.” (Weintraub, 1985, p. 147)

Axiomatically false means that the theory/model is BEYOND repair and has to be fully REPLACED. The replacement of the axiomatic foundations is what methodologists call a paradigm shift. Nothing less will do.

Nick Rowe has not realized this and reiterates the Walrasian story with a new spin which is as senseless as adding epicycles to the geocentric model.

David Glasner is already enlightened: “Most of all, they represent an uncritical transfer of partial-equilibrium microeconomic thinking to a problem that requires a system-wide macroeconomic approach. That approach should not ignore microeconomic reasoning, but it has to transcend both partial-equilibrium supply-demand analysis and the mathematics of intertemporal optimization.” This crucial insight is beyond sticky Nick and others of the Walrasian ilk.

To rise above Walrasian and Keynesian drivel requires a Paradigm Shift from Walrasian microfoundations and Keynes’ flawed macrofoundations to entirely new macrofoundations (2014).#1 New macrofoundations deliver the materially/formally consistent general theory of profit, employment, interest, and money.

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2011). Primary and Secondary Markets. SSRN Working Paper Series, 1917012: 1–26. URL

Kakarot-Handtke, E. (2014). Objective Principles of Economics. SSRN Working Paper Series, 2418851: 1–19. URL

Weintraub, E. R. (1985). Joan Robinson’s Critique of Equilibrium: An Appraisal. American Economic Review, Papers and Proceedings, 75(2): 146–149. URL

#1 See also From Orthodoxy to Heterodoxy to Sysdoxy’ and ‘How to restart economics.

Immediately following A brief rectification employment theory.

September 27, 2016

The choice between Friedmanian pest and Keynesian cholera

Comment on Brad DeLong on ‘The Stakes of the Helicopter Money Debate: A Primer’

Blog-Reference

Brad DeLong summarizes: “The Great Moderation of the business cycle from 1984-2007 was a rich enough pudding to be proof, for the rough consensus of mainstream economists at least, that Keynes had been wrong and Friedman had been right. But in the aftermath of 2007, it became very clear that they — or, rather, we, ... — were very, tragically, dismally and grossly wrong.”

And then he continues: “Now we face a choice ...”

No, there never has been a choice between the Friedmanians and Keynesians because BOTH are wrong. Both are groping in the dark with regard to the two most important features of the market economy: the profit mechanism and the price mechanism. Because of this, the discussion about monetary and fiscal policy, or helicopter money for that matter, never had more scientific content than a free ink-blot association.

“In order to tell the politicians and practitioners something about causes and best means, the economist needs the true theory or else he has not much more to offer than educated common sense or his personal opinion.” (Stigum, 1991, p. 30)

Economists have no true theory. Economics is a failed science. What Friedmanians and Keynesians have to offer is political opinion without sound scientific foundations.

For the proof let us very briefly turn to the formally and empirically correct employment theory (2012; 2014). The basic version of the objective structural Employment Law is shown on Wikimedia AXEC62a:

Blog-Reference

Brad DeLong summarizes: “The Great Moderation of the business cycle from 1984-2007 was a rich enough pudding to be proof, for the rough consensus of mainstream economists at least, that Keynes had been wrong and Friedman had been right. But in the aftermath of 2007, it became very clear that they — or, rather, we, ... — were very, tragically, dismally and grossly wrong.”

And then he continues: “Now we face a choice ...”

No, there never has been a choice between the Friedmanians and Keynesians because BOTH are wrong. Both are groping in the dark with regard to the two most important features of the market economy: the profit mechanism and the price mechanism. Because of this, the discussion about monetary and fiscal policy, or helicopter money for that matter, never had more scientific content than a free ink-blot association.

“In order to tell the politicians and practitioners something about causes and best means, the economist needs the true theory or else he has not much more to offer than educated common sense or his personal opinion.” (Stigum, 1991, p. 30)

Economists have no true theory. Economics is a failed science. What Friedmanians and Keynesians have to offer is political opinion without sound scientific foundations.

For the proof let us very briefly turn to the formally and empirically correct employment theory (2012; 2014). The basic version of the objective structural Employment Law is shown on Wikimedia AXEC62a:

From this equation follows inter alia:

(i) An increase in the expenditure ratio ρE leads to higher employment (the letter ρ stands for ratio).

(ii) Increasing investment expenditures I exert a positive influence on employment,

(iii) An increase in the factor cost ratio ρF≡W/PR leads to higher employment.

The complete AND testable Employment Law is a bit longer and contains in addition profit distribution, public deficit spending, and import/export.

Items (i) and (ii) cover Keynes’ arguments about the role of aggregate demand, which have been commonsensical right but formally defective. The factor cost ratio ρF as defined in (iii) embodies the price mechanism which works very differently from what the representative economist hallucinates. As a matter of fact, overall employment (in the world economy or a closed national economy) INCREASES if the average wage rate W INCREASES relative to average price P and productivity R.

So, in simple terms, full employment (in any definition) can be achieved by increasing aggregate demand or by INCREASING the average wage rate (or by a combination of the two).

The second alternative is preferable to Keynesian deficit spending#1 but it is the very opposite of what the broad consensus always told the world: “We economists have all learned, and many of us teach, that the remedy for excess supply in any market is a reduction in price. If this is prevented by combinations in restraint of trade or by government regulations, then those impediments to competition should be removed.” (Tobin, 1997, p. 11)

Both, the Friedmanian and Keynesian approaches have produced misleading policy advice. Unemployment is ultimately the result of theory failure. Before economists can hope to be taken seriously they have to do some scientific homework.

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2012). Keynes’s Employment Function and the Gratuitous Phillips Curve Disaster. SSRN Working Paper Series, 2130421: 1–19. URL

Kakarot-Handtke, E. (2014). Towards Full Employment Through Applied Algebra and Counter-Intuitive Behavior. SSRN Working Paper Series, 2456184: 1–25. URL

Stigum, B. P. (1991). Toward a Formal Science of Economics: The Axiomatic Method in Economics and Econometrics. Cambridge: MIT Press.

Tobin, J. (1997). An Overview of the General Theory. In G. C. Harcourt, and P. A. Riach (Eds.), The ’Second Edition’ of The General Theory, Vol. 2, 3–27. Oxon: Routledge.

#1 Keynesianism as ultimate profit machine

You say: “I get the sense that you expect too much from the ‘dismal science’.”

