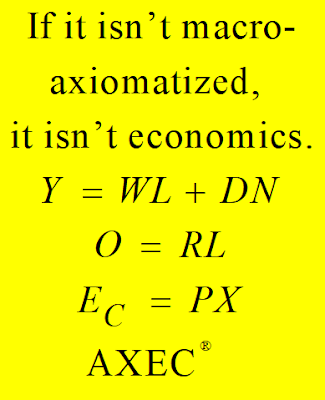

Neither Walrasians nor Keynesians have a clear idea of the fundamental economic concepts income and profit, nor of the interdependence of qualitatively different markets. Critique of these approaches is necessary but not overly productive. A real breakthrough requires a new set of premises because no way leads from the accustomed behavioral assumptions to the understanding of how the economy works. More precisely, the hitherto accepted behavioral axioms have to be replaced by structural axioms. Starting from new formal foundations, this paper gives a comprehensive and consistent account of the objective interrelations of the monetary economy’s elementary building blocks.

This blog connects to the AXEC Project which applies a superior method of economic analysis. The following comments have been posted on selected blogs as catalysts for the ongoing Paradigm Shift. The comments are brought together here for information. The full debates are directly accessible via the Blog-References. Scrap the lot and start again―that is what a Paradigm Shift is all about. Time to make economics a science.

July 27, 2013

July 24, 2013

Clueless

Comment on Fred Zaman on 'Rethinking Keynes’ non-Euclidian theory of the economy'

Blog-Reference

Blog-Reference

It seems that political economists have run out of arguments. Hence it is appropriate that this thread's summary is given by a theoretical economist: “..., before accepting the conclusions of any economist’s model as applicable to the real world, the careful student should always examine and be prepared to criticize the applicability of the fundamental postulates of the model; for, in the absence of any mistake in logic, the axioms of the model determine its conclusions.” (Davidson, 2002, p. 41)

Keynes has to be praised for “throwing over” the classical axioms (aka Euclidean). Post Keynesians have to be criticized for failing to establish a new set of axioms (aka non-Euclidean). Theoretical economics is, therefore, hanging in the air and, as a consequence, Political Economy with it. Economists have not yet done their science homework.

Egmont Kakarot-Handtke

References

Davidson, P. (2002). Financial Markets, Money and the Real World. Cheltenham, Northampton: Edward Elgar.

July 18, 2013

Economics and systems theory

Comment on Fred Zaman on 'Rethinking Keynes’ non-Euclidian theory of the economy'

Blog-Reference

The idea that systems theory could be useful in economics is not as novel as you might think. In fact, it provides the strongest backup for the claim of neoclassicals that what they do is science: “General systems theory (G.S.T.), of which general equilibrium theory is but a specification to certain economic problems, has existed for many years. … G.S.T., then, looks for, and finds, many structural similarities among fields of scientific analysis. To the extent that G.S.T. is a constructive approach to inquiry, general equilibrium theory in economics becomes rooted not just in the particular tradition that have generated the multi-fold extensions of the Arrow-Debreu-McKenzie [ADM] model, but in the very structural unities of science itself. To attack general equilibrium theory in economics as a legitimate model of reasoning is to simultaneously deny homeostatic reasoning to psychologists and morphogenetic analysis to the biologist. To argue that G.S.T. is inapplicable to economics is to negate claims that economics is a science.” (Weintraub, 1979, pp. 71-72)

To propagate systems theory seems not to be the way to a fundamental Paradigm Shift, rather to improve neoclassical systems theory, i.e. to more descriptive realism.

Apart from this, I would like to support your appeal to take systems theory seriously: “Concepts of equilibrium, homeostasis, adjustment, etc., are suitable for the maintenance of systems, but inadequate for the phenomena of change, differentiation, evolution, negentropy, production of improbable states, creativity, building-up of tensions, self-realization, emergence, etc;” (von Bertalanffy, 1969, p. 23)

Systems theorists realized this long ago but equibrilists are still behind the curve.