I get the sense that you have some trouble with clear thinking. It is very well known and communicated each year in no uncertain terms that economics is a science: “Bank of Sweden Prize in Economic Sciences in Memory of Alfred Nobel”.

Science is well-defined by the criteria of formal and material consistency: “Research is in fact a continuous discussion of the consistency of theories: formal consistency insofar as the discussion relates to the logical cohesion of what is asserted in joint theories; material consistency insofar as the agreement of observations with theories is concerned.” (Klant, 1994)

It is a provable fact that neither Walrasianism, nor Keynesianism, nor Marxianism, nor Austrianism is materially/formally consistent. All these approaches are axiomatically false, that is, beyond repair.#1

If you think that it is ‘too much’ to demand from economics to live up to scientific standards then you have to see to it, firstly, that the word ‘sciences’ is eliminated from the “Bank of Sweden Prize in Economic Sciences”. The general public has to be informed that the 200-year-old claim and the actual state of economics do not match. It follows, secondly, that economists have to be expelled from the scientific community. It follows, thirdly, that organizations like the AEA refrain from speaking in the name of science.

Your argument misses the point. I expect nothing from the currently active and failed economists other than to drop the claim that they are doing science. This claim is ‘too much’.

#1 All models are false because all economists are stupid

(i) An increase in the expenditure ratio ρE leads to higher employment (the letter ρ stands for ratio).

(ii) Increasing investment expenditures I exert a positive influence on employment,

(iii) An increase in the factor cost ratio ρF≡W/PR leads to higher employment.

The complete AND testable Employment Law is a bit longer and contains in addition profit distribution, public deficit spending, and import/export.

Items (i) and (ii) cover Keynes’ arguments about the role of aggregate demand, which have been commonsensical right but formally defective. The factor cost ratio ρF as defined in (iii) embodies the price mechanism which works very differently from what the representative economist hallucinates. As a matter of fact, overall employment (in the world economy or a closed national economy) INCREASES if the average wage rate W INCREASES relative to average price P and productivity R.

So, in simple terms, full employment (in any definition) can be achieved by increasing aggregate demand or by INCREASING the average wage rate (or by a combination of the two).

The second alternative is preferable to Keynesian deficit spending#1 but it is the very opposite of what the broad consensus always told the world: “We economists have all learned, and many of us teach, that the remedy for excess supply in any market is a reduction in price. If this is prevented by combinations in restraint of trade or by government regulations, then those impediments to competition should be removed.” (Tobin, 1997, p. 11)

Both, the Friedmanian and Keynesian approaches have produced misleading policy advice. Unemployment is ultimately the result of theory failure. Before economists can hope to be taken seriously they have to do some scientific homework.

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2012). Keynes’s Employment Function and the Gratuitous Phillips Curve Disaster. SSRN Working Paper Series, 2130421: 1–19. URL

Kakarot-Handtke, E. (2014). Towards Full Employment Through Applied Algebra and Counter-Intuitive Behavior. SSRN Working Paper Series, 2456184: 1–25. URL

Stigum, B. P. (1991). Toward a Formal Science of Economics: The Axiomatic Method in Economics and Econometrics. Cambridge: MIT Press.

Tobin, J. (1997). An Overview of the General Theory. In G. C. Harcourt, and P. A. Riach (Eds.), The ’Second Edition’ of The General Theory, Vol. 2, 3–27. Oxon: Routledge.

#1 Keynesianism as ultimate profit machine

***

REPLY to Ray LaPan-Love on Sep 28You say: “I get the sense that you expect too much from the ‘dismal science’.”

I get the sense that you have some trouble with clear thinking. It is very well known and communicated each year in no uncertain terms that economics is a science: “Bank of Sweden Prize in Economic Sciences in Memory of Alfred Nobel”.

Science is well-defined by the criteria of formal and material consistency: “Research is in fact a continuous discussion of the consistency of theories: formal consistency insofar as the discussion relates to the logical cohesion of what is asserted in joint theories; material consistency insofar as the agreement of observations with theories is concerned.” (Klant, 1994)

It is a provable fact that neither Walrasianism, nor Keynesianism, nor Marxianism, nor Austrianism is materially/formally consistent. All these approaches are axiomatically false, that is, beyond repair.#1

If you think that it is ‘too much’ to demand from economics to live up to scientific standards then you have to see to it, firstly, that the word ‘sciences’ is eliminated from the “Bank of Sweden Prize in Economic Sciences”. The general public has to be informed that the 200-year-old claim and the actual state of economics do not match. It follows, secondly, that economists have to be expelled from the scientific community. It follows, thirdly, that organizations like the AEA refrain from speaking in the name of science.

Your argument misses the point. I expect nothing from the currently active and failed economists other than to drop the claim that they are doing science. This claim is ‘too much’.

#1 All models are false because all economists are stupid

The trouble with Naked Keynesianism

Comment on Matias Vernengo on ‘The Trouble with Paul Romer’s Angriness’

Blog-Reference

In his recent paper, ‘The Trouble With Macroeconomics’ Paul Romer put DSGE and its main proponents ― Lucas, Sargent, Prescott ― to rest. From the fact that microfounded macro is an officially buried research program, though, does not follow that Keynesian macro can now be taken seriously.

Keynes, too, based macroeconomics on logically and conceptually defective foundations, and neither Post Keynesians nor New Keynesians nor Anti-Keynesians have realized his foundational blunder in 80+ years.

For details see How Keynes got macro wrong and Allais got it right and All models are false because all economists are stupid.

Egmont Kakarot-Handtke

Blog-Reference

In his recent paper, ‘The Trouble With Macroeconomics’ Paul Romer put DSGE and its main proponents ― Lucas, Sargent, Prescott ― to rest. From the fact that microfounded macro is an officially buried research program, though, does not follow that Keynesian macro can now be taken seriously.

Keynes, too, based macroeconomics on logically and conceptually defective foundations, and neither Post Keynesians nor New Keynesians nor Anti-Keynesians have realized his foundational blunder in 80+ years.

For details see How Keynes got macro wrong and Allais got it right and All models are false because all economists are stupid.

Egmont Kakarot-Handtke

September 26, 2016

How Keynes got macroeconomics wrong and Allais got it right

Comment on Lars Syll on ‘Good advice to aspiring economists’

Blog-Reference and Blog-Reference on Sep 28 and Blog-Reference on Nov 28 and Blog-Reference on Dec 2, 2019, adapted to context and Blog-Reference on Dec 4

Keynes based macroeconomics on logically and conceptually defective foundations and neither Post Keynesians nor New Keynesians nor Anti-Keynesians have realized his foundational blunder in 80+ years (2014).

Keynes defined the formal core of the General Theory as follows: “Income = value of output = consumption + investment. Saving = income − consumption. Therefore saving = investment.” (1973, p. 63)

This syllogism is defective because Keynes never came to grips with profit: “His Collected Writings show that he wrestled to solve the Profit Puzzle up till the semi-final versions of his GT but in the end he gave up and discarded the draft chapter dealing with it.” (Tómasson et al., 2010, p. 12)

Keynes had NO idea of the fundamental concepts of economics, viz. profit and income. Because profit is ill-defined the whole theoretical superstructure of macroeconomics is false, in particular, ALL I=S/IS-LM models (2011; 2013).

Allais clearly identified Keynes major fault: “... mais son [Keynes’] insuffisance logique ne lui a pas permis de résoudre les problèmes que son intuition lui avait fait entrevoir.” (1993, p. 70). In other words, Keynes saw the problems but could not solve them because of his logical insufficiency.

The correct relationship is given by Qre≡I−S (Allais, 1993, p. 69) Legend: Qre retained profit, S household sector's saving, I business sector's investment expenditures.

It is pretty obvious from this equation that I and S are NEVER equal, neither ex-ante nor ex-post. The argument that I=S is merely an accounting identity proves only that, as a general rule, economists are too stupid to understand the elementary mathematics of accounting (2012). Allais understood it.

Egmont Kakarot-Handtke

References

Allais, M. (1993). Les Fondements Comptable de la Macro-Économie. Paris: Presses Universitaires de France, 2nd edition.

Kakarot-Handtke, E. (2011). Squaring the Investment Cycle. SSRN Working Paper Series, 1911796: 1–25. URL

Kakarot-Handtke, E. (2012). The Common Error of Common Sense: An Essential Rectification of the Accounting Approach. SSRN Working Paper Series, 2124415: 1–23. URL

Kakarot-Handtke, E. (2013). Settling the Theory of Saving. SSRN Working Paper Series, 2220651: 1–23. URL

Kakarot-Handtke, E. (2014). The Three Fatal Mistakes of Yesterday Economics: Profit, I=S, Employment. SSRN Working Paper Series, 2489792: 1–13. URL

Keynes, J. M. (1973). The General Theory of Employment Interest and Money. London, Basingstoke: Macmillan.

Tómasson, G., and Bezemer, D. J. (2010). What is the Source of Profit and Interest? A Classical Conundrum Reconsidered. MPRA Paper, 20557: 1–34. URL

Related 'Wikipedia and the promotion of economists’ idiotism' and 'Macro for dummies' and 'Rectification of MMT macro accounting' and 'A tale of three accountants' and 'Review of the economics troops' and 'Keynesianism as ultimate profit machine' and 'Profit and the collective failure of economists' and 'Wikipedia and the promotion of economists’ idiotism (II)' and 'Flow-Balance-Inconsistency ― inscription on the gravestone of economics' and 'The GDP-death-blow for the economics profession'. For details of the big picture see cross-references Refutation of I=S and cross-references Accounting.

Blog-Reference and Blog-Reference on Sep 28 and Blog-Reference on Nov 28 and Blog-Reference on Dec 2, 2019, adapted to context and Blog-Reference on Dec 4

Keynes based macroeconomics on logically and conceptually defective foundations and neither Post Keynesians nor New Keynesians nor Anti-Keynesians have realized his foundational blunder in 80+ years (2014).

Keynes defined the formal core of the General Theory as follows: “Income = value of output = consumption + investment. Saving = income − consumption. Therefore saving = investment.” (1973, p. 63)

This syllogism is defective because Keynes never came to grips with profit: “His Collected Writings show that he wrestled to solve the Profit Puzzle up till the semi-final versions of his GT but in the end he gave up and discarded the draft chapter dealing with it.” (Tómasson et al., 2010, p. 12)

Keynes had NO idea of the fundamental concepts of economics, viz. profit and income. Because profit is ill-defined the whole theoretical superstructure of macroeconomics is false, in particular, ALL I=S/IS-LM models (2011; 2013).

Allais clearly identified Keynes major fault: “... mais son [Keynes’] insuffisance logique ne lui a pas permis de résoudre les problèmes que son intuition lui avait fait entrevoir.” (1993, p. 70). In other words, Keynes saw the problems but could not solve them because of his logical insufficiency.

The correct relationship is given by Qre≡I−S (Allais, 1993, p. 69) Legend: Qre retained profit, S household sector's saving, I business sector's investment expenditures.

It is pretty obvious from this equation that I and S are NEVER equal, neither ex-ante nor ex-post. The argument that I=S is merely an accounting identity proves only that, as a general rule, economists are too stupid to understand the elementary mathematics of accounting (2012). Allais understood it.

Egmont Kakarot-Handtke

References

Allais, M. (1993). Les Fondements Comptable de la Macro-Économie. Paris: Presses Universitaires de France, 2nd edition.

Kakarot-Handtke, E. (2011). Squaring the Investment Cycle. SSRN Working Paper Series, 1911796: 1–25. URL

Kakarot-Handtke, E. (2012). The Common Error of Common Sense: An Essential Rectification of the Accounting Approach. SSRN Working Paper Series, 2124415: 1–23. URL

Kakarot-Handtke, E. (2013). Settling the Theory of Saving. SSRN Working Paper Series, 2220651: 1–23. URL

Kakarot-Handtke, E. (2014). The Three Fatal Mistakes of Yesterday Economics: Profit, I=S, Employment. SSRN Working Paper Series, 2489792: 1–13. URL

Keynes, J. M. (1973). The General Theory of Employment Interest and Money. London, Basingstoke: Macmillan.

Tómasson, G., and Bezemer, D. J. (2010). What is the Source of Profit and Interest? A Classical Conundrum Reconsidered. MPRA Paper, 20557: 1–34. URL

Related 'Wikipedia and the promotion of economists’ idiotism' and 'Macro for dummies' and 'Rectification of MMT macro accounting' and 'A tale of three accountants' and 'Review of the economics troops' and 'Keynesianism as ultimate profit machine' and 'Profit and the collective failure of economists' and 'Wikipedia and the promotion of economists’ idiotism (II)' and 'Flow-Balance-Inconsistency ― inscription on the gravestone of economics' and 'The GDP-death-blow for the economics profession'. For details of the big picture see cross-references Refutation of I=S and cross-references Accounting.