Egmont Kakarot-Handtke

References

von Bertalanffy, L. (1969). General Systems Theory. New York: Braziller.

Weintraub, E. R. (1979). Microfoundations. Cambridge, London, New York, etc.: Cambridge University Press.

Blog-Reference

The idea that systems theory could be useful in economics is not as novel as you might think. In fact, it provides the strongest backup for the claim of neoclassicals that what they do is science: “General systems theory (G.S.T.), of which general equilibrium theory is but a specification to certain economic problems, has existed for many years. … G.S.T., then, looks for, and finds, many structural similarities among fields of scientific analysis. To the extent that G.S.T. is a constructive approach to inquiry, general equilibrium theory in economics becomes rooted not just in the particular tradition that have generated the multi-fold extensions of the Arrow-Debreu-McKenzie [ADM] model, but in the very structural unities of science itself. To attack general equilibrium theory in economics as a legitimate model of reasoning is to simultaneously deny homeostatic reasoning to psychologists and morphogenetic analysis to the biologist. To argue that G.S.T. is inapplicable to economics is to negate claims that economics is a science.” (Weintraub, 1979, pp. 71-72)

To propagate systems theory seems not to be the way to a fundamental Paradigm Shift, rather to improve neoclassical systems theory, i.e. to more descriptive realism.

Apart from this, I would like to support your appeal to take systems theory seriously: “Concepts of equilibrium, homeostasis, adjustment, etc., are suitable for the maintenance of systems, but inadequate for the phenomena of change, differentiation, evolution, negentropy, production of improbable states, creativity, building-up of tensions, self-realization, emergence, etc;” (von Bertalanffy, 1969, p. 23)

Systems theorists realized this long ago but equibrilists are still behind the curve.

Egmont Kakarot-Handtke

References

von Bertalanffy, L. (1969). General Systems Theory. New York: Braziller.

Weintraub, E. R. (1979). Microfoundations. Cambridge, London, New York, etc.: Cambridge University Press.

July 17, 2013

Keynes, Hayek, Kant

Comment on Fred Zaman on 'Rethinking Keynes’ non-Euclidian theory of the economy'

Blog-Reference

In the glorious days of economics, the great thinker Hayek was quipped by the great thinker Keynes: “... a remorseless logician can end up in Bedlam.” (Keynes, cited in Moggridge 1976, p. 36)

Economists in those days already were confused confusers (2013). This is not a lament but a statement of fact. Neither Keynes nor Hayek had a clear idea of the foundational concepts of income and profit. That's easy to prove.

We perfectly agree with Kant’s dictum: “Theory without empirical content is hollow. Empirical observations without [good & falsifiable] theory are directionless.”

Theory, though, starts with axioms, as Kant would have told you also.

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2013). Confused Confusers: How to Stop Thinking Like an Economist and Start Thinking Like a Scientist. SSRN Working Paper Series, 2207598: 1–16. URL

Moggridge, D. E. (1976). Keynes. London, Basingstoke: Macmillan.

Blog-Reference

In the glorious days of economics, the great thinker Hayek was quipped by the great thinker Keynes: “... a remorseless logician can end up in Bedlam.” (Keynes, cited in Moggridge 1976, p. 36)

Economists in those days already were confused confusers (2013). This is not a lament but a statement of fact. Neither Keynes nor Hayek had a clear idea of the foundational concepts of income and profit. That's easy to prove.

We perfectly agree with Kant’s dictum: “Theory without empirical content is hollow. Empirical observations without [good & falsifiable] theory are directionless.”

Theory, though, starts with axioms, as Kant would have told you also.

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2013). Confused Confusers: How to Stop Thinking Like an Economist and Start Thinking Like a Scientist. SSRN Working Paper Series, 2207598: 1–16. URL

Moggridge, D. E. (1976). Keynes. London, Basingstoke: Macmillan.