***

Wikimedia AXEC172

Wikimedia AXEC143d

From gossip to the correct employment theory

Comment on ProGrowthLiberal on ‘The New Men Without Jobs Conservative Excuse’

Blog-Reference

Economists love to psychologize about their fellow citizens. A long-standing topos is that the unemployed are drunkards, sluggards, criminals, social parasites, or smart optimizers who simply prefer leisure over work.

It is pretty obvious that NO way leads from this brain-dead folk psychological gossip to the explanation of employment/unemployment for the economy as a whole. Nonetheless, economists are quite sure how to cure unemployment: “We economists have all learned, and many of us teach, that the remedy for excess supply in any market is a reduction in price. If this is prevented by combinations in restraint of trade or by government regulations, then those impediments to competition should be removed. Applied to economy-wide unemployment, this doctrine places the blame on trade unions and governments, not on any failure of competitive markets.” (Tobin, 1997, p. 11)

In more than 200 years, employment theory has not risen above this substandard intellectual level. Time for a sketch of the formally and empirically correct employment theory (2012; 2014). The basic version of the objective structural Employment Law is shown on Wikimedia AXEC62:

Blog-Reference

Economists love to psychologize about their fellow citizens. A long-standing topos is that the unemployed are drunkards, sluggards, criminals, social parasites, or smart optimizers who simply prefer leisure over work.

It is pretty obvious that NO way leads from this brain-dead folk psychological gossip to the explanation of employment/unemployment for the economy as a whole. Nonetheless, economists are quite sure how to cure unemployment: “We economists have all learned, and many of us teach, that the remedy for excess supply in any market is a reduction in price. If this is prevented by combinations in restraint of trade or by government regulations, then those impediments to competition should be removed. Applied to economy-wide unemployment, this doctrine places the blame on trade unions and governments, not on any failure of competitive markets.” (Tobin, 1997, p. 11)

In more than 200 years, employment theory has not risen above this substandard intellectual level. Time for a sketch of the formally and empirically correct employment theory (2012; 2014). The basic version of the objective structural Employment Law is shown on Wikimedia AXEC62:

From this equation follows inter alia:

(i) An increase in the expenditure ratio ρE leads to higher employment (the letter rho ρ stands for ratio). An expenditure ratio ρE greater than 1 indicates credit expansion, a ratio ρE less than 1 indicates credit contraction.

(i) An increase in the expenditure ratio ρE leads to higher employment (the letter rho ρ stands for ratio). An expenditure ratio ρE greater than 1 indicates credit expansion, a ratio ρE less than 1 indicates credit contraction.

(ii) Increasing investment expenditures I exert a positive influence on employment, a slowdown of growth does the opposite.

(iii) An increase in the factor cost ratio ρF≡W/PR leads to higher employment.

The complete AND testable Employment Law is a bit longer and contains in addition profit distribution, public deficit spending, and import/export.

Items (i) and (ii) cover Keynes’ arguments about the role of aggregate demand, which have been commonsensically right but formally defective. More precisely, Keynes’s multiplier is provable false. The factor cost ratio ρF as defined in (iii) embodies the price mechanism which works very differently from what the representative economist hallucinates. As a matter of fact, overall employment (in the world economy or a closed national economy) INCREASES if the average wage rate W INCREASES relative to average price P and productivity R.

So, in simple terms, full employment (in any definition) can be achieved by increasing overall demand (expenditure ratio, investment expenditures, etc.) or by INCREASING the average wage rate or by a combination of the two.

Both, the Walrasian and Keynesian approaches have produced misleading policy advice. Unemployment is ultimately the result of theory failure, that is, of the utter scientific incompetence of economists who are mainly occupied with gossiping about whether the new men without jobs are floated by wives, girlfriends, relatives, or by Uncle Sam. It is only a question of time before these new men get the idea to tar and feather the ‘throng of superfluous economists’ (Joan Robinson).

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2012). Keynes’s Employment Function and the Gratuitous Phillips Curve Disaster. SSRN Working Paper Series, 2130421: 1–19. URL

Kakarot-Handtke, E. (2014). Towards Full Employment Through Applied Algebra and Counter-Intuitive Behavior. SSRN Working Paper Series, 2456184: 1–25. URL

Tobin, J. (1997). An Overview of the General Theory. In G. C. Harcourt, and P. A. Riach (Eds.), The ’Second Edition’ of The General Theory, volume 2, pages 3–27. Oxon: Routledge.

(iii) An increase in the factor cost ratio ρF≡W/PR leads to higher employment.

The complete AND testable Employment Law is a bit longer and contains in addition profit distribution, public deficit spending, and import/export.

Items (i) and (ii) cover Keynes’ arguments about the role of aggregate demand, which have been commonsensically right but formally defective. More precisely, Keynes’s multiplier is provable false. The factor cost ratio ρF as defined in (iii) embodies the price mechanism which works very differently from what the representative economist hallucinates. As a matter of fact, overall employment (in the world economy or a closed national economy) INCREASES if the average wage rate W INCREASES relative to average price P and productivity R.

So, in simple terms, full employment (in any definition) can be achieved by increasing overall demand (expenditure ratio, investment expenditures, etc.) or by INCREASING the average wage rate or by a combination of the two.

Both, the Walrasian and Keynesian approaches have produced misleading policy advice. Unemployment is ultimately the result of theory failure, that is, of the utter scientific incompetence of economists who are mainly occupied with gossiping about whether the new men without jobs are floated by wives, girlfriends, relatives, or by Uncle Sam. It is only a question of time before these new men get the idea to tar and feather the ‘throng of superfluous economists’ (Joan Robinson).

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2012). Keynes’s Employment Function and the Gratuitous Phillips Curve Disaster. SSRN Working Paper Series, 2130421: 1–19. URL

Kakarot-Handtke, E. (2014). Towards Full Employment Through Applied Algebra and Counter-Intuitive Behavior. SSRN Working Paper Series, 2456184: 1–25. URL

Tobin, J. (1997). An Overview of the General Theory. In G. C. Harcourt, and P. A. Riach (Eds.), The ’Second Edition’ of The General Theory, volume 2, pages 3–27. Oxon: Routledge.

All models are false because all economists are stupid

Comment on David Glasner on ‘Paul Romer on Modern Macroeconomics, Or, the “All Models Are False” Dodge’

Blog-Reference

Theoretical economics is science and science is digital=binary=true/false and NOTHING in between. Political economics is the very opposite of science and it resides in the bottomless swamp between true/false where “... nothing is clear and everything is possible.” (Keynes, 1973, p. 292). One will invariably find that political economists adhere to the freak methodology of anything goes/nothing matters.#1

What David Glasner does not seem to realize in his laudable refutation of the silly ‘All models are wrong’ excuse is that with regard to simplification and abstraction and the deductive method ALL has been said by the founding fathers:

In his recent paper, ‘The Trouble With Macroeconomics’#2 Paul Romer puts DSGE and its main proponents ― Lucas, Sargent, Prescott ― to rest. In the final section ‘The Trouble Ahead For All of Economics’ he appeals to emotions: “It is sad to recognize that economists who made such important scientific contributions in the early stages of their careers followed a trajectory that took them away from science.”

While it is true that DSGE and its proponents are outside of science it is NOT correct to give the impression that an accident happened at some point on the way which led from science to non-science. The fact of the matter is that DSGE has ALWAYS been outside of science because economics has ALWAYS been outside of science. The adherents to the DSGE/RBC program have done exactly what they were supposed to do: “It is a touchstone of accepted economics that all explanations must run in terms of the actions and reactions of individuals. Our behavior in judging economic research, in peer review of papers and research, and in promotions, includes the criterion that in principle the behavior we explain and the policies we propose are explicable in terms of individuals, not of other social categories.” (Arrow, 1994, p. 1)

This definition of the subject matter translates into the following set of hardcore propositions/axioms: “HC1 economic agents have preferences over outcomes; HC2 agents individually optimize subject to constraints; HC3 agent choice is manifest in interrelated markets; HC4 agents have full relevant knowledge; HC5 observable outcomes are coordinated, and must be discussed with reference to equilibrium states.” (Weintraub, 1985, p. 147)

The critical axioms are HC2 and HC5. Krugman put it nicely: “... most of what I and many others do is sorta-kinda neoclassical because it takes the maximization-and-equilibrium world as a starting point.”

It is obvious to anyone with a modicum of scientific instinct that the axiomatic starting point of orthodox economics is methodologically forever unacceptable. The axiom set consists of blatant NONENTITIES but each student generation has swallowed it without turning an eyelid. Lucas, Sargent, and Prescott certainly did. This is scientifically disqualifying.

In order to be applicable HC2, which translates formally into calculus, requires a lot of auxiliary assumptions, most prominently a well-behaved production function. Taken together, all axioms and auxiliary assumptions crystallize into SS-DD-equilibrium or what Leijonhufvud famously called the Totem of Micro/Macro.

Needless to stress that ALL THREE elements of the standard tool (SS-function, DD-function, equilibrium) are NONENTITIES. The fact that neither SS/DD functions nor an equilibrium exist leads with an inescapable consequence to the identification problem in Econometrics (see Romer Sec. 4). Romer takes this insurmountable technical difficulty as a methodological silver bullet in order to finish off DSGE/RBC. It should be noted, though, that the identification problem has its roots in the Walrasian axiom set HC1/HC5 which is the accepted common ground of orthodox economics.

To throw DSGE/RBC unceremoniously out of science is only the first step because textbook supply-demand-equilibrium, which is built upon the same maximization-and-equilibrium axioms, is proto-scientific garbage since Jevons/Walras/Menger.

This is the current state of economics: Walrasian microfoundations are false for 150+ years and Keynesian macrofoundations are false for 80+ years. As a consequence, roughly 90 percent of the content of peer-reviewed economic quality journals and 100 percent of textbooks is false.

To rise above the proto-scientific level requires a Paradigm Shift from Walrasian microfoundations and Keynes’ flawed macrofoundations to entirely new macrofoundations (2015). In methodological terms, rethinking macroeconomics requires the replacement of false axioms with true axioms and the dishonorable discharge of the Walrasian, Keynesian, Marxian, and Austrian crowd from science.

Egmont Kakarot-Handtke

References

Arrow, K. J. (1994). Methodological Individualism and Social Knowledge. American Economic Review, Papers and Proceedings, 84(2): 1–9. URL

Kakarot-Handtke, E. (2015). Major Defects of the Market Economy. SSRN Working Paper Series, 2624350: 1–40. URL

Keynes, J. M. (1973). The General Theory of Employment Interest and Money. London, Basingstoke: Macmillan.

Mill, J. S. (1874). Essays on Some Unsettled Questions of Political Economy. On the Definition of Political Economy; and on the Method of Investigation Proper To It. Library of Economics and Liberty. URL

Mill, J. S. (2006). A System of Logic Ratiocinative and Inductive. Being a Connected View of the Principles of Evidence and the Methods of Scientific Investigation, Vol. 8 of Collected Works of John Stuart Mill. Indianapolis: Liberty Fund.

Walras, L. (2010). Elements of Pure Economics. London, New York: Routledge.

Weintraub, E. R. (1985). Joan Robinson’s Critique of Equilibrium: An Appraisal. American Economic Review, Papers and Proceedings, 75(2): 146–149. URL

#1 Eclecticism, anything goes, and the pluralism of false theories

#2 The Trouble With Macroeconomics, Paul Romer, Paper of Sep 14, 2016

Related 'Economics between mathiness, dyscalculia and idiocy' and 'Schizonomics' and 'Modern macro moronism' and 'The methodological blunders of fake scientists' and 'If it isn’t macro-axiomatized, it isn’t economics' and 'Economics is a science? You must be joking!' and 'New economic thinking, or, let’s put lipstick on the dead pig' and 'Economists and the destructive power of stupidity' and 'Failed economics: The losers’ long list of lame excuses' and 'Economists: scientists or political clowns?' and 'There is no soft science only soft brains' and 'Wikipedia and the promotion of economists’ idiotism (II) ad 'Macroeconomics: Economists are too stupid for science' and 'The economist as storyteller' and 'Economists: Time to say goodbye' and 'Your economics is refuted on all counts: here is the real thing'.