July 16, 2013

Anything goes — for a while (II)

Comment on Fred Zaman on 'Rethinking Keynes’ non-Euclidian theory of the economy'

Blog-Reference

The analytical starting point determines the course of a theoretical investigation and ultimately the productiveness of an approach. The Classics took production and accumulation as their point of departure, the Neoclassicals exchange. Exchange implies behavioral assumptions and notions like rationality, optimization, and equilibrium. This approach has led into a blind alley. Why?

“For if orthodox economics is at fault, the error is to be found not in the superstructure, which has been erected with great care for logical consistency, but in a lack of clearness and of generality in the premises.” (Keynes, 1973, p. xxi)

To change a theory, therefore, means to change its premises or, in Keynes’ words, to ‘throw over’ the axioms. One can take this figuratively or literally. I take it literally and this means that the subjective-behavioral axioms of standard economics are fully replaced by objective-structural axioms. In Keynes' metaphor: we move from Euclidean to non-Euclidean axioms. To recall, Keynes preserved part of the foundational assumptions of orthodoxy. This halfway construction is unsatisfactory.

(2a) Axiomatization is indispensable because the methodological anything-goes mentality among economists is the proximate reason for the proto-scientific condition of theoretical economics. Because of conceptual sloppiness, neither orthodoxy nor heterodoxy has a clear idea of the fundamental economic concepts income and profit. Doing economics without a clear idea of income and profit is like doing physics without a clear idea of force and mass — it cannot yield practical results, and it has not.

(2b) I have demonstrated that Keynes' formal basis is a limiting case of the structural axiom set. This means that there is no contradiction between the two formalisms, the latter is only more general (see Set and Subset, 2011, Sec. 20).

(2c) This implies that the concept of saving is also more general. Total saving is given axiomatically as monetary and nonmonetary saving. Monetary saving is identical with Keynes' definition. Nonmonetary saving is identical with Friedman's notion (see Primary and Secondary Markets, 2011, Sec. 4.2). The structural axiomatic approach consistently integrates Keynes and Friedman, although only with regard to consumption/saving.

(2d) The relation between monetary saving, liquidity and interest rate has been dealt with in (2011, Sec. 9). The structural axiom set formally underpins Keynes' conception of liquidity preference. The commonplace quantity theory is refuted.

(2e) A summary of the structural-systemic axiomatic theory of saving has been given in Settling the Theory of Saving (2013). The classical notion of saving/time preference, which reappears in DSGE, is refuted.

(2f) The structural axiom set consists exclusively of measurable variables and yields testable propositions.

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2011a). Keynes’ Missing Axioms. SSRN Working Paper Series, 1841408: 1–33. URL

Kakarot-Handtke, E. (2011b). Primary and Secondary Markets. SSRN Working Paper Series, 1917012: 1–26. URL

Kakarot-Handtke, E. (2011c). Reconstructing the Quantity Theory (I). SSRN Working Paper Series, 1895268: 1–26. URL

Kakarot-Handtke, E. (2013). Settling the Theory of Saving. SSRN Working Paper Series, 2220651: 1–23. URL

Keynes, J. M. (1973). The General Theory of Employment Interest and Money. The Collected Writings of John Maynard Keynes Vol. VII. London, Basingstoke: Macmillan. (1936).

Blog-Reference

The analytical starting point determines the course of a theoretical investigation and ultimately the productiveness of an approach. The Classics took production and accumulation as their point of departure, the Neoclassicals exchange. Exchange implies behavioral assumptions and notions like rationality, optimization, and equilibrium. This approach has led into a blind alley. Why?

“For if orthodox economics is at fault, the error is to be found not in the superstructure, which has been erected with great care for logical consistency, but in a lack of clearness and of generality in the premises.” (Keynes, 1973, p. xxi)

To change a theory, therefore, means to change its premises or, in Keynes’ words, to ‘throw over’ the axioms. One can take this figuratively or literally. I take it literally and this means that the subjective-behavioral axioms of standard economics are fully replaced by objective-structural axioms. In Keynes' metaphor: we move from Euclidean to non-Euclidean axioms. To recall, Keynes preserved part of the foundational assumptions of orthodoxy. This halfway construction is unsatisfactory.

(2a) Axiomatization is indispensable because the methodological anything-goes mentality among economists is the proximate reason for the proto-scientific condition of theoretical economics. Because of conceptual sloppiness, neither orthodoxy nor heterodoxy has a clear idea of the fundamental economic concepts income and profit. Doing economics without a clear idea of income and profit is like doing physics without a clear idea of force and mass — it cannot yield practical results, and it has not.

(2b) I have demonstrated that Keynes' formal basis is a limiting case of the structural axiom set. This means that there is no contradiction between the two formalisms, the latter is only more general (see Set and Subset, 2011, Sec. 20).

(2c) This implies that the concept of saving is also more general. Total saving is given axiomatically as monetary and nonmonetary saving. Monetary saving is identical with Keynes' definition. Nonmonetary saving is identical with Friedman's notion (see Primary and Secondary Markets, 2011, Sec. 4.2). The structural axiomatic approach consistently integrates Keynes and Friedman, although only with regard to consumption/saving.

(2d) The relation between monetary saving, liquidity and interest rate has been dealt with in (2011, Sec. 9). The structural axiom set formally underpins Keynes' conception of liquidity preference. The commonplace quantity theory is refuted.

(2e) A summary of the structural-systemic axiomatic theory of saving has been given in Settling the Theory of Saving (2013). The classical notion of saving/time preference, which reappears in DSGE, is refuted.

(2f) The structural axiom set consists exclusively of measurable variables and yields testable propositions.

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2011a). Keynes’ Missing Axioms. SSRN Working Paper Series, 1841408: 1–33. URL

Kakarot-Handtke, E. (2011b). Primary and Secondary Markets. SSRN Working Paper Series, 1917012: 1–26. URL

Kakarot-Handtke, E. (2011c). Reconstructing the Quantity Theory (I). SSRN Working Paper Series, 1895268: 1–26. URL

Kakarot-Handtke, E. (2013). Settling the Theory of Saving. SSRN Working Paper Series, 2220651: 1–23. URL

Keynes, J. M. (1973). The General Theory of Employment Interest and Money. The Collected Writings of John Maynard Keynes Vol. VII. London, Basingstoke: Macmillan. (1936).

July 15, 2013

Anything goes — for a while (I)

Comment on Fred Zaman on 'Rethinking Keynes’ non-Euclidian theory of the economy'

Blog-Reference

Your post comes to the heart of the matter. Please allow me to answer it in two separate parts. The second part will follow within one or two days.

(1a) I am aware that you wrote an article about who is a Post Keynesian. By rephrasing Eichner's title [Why Economics is Not Yet a Science] I by no means intended to take a hand in that discussion. Whether Eichner is a Post Keynesian or not is tangential to the content of my paper Why Post Keynesianism is Not Yet a Science (2013).

(1b) My point of departure is the quote: “For Keynes, as for Post Keynesians the guiding motto is 'it is better to be roughly right than precisely wrong!'" (Davidson, 1984, p. 574). It is this motto that I attack because it provides the justification for conceptual carelessness and I am by no means the first to realize that intellectual sloppiness is the hallmark of both neoclassical and Keynesian economics:

“I think it is the lack of quite sharply defined concepts that the main difficulty lies, and not in any intrinsic difference between the fields of economics and other sciences.” (von Neumann, quoted in Mirowski, 2002, p. 146 fn. 49), see also Confused Confusers: How to Stop Thinking Like an Economist and Start Thinking Like a Scientist (2013).

(1c) The methodological anything-goes mentality is the main reason for the proto-scientific condition of theoretical economics.