Marie I. George Aristotle on Paideia of Principles

Blog-Reference

Theoretical economics is science and science is digital=binary=true/false and NOTHING in between. Political economics is the very opposite of science and it resides in the bottomless swamp between true/false where “... nothing is clear and everything is possible.” (Keynes, 1973, p. 292). One will invariably find that political economists adhere to the freak methodology of anything goes/nothing matters.#1

What David Glasner does not seem to realize in his laudable refutation of the silly ‘All models are wrong’ excuse is that with regard to simplification and abstraction and the deductive method ALL has been said by the founding fathers:

- “Any order of phenomena, however complicated, may be studied scientifically provided the rule of proceeding from the simple to the complex is always observed.” (Walras, 2010, p. 211)

- “The conclusions of geometry are not strictly true of such lines, angles, and figures, as human hands can construct. But no one, therefore, contends that the conclusions of geometry are of no utility, or that it would be better to shut up Euclid’s Elements, and content ourselves with ‘practice’ and ‘experience’.” (J. S. Mill, 1874, V.48)

- “The ground of confidence in any concrete deductive science is not the à priori reasoning itself, but the accordance between its results and those of observation à posteriori.” (Mill, 2006, p. 896)

In his recent paper, ‘The Trouble With Macroeconomics’#2 Paul Romer puts DSGE and its main proponents ― Lucas, Sargent, Prescott ― to rest. In the final section ‘The Trouble Ahead For All of Economics’ he appeals to emotions: “It is sad to recognize that economists who made such important scientific contributions in the early stages of their careers followed a trajectory that took them away from science.”

While it is true that DSGE and its proponents are outside of science it is NOT correct to give the impression that an accident happened at some point on the way which led from science to non-science. The fact of the matter is that DSGE has ALWAYS been outside of science because economics has ALWAYS been outside of science. The adherents to the DSGE/RBC program have done exactly what they were supposed to do: “It is a touchstone of accepted economics that all explanations must run in terms of the actions and reactions of individuals. Our behavior in judging economic research, in peer review of papers and research, and in promotions, includes the criterion that in principle the behavior we explain and the policies we propose are explicable in terms of individuals, not of other social categories.” (Arrow, 1994, p. 1)

This definition of the subject matter translates into the following set of hardcore propositions/axioms: “HC1 economic agents have preferences over outcomes; HC2 agents individually optimize subject to constraints; HC3 agent choice is manifest in interrelated markets; HC4 agents have full relevant knowledge; HC5 observable outcomes are coordinated, and must be discussed with reference to equilibrium states.” (Weintraub, 1985, p. 147)

The critical axioms are HC2 and HC5. Krugman put it nicely: “... most of what I and many others do is sorta-kinda neoclassical because it takes the maximization-and-equilibrium world as a starting point.”

It is obvious to anyone with a modicum of scientific instinct that the axiomatic starting point of orthodox economics is methodologically forever unacceptable. The axiom set consists of blatant NONENTITIES but each student generation has swallowed it without turning an eyelid. Lucas, Sargent, and Prescott certainly did. This is scientifically disqualifying.

In order to be applicable HC2, which translates formally into calculus, requires a lot of auxiliary assumptions, most prominently a well-behaved production function. Taken together, all axioms and auxiliary assumptions crystallize into SS-DD-equilibrium or what Leijonhufvud famously called the Totem of Micro/Macro.

Needless to stress that ALL THREE elements of the standard tool (SS-function, DD-function, equilibrium) are NONENTITIES. The fact that neither SS/DD functions nor an equilibrium exist leads with an inescapable consequence to the identification problem in Econometrics (see Romer Sec. 4). Romer takes this insurmountable technical difficulty as a methodological silver bullet in order to finish off DSGE/RBC. It should be noted, though, that the identification problem has its roots in the Walrasian axiom set HC1/HC5 which is the accepted common ground of orthodox economics.

To throw DSGE/RBC unceremoniously out of science is only the first step because textbook supply-demand-equilibrium, which is built upon the same maximization-and-equilibrium axioms, is proto-scientific garbage since Jevons/Walras/Menger.

This is the current state of economics: Walrasian microfoundations are false for 150+ years and Keynesian macrofoundations are false for 80+ years. As a consequence, roughly 90 percent of the content of peer-reviewed economic quality journals and 100 percent of textbooks is false.

To rise above the proto-scientific level requires a Paradigm Shift from Walrasian microfoundations and Keynes’ flawed macrofoundations to entirely new macrofoundations (2015). In methodological terms, rethinking macroeconomics requires the replacement of false axioms with true axioms and the dishonorable discharge of the Walrasian, Keynesian, Marxian, and Austrian crowd from science.

Egmont Kakarot-Handtke

References

Arrow, K. J. (1994). Methodological Individualism and Social Knowledge. American Economic Review, Papers and Proceedings, 84(2): 1–9. URL

Kakarot-Handtke, E. (2015). Major Defects of the Market Economy. SSRN Working Paper Series, 2624350: 1–40. URL

Keynes, J. M. (1973). The General Theory of Employment Interest and Money. London, Basingstoke: Macmillan.

Mill, J. S. (1874). Essays on Some Unsettled Questions of Political Economy. On the Definition of Political Economy; and on the Method of Investigation Proper To It. Library of Economics and Liberty. URL

Mill, J. S. (2006). A System of Logic Ratiocinative and Inductive. Being a Connected View of the Principles of Evidence and the Methods of Scientific Investigation, Vol. 8 of Collected Works of John Stuart Mill. Indianapolis: Liberty Fund.

Walras, L. (2010). Elements of Pure Economics. London, New York: Routledge.

Weintraub, E. R. (1985). Joan Robinson’s Critique of Equilibrium: An Appraisal. American Economic Review, Papers and Proceedings, 75(2): 146–149. URL

#1 Eclecticism, anything goes, and the pluralism of false theories

#2 The Trouble With Macroeconomics, Paul Romer, Paper of Sep 14, 2016

Related 'Economics between mathiness, dyscalculia and idiocy' and 'Schizonomics' and 'Modern macro moronism' and 'The methodological blunders of fake scientists' and 'If it isn’t macro-axiomatized, it isn’t economics' and 'Economics is a science? You must be joking!' and 'New economic thinking, or, let’s put lipstick on the dead pig' and 'Economists and the destructive power of stupidity' and 'Failed economics: The losers’ long list of lame excuses' and 'Economists: scientists or political clowns?' and 'There is no soft science only soft brains' and 'Wikipedia and the promotion of economists’ idiotism (II) ad 'Macroeconomics: Economists are too stupid for science' and 'The economist as storyteller' and 'Economists: Time to say goodbye' and 'Your economics is refuted on all counts: here is the real thing'.