(1d) The stated purpose of my paper is to demonstrate that conceptual and formal sloppiness leads to theoretical errors. It is well known that a theory that contains logical errors is worthless even if it makes good sense from a political point of view. To resume that Keynesianism is logically defective is not anti-Keynesian. The errors can be corrected and it can even be shown that some of Keynes' verbal statements that were hitherto hanging in the air are fortified by a correct formal underpinning. That is: axiomatization is healthy for Post Keynesianism.

(1e) I have demonstrated that a correct formalism would have saved the life of Post Keynesianism in the Phillips Curve debate, see Keynes Employment Function and the Gratuitous Phillips Curve Disaster (2012).

(1f) I think two of your statements deserve rigorous refutation:

• You can define anything you want but as a sage once said: “A rose by any other name will smell as sweet!”

• ... the two cited equations [Y=C+I, S=Y−C] are simply accounting identities — and by definition, they can not be false as long as one accepts the definitions. But I=S is merely an ex-post accounting identity and by itself is just as true for neoclassical economics as for anything else — including Marxian economics.

(1g) I have refuted the first statement in Keynes's Missing Axioms (2011, Sec. 17-20) and Why Post Keynesianism is Not Yet a Science (2013, Sec. VI-VIII)

(1h) I have refuted the second statement in The Common Error of Common Sense: An Essential Rectification of the Accounting Approach (2012).

For details see my forthcoming post.

Egmont Kakarot-Handtke

References

Davidson, P. (1984). Reviving Keynes’s Revolution. Journal of Post Keynesian Economics, 6(4): 561–575. URL

Kakarot-Handtke, E. (2011). Keynes’s Missing Axioms. SSRN Working Paper Series, 1841408: 1–33. URL

Kakarot-Handtke, E. (2012a). The Common Error of Common Sense: An Essential Rectification of the Accounting Approach. SSRN Working Paper Series, 2124415: 1–23. URL

Kakarot-Handtke, E. (2012b). Keynes’s Employment Function and the Gratuitous Phillips Curve Disaster. SSRN Working Paper Series, 2130421: 1–19. URL

Kakarot-Handtke, E. (2013a). Confused Confusers: How to Stop Thinking Like an Economist and Start Thinking Like a Scientist. SSRN Working Paper Series, 2207598: 1–16. URL

Kakarot-Handtke, E. (2013b). Why Post Keynesianism is Not Yet a Science. Economic Analysis and Policy, 43(1): 97–106. URL

Mirowski, P. (2002). Machine Dreams. Cambridge: Cambridge University Press.

Blog-Reference

Your post comes to the heart of the matter. Please allow me to answer it in two separate parts. The second part will follow within one or two days.

(1a) I am aware that you wrote an article about who is a Post Keynesian. By rephrasing Eichner's title [Why Economics is Not Yet a Science] I by no means intended to take a hand in that discussion. Whether Eichner is a Post Keynesian or not is tangential to the content of my paper Why Post Keynesianism is Not Yet a Science (2013).

(1b) My point of departure is the quote: “For Keynes, as for Post Keynesians the guiding motto is 'it is better to be roughly right than precisely wrong!'" (Davidson, 1984, p. 574). It is this motto that I attack because it provides the justification for conceptual carelessness and I am by no means the first to realize that intellectual sloppiness is the hallmark of both neoclassical and Keynesian economics:

“I think it is the lack of quite sharply defined concepts that the main difficulty lies, and not in any intrinsic difference between the fields of economics and other sciences.” (von Neumann, quoted in Mirowski, 2002, p. 146 fn. 49), see also Confused Confusers: How to Stop Thinking Like an Economist and Start Thinking Like a Scientist (2013).

(1c) The methodological anything-goes mentality is the main reason for the proto-scientific condition of theoretical economics.

(1d) The stated purpose of my paper is to demonstrate that conceptual and formal sloppiness leads to theoretical errors. It is well known that a theory that contains logical errors is worthless even if it makes good sense from a political point of view. To resume that Keynesianism is logically defective is not anti-Keynesian. The errors can be corrected and it can even be shown that some of Keynes' verbal statements that were hitherto hanging in the air are fortified by a correct formal underpinning. That is: axiomatization is healthy for Post Keynesianism.

(1e) I have demonstrated that a correct formalism would have saved the life of Post Keynesianism in the Phillips Curve debate, see Keynes Employment Function and the Gratuitous Phillips Curve Disaster (2012).

(1f) I think two of your statements deserve rigorous refutation:

• You can define anything you want but as a sage once said: “A rose by any other name will smell as sweet!”

• ... the two cited equations [Y=C+I, S=Y−C] are simply accounting identities — and by definition, they can not be false as long as one accepts the definitions. But I=S is merely an ex-post accounting identity and by itself is just as true for neoclassical economics as for anything else — including Marxian economics.

(1g) I have refuted the first statement in Keynes's Missing Axioms (2011, Sec. 17-20) and Why Post Keynesianism is Not Yet a Science (2013, Sec. VI-VIII)

(1h) I have refuted the second statement in The Common Error of Common Sense: An Essential Rectification of the Accounting Approach (2012).

For details see my forthcoming post.

Egmont Kakarot-Handtke

References

Davidson, P. (1984). Reviving Keynes’s Revolution. Journal of Post Keynesian Economics, 6(4): 561–575. URL

Kakarot-Handtke, E. (2011). Keynes’s Missing Axioms. SSRN Working Paper Series, 1841408: 1–33. URL

Kakarot-Handtke, E. (2012a). The Common Error of Common Sense: An Essential Rectification of the Accounting Approach. SSRN Working Paper Series, 2124415: 1–23. URL

Kakarot-Handtke, E. (2012b). Keynes’s Employment Function and the Gratuitous Phillips Curve Disaster. SSRN Working Paper Series, 2130421: 1–19. URL

Kakarot-Handtke, E. (2013a). Confused Confusers: How to Stop Thinking Like an Economist and Start Thinking Like a Scientist. SSRN Working Paper Series, 2207598: 1–16. URL

Kakarot-Handtke, E. (2013b). Why Post Keynesianism is Not Yet a Science. Economic Analysis and Policy, 43(1): 97–106. URL

Mirowski, P. (2002). Machine Dreams. Cambridge: Cambridge University Press.

July 14, 2013

Hopeless, but not serious

Comment on Fred Zaman on 'Rethinking Keynes’ non-Euclidian theory of the economy'

Blog-Reference

Perhaps we agree on the following.

The neoclassical approach is inadmissible. This needs no further elaboration because enlightened Neoclassicals have already abandoned it.

The Keynesian approach is inadmissible because it is formally defective. The proof has been given in (2013).

The heterodox camp has unearthed many flaws of standard economics but failed to develop an alternative that satisfies scientific standards, i.e. material and formal consistency.

Even Paul Schächterle's fresh theory of the labor market can give us not much impetus because he overlooked that it is well-known textbook stuff (Samuelson and Nordhaus, 1998, p. 229, Fig. 13-4).

As an old Viennese saying goes: the situation is hopeless, but not serious.

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2013). Why Post Keynesianism is Not Yet a Science. Economic Analysis and Policy, 43(1): 97–106. URL

Samuelson, P. A., and Nordhaus, W. D. (1998). Economics. Boston, MA, Burr Ridge, etc.: Irwin, McGraw-Hill, 16th edition.

Blog-Reference

Perhaps we agree on the following.

The neoclassical approach is inadmissible. This needs no further elaboration because enlightened Neoclassicals have already abandoned it.

The Keynesian approach is inadmissible because it is formally defective. The proof has been given in (2013).

The heterodox camp has unearthed many flaws of standard economics but failed to develop an alternative that satisfies scientific standards, i.e. material and formal consistency.