Wikimedia AXEC121i

***

True or false: income=wages+profits? False

Comment Lars Syll on ‘Stiglitz and the demise of marginal productivity theory’

Blog-Reference

The trouble with distribution theory started with Ricardo who got the distinction between wage, profit, and rent wrong (2011). Then Marx got the class theory of profit wrong (2014a). Neoclassical marginal distribution theory, of course, is unsurpassable idiotism, but Keynesianism did not perform much better, and Heterodoxy has actually multiple profit theories that do not fit together.#1

Yes, distribution theory has always been the deepest swamp of economics. For the correct approach see (2014b).

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2011). When Ricardo Saw Profit, He Called it Rent: On the Vice of Parochial Realism. SSRN Working Paper Series, 1932119: 1–19. URL

Kakarot-Handtke, E. (2014a). Profit for Marxists. SSRN Working Paper Series, 2414301: 1–25. URL

Kakarot-Handtke, E. (2014b). The Profit Theory is False Since Adam Smith. What About the True Distribution Theory? SSRN Working Paper Series, 2511741: 1–23. URL

#1 Heterodoxy, too, is proto-scientific garbage

Blog-Reference

The trouble with distribution theory started with Ricardo who got the distinction between wage, profit, and rent wrong (2011). Then Marx got the class theory of profit wrong (2014a). Neoclassical marginal distribution theory, of course, is unsurpassable idiotism, but Keynesianism did not perform much better, and Heterodoxy has actually multiple profit theories that do not fit together.#1

Yes, distribution theory has always been the deepest swamp of economics. For the correct approach see (2014b).

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2011). When Ricardo Saw Profit, He Called it Rent: On the Vice of Parochial Realism. SSRN Working Paper Series, 1932119: 1–19. URL

Kakarot-Handtke, E. (2014a). Profit for Marxists. SSRN Working Paper Series, 2414301: 1–25. URL

Kakarot-Handtke, E. (2014b). The Profit Theory is False Since Adam Smith. What About the True Distribution Theory? SSRN Working Paper Series, 2511741: 1–23. URL

#1 Heterodoxy, too, is proto-scientific garbage

September 25, 2016

Kick out the king and don’t forget the jesters

Comment on Marc Lavoie on ‘Rethinking Macroeconomic Theory Before the Next Crisis’

Blog-Reference

“In order to tell the politicians and practitioners something about causes and best means, the economist needs the true theory or else he has not much more to offer than educated common sense or his personal opinion.” (Stigum, 1991, p. 30)

Economists have no true theory. Economics is a failed science. Lacking the true theory means that economists do not understand how the actual monetary economy works and from this follows that they are, as a matter of principle, in NO position to give policy guidance. To derive policy advice from defective models is not different from poultry entrails reading.

Both, neoclassical and Keynesian policy proposals have NO sound theoretical foundations. Economists always argue horizontally and compare different proposals instead of vertically looking downward to their premises. The fact of the matter is that Walrasianism, Keynesianism, Marxianism, Austrianism is axiomatically false and because of this ALL their policy guidance is worthless.

Lavoie takes the 2008 crisis and its aftermath in order to prove that Orthodoxy got it often wrong and Heterodoxy got it often right. The problem is this: in economics, almost everything and the exact opposite has already been said sometime, somewhere, by somebody. So it is easy to show ex-post with selected examples where the own party was right and the other party was wrong.

This is not how science works. Science is about the material and formal consistency of a theory which crucially depends on the foundational propositions/premises/assumptions/ axioms. This is known since antiquity: “When the premises are certain, true, and primary, and the conclusion formally follows from them, this is demonstration, and produces scientific knowledge of a thing.” (Aristotle). The scientific failure of economics consists in the fact that Walrasianism, Keynesianism, Marxianism, Austrianism is axiomatically false, that is, built upon green cheese assumptions.

Orthodox economics is built upon this set of foundational propositions/axioms: “HC1 economic agents have preferences over outcomes; HC2 agents individually optimize subject to constraints; HC3 agent choice is manifest in interrelated markets; HC4 agents have full relevant knowledge; HC5 observable outcomes are coordinated, and must be discussed with reference to equilibrium states.” (Weintraub, 1985, p. 147)

Methodologically, this axiom set is forever unacceptable but economists swallowed it hook, line, and sinker from Jevons/Walras/Menger onward to DSGE/RBC and its New Keynesian variants. The microfoundations approach is not a degenerate research program but has already been dead in the cradle.

Keynes started the macrofoundations research program in the General Theory formally as follows: “Income = value of output = consumption + investment. Saving = income − consumption. Therefore saving = investment.” (p. 63)

These formal foundations are conceptually and logically defective because Keynes never came to grips with profit and therefore “discarded the draft chapter dealing with it.” (Tómasson et al., 2010, p. 12)

Keynes’s original blunder kicked off a chain reaction of errors/mistakes. As a result, all I=S/IS-LM models are worthless. Most importantly, Keynes’s profit conundrum remained unsolved. To this day neither Walrasians, Keynesians, Marxians, nor Austrians got profit right. As the Palgrave dictionary puts it: “A satisfactory theory of profits is still elusive” (Desai). Because economists have NO IDEA of the PIVOTAL concept of their subject matter they cannot explain how the actual economy works which means that their policy guidance has NO sound scientific foundation (2015).

This is the current state of economics: Walrasian microfoundations are false for 150+ years and the Keynesian macrofoundations are false for 80+ years. To expect good advice for the future of macro from economists who were active participants in the joint disaster of Orthodoxy and Heterodoxy is beyond ridiculous.

Marc Lavoie concludes his comprehensive synopsis of orthodox errors/mistakes/falsehoods: “Providing new clothes to the Naked Emperor of mainstream economics won’t do; the Emperor needs to be dethroned.” Indeed, but don’t forget to kick out the heterodox jesters, too.

To rise above the proto-scientific level requires a paradigm shift from Walrasian microfoundations and Keynes’s flawed macrofoundations to entirely new macrofoundations.#1 In methodological terms, rethinking macroeconomics requires the replacement of false axioms by true axioms and the dishonorable discharge of the Walrasian, Keynesian, Marxian, Austrian crowd from science. As Romer recently put it: there is trouble ahead for ALL of the economics.

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2015). Major Defects of the Market Economy. SSRN Working Paper Series, 2624350: 1–40. URL

Stigum, B. P. (1991). Toward a Formal Science of Economics: The Axiomatic Method in Economics and Econometrics. Cambridge: MIT Press.