Even Paul Schächterle's fresh theory of the labor market can give us not much impetus because he overlooked that it is well-known textbook stuff (Samuelson and Nordhaus, 1998, p. 229, Fig. 13-4).

As an old Viennese saying goes: the situation is hopeless, but not serious.

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2013). Why Post Keynesianism is Not Yet a Science. Economic Analysis and Policy, 43(1): 97–106. URL

Samuelson, P. A., and Nordhaus, W. D. (1998). Economics. Boston, MA, Burr Ridge, etc.: Irwin, McGraw-Hill, 16th edition.

July 13, 2013

Vaguely right could simply be vaguely wrong

Comment on Fred Zaman on 'Rethinking Keynes’ non-Euclidian theory of the economy'

Blog-Reference

(a) It is not the question of what I prefer or like, it is the question of what is a scientific proposition.

(b) It is important to distinguish between method and actual application. Spinoza used the axiomatic method to prove the existence of God. This, obviously, is a misapplication. This misapplication is no argument against the method. By defending the method I do not defend the neoclassical axioms. That is a shortcut of your own making.

(c) If you prefer the vaguely right you must already know what is right. However, there is no criterion to discriminate between vaguely right and vaguely wrong. Finally, if you already know what is right why are you content with vaguely right? The argument is silly because it presupposes what it tries to prove.

(d) The first rule of science is that there is no such thing as a pure and simple fact.

(e) You can look out of the window and say the sun rises. That's not science, that is common sense. As J. S. Mill put it: “People fancied they saw the sun rise and set, the stars revolve in circles round the pole. We now know that they saw no such thing; what they really saw was a set of appearances, equally reconcileable with the theory they held and with a totally different one. It seems strange that such an instance as this, ... , should not have opened the eyes of the bigots of common sense, and inspired them with a more modest distrust of the competency of mere ignorance to judge the conclusions of cultivated thought.” (Mill, 2006, p. 783). It certainly did not open the eyes of Paul Schächterle.

(f) If Malthus refreshes you that's ok. Unfortunately, you are in the wrong movie. Science is not about wellness but about knowledge.

(g) Neither Malthus, nor Keynes, nor you, nor anybody else can grasp the essence of real economic movements and relations by looking out of the window: “Since, therefore, it is vain to hope that truth can be arrived at, either in Political Economy or in any other department of the social science, while we look at the facts in the concrete, clothed in all the complexity with which nature has surrounded them, and endeavour to elicit a general law by a process of induction from a comparison of details; there remains no other method than the à priori one, or that of ‘abstract speculation.’” (Mill, 2004, p. 113-114)

Egmont Kakarot-Handtke

References

Mill, J. S. (2004). Essays on Some Unsettled Questions of Political Economy, chapter On the Definition of Political Economy; and the Method of Investigation Proper to It., pages 93–125. Electronic Classic Series PA 18202: Pennsylvania State University. URL

Mill, J. S. (2006). A System of Logic Ratiocinative and Inductive. Being a Connected View of the Principles of Evidence and the Methods of Scientific Investigation, volume 8 of Collected Works of John Stuart Mill. Indianapolis: Liberty Fund.

Blog-Reference

(a) It is not the question of what I prefer or like, it is the question of what is a scientific proposition.

(b) It is important to distinguish between method and actual application. Spinoza used the axiomatic method to prove the existence of God. This, obviously, is a misapplication. This misapplication is no argument against the method. By defending the method I do not defend the neoclassical axioms. That is a shortcut of your own making.

(c) If you prefer the vaguely right you must already know what is right. However, there is no criterion to discriminate between vaguely right and vaguely wrong. Finally, if you already know what is right why are you content with vaguely right? The argument is silly because it presupposes what it tries to prove.

(d) The first rule of science is that there is no such thing as a pure and simple fact.