Tómasson, G., and Bezemer, D. J. (2010). What is the Source of Profit and Interest? A Classical Conundrum Reconsidered. MPRA Paper, 20557: 1–34. URL

Weintraub, E. R. (1985). Joan Robinson’s Critique of Equilibrium: An Appraisal. American Economic Review, Papers and Proceedings, 75(2): 146–149. URL

#1 From Orthodoxy to Heterodoxy to Sysdoxy

You are missing the point. This thread is neither about economic history nor the USA but about economic theory. Economics ― understood as science ― is about an abstract entity called the monetary economy or the market economy and about how this entity works. More specifically economics is about the laws or invariants of the economic system. Like in physics, where there is no American, French or Chinese Law of the Lever, there are no American, French, or Chinese economic laws.

The task of economics ― understood as science ― is to figure out the systemic laws of the monetary economy and NOTHING else.

However, there have always been political economics and theoretical economics. The founding fathers were straightforward people and called themselves political economists, that is, they left no doubt that their main business was agenda pushing. Economists never got out of political economics. In other words, theoretical economics (= science) ultimately could not emancipate itself from political economics (= agenda-pushing). And this is how economics became one of the most embarrassing failures in the history of scientific thought.

The main topic of your post is how to make America economically great again. This is a legitimate political issue but has to be clearly separated from the core question of economics ― understood as science ― which is: How does the monetary economy work?

Science is well-defined by the criteria of formal and material consistency. It is a provable fact that neither Walrasianism, Keynesianism, Marxianism, nor Austrianism is materially/formally consistent. So, all we actually have is scientifically worthless political economics.

You say: “Let’s put a little more emphasis on productivity and growth and a little less on economic stability. If you want a metaphor, why not shoot for the Moon, like we did in the ‘60s?”

Clearly, if you want to go to the moon you have to figure out the laws of physics first. Likewise, if you want to make America economically great you have to figure out the laws of economics first. After more than 200 years, the representative economist does not even know the macroeconomic Profit Law#1 and this includes Walrasians and Keynesians and Marc Lavoie and you.

#1 The Profit Theory is False Since Adam Smith. What About the True Distribution Theory?

You say: “Economics is not a science. I know of no better evidenciary proof of this than the above discussion of the various contradictory theories none of which depict reality.”

This is true#1 but the problem is that what you are doing is NOT science either but storytelling. The very task of science is to move from mere opinion and wish-wash to scientific knowledge.

“There are always many different opinions and conventions concerning any one problem or subject-matter ... This shows that they are not all true. For if they conflict, then at best only one of them can be true. Thus it appears that Parmenides ... was the first to distinguish clearly between truth or reality on the one hand, and convention or conventional opinion (hearsay, plausible myth) on the other ...” (Popper, 1994)

What is indeed needed is, as Marc Lavoie put it in the title ‘Rethinking Macroeconomic Theory Before the Next Crisis’. What is NOT needed is just another conventional opinion about how the American economy performed in the 1960s.

#1 All models are false because all economists are stupid and The real problem with the economics Nobel.

Blog-Reference

“In order to tell the politicians and practitioners something about causes and best means, the economist needs the true theory or else he has not much more to offer than educated common sense or his personal opinion.” (Stigum, 1991, p. 30)

Economists have no true theory. Economics is a failed science. Lacking the true theory means that economists do not understand how the actual monetary economy works and from this follows that they are, as a matter of principle, in NO position to give policy guidance. To derive policy advice from defective models is not different from poultry entrails reading.

Both, neoclassical and Keynesian policy proposals have NO sound theoretical foundations. Economists always argue horizontally and compare different proposals instead of vertically looking downward to their premises. The fact of the matter is that Walrasianism, Keynesianism, Marxianism, Austrianism is axiomatically false and because of this ALL their policy guidance is worthless.

Lavoie takes the 2008 crisis and its aftermath in order to prove that Orthodoxy got it often wrong and Heterodoxy got it often right. The problem is this: in economics, almost everything and the exact opposite has already been said sometime, somewhere, by somebody. So it is easy to show ex-post with selected examples where the own party was right and the other party was wrong.

This is not how science works. Science is about the material and formal consistency of a theory which crucially depends on the foundational propositions/premises/assumptions/ axioms. This is known since antiquity: “When the premises are certain, true, and primary, and the conclusion formally follows from them, this is demonstration, and produces scientific knowledge of a thing.” (Aristotle). The scientific failure of economics consists in the fact that Walrasianism, Keynesianism, Marxianism, Austrianism is axiomatically false, that is, built upon green cheese assumptions.

Orthodox economics is built upon this set of foundational propositions/axioms: “HC1 economic agents have preferences over outcomes; HC2 agents individually optimize subject to constraints; HC3 agent choice is manifest in interrelated markets; HC4 agents have full relevant knowledge; HC5 observable outcomes are coordinated, and must be discussed with reference to equilibrium states.” (Weintraub, 1985, p. 147)

Methodologically, this axiom set is forever unacceptable but economists swallowed it hook, line, and sinker from Jevons/Walras/Menger onward to DSGE/RBC and its New Keynesian variants. The microfoundations approach is not a degenerate research program but has already been dead in the cradle.

Keynes started the macrofoundations research program in the General Theory formally as follows: “Income = value of output = consumption + investment. Saving = income − consumption. Therefore saving = investment.” (p. 63)

These formal foundations are conceptually and logically defective because Keynes never came to grips with profit and therefore “discarded the draft chapter dealing with it.” (Tómasson et al., 2010, p. 12)

Keynes’s original blunder kicked off a chain reaction of errors/mistakes. As a result, all I=S/IS-LM models are worthless. Most importantly, Keynes’s profit conundrum remained unsolved. To this day neither Walrasians, Keynesians, Marxians, nor Austrians got profit right. As the Palgrave dictionary puts it: “A satisfactory theory of profits is still elusive” (Desai). Because economists have NO IDEA of the PIVOTAL concept of their subject matter they cannot explain how the actual economy works which means that their policy guidance has NO sound scientific foundation (2015).

This is the current state of economics: Walrasian microfoundations are false for 150+ years and the Keynesian macrofoundations are false for 80+ years. To expect good advice for the future of macro from economists who were active participants in the joint disaster of Orthodoxy and Heterodoxy is beyond ridiculous.