(e) You can look out of the window and say the sun rises. That's not science, that is common sense. As J. S. Mill put it: “People fancied they saw the sun rise and set, the stars revolve in circles round the pole. We now know that they saw no such thing; what they really saw was a set of appearances, equally reconcileable with the theory they held and with a totally different one. It seems strange that such an instance as this, ... , should not have opened the eyes of the bigots of common sense, and inspired them with a more modest distrust of the competency of mere ignorance to judge the conclusions of cultivated thought.” (Mill, 2006, p. 783). It certainly did not open the eyes of Paul Schächterle.

(f) If Malthus refreshes you that's ok. Unfortunately, you are in the wrong movie. Science is not about wellness but about knowledge.

(g) Neither Malthus, nor Keynes, nor you, nor anybody else can grasp the essence of real economic movements and relations by looking out of the window: “Since, therefore, it is vain to hope that truth can be arrived at, either in Political Economy or in any other department of the social science, while we look at the facts in the concrete, clothed in all the complexity with which nature has surrounded them, and endeavour to elicit a general law by a process of induction from a comparison of details; there remains no other method than the à priori one, or that of ‘abstract speculation.’” (Mill, 2004, p. 113-114)

Egmont Kakarot-Handtke

References

Mill, J. S. (2004). Essays on Some Unsettled Questions of Political Economy, chapter On the Definition of Political Economy; and the Method of Investigation Proper to It., pages 93–125. Electronic Classic Series PA 18202: Pennsylvania State University. URL

Mill, J. S. (2006). A System of Logic Ratiocinative and Inductive. Being a Connected View of the Principles of Evidence and the Methods of Scientific Investigation, volume 8 of Collected Works of John Stuart Mill. Indianapolis: Liberty Fund.

What Keynesian revolution?

Comment on Fred Zaman on 'Rethinking Keynes’ non-Euclidian theory of the economy'

Blog-Reference

There are two kinds of revolutions, political and scientific, and you are in the wrong movie. The Keynesian Revolution was intended as a scientific revolution: “But, if my explanations are right, it is my fellow economists, not the general public, whom I must first convince. At this stage of the argument the general public, though welcome at the debate, are only eavesdroppers at an attempt by an economist to bring to an issue the deep divergences of opinion between fellow economists which have for the time being almost destroyed the practical influence of economic theory, and will, until they are resolved, continue to do so.” (Keynes, 1973, p. xxi)

Political revolutions are usually not started by politely throwing the public out of the auditorium.

Keynes and his contemporaries witnessed two scientific revolutions. In physics, Einstein put forth the theory of relativity, in mathematics Hilbert put forth the axiomatic method. Both scientific revolutions were recognized by their contemporaries as such. Keynes, like most economists before him, tried to profit from the prestige and triumph of the real sciences to sell a paltry piece of common sense.

The physicists got the GENERAL Theory of Relativity, and Keynes titled his book the GENERAL Theory. The mathematicians got the non-Euclidean axioms, Keynes threw over the second postulate of the classical doctrine [The utility of the wage ...] and declared this as akin to throwing over Euclid's axiom of parallels (Keynes, 1973, p. 17).

Keynes' talk of generality and axioms was sales talk for his fellow economists. He understood the axiomatic method but he did not apply it, quite the contrary: “There is, however, no absolute need to start with axioms, let alone particular ones, or even with abstraction. There is a role for historical generalisation, which relies on one of the most important logical tools, pattern recognition (metaphor, analogy); and a role for argument from first principles. Both of these procedures are part of what Keynes called ‘human logic’ in contrast to ‘formal logic.’” (Keynes, quoted in Chick, 1998, p. 1860)

Keynes never intended to leave the realm of common sense (aka human logic) “where nothing is clear and everything is possible” (see Section 3 of my paper in Real-World Economics Review, Issue No. 63, 2013).

It was the Neoclassicals who recognized that there is a real problem and tried to get out of the perennial verbiage of Political Economy: “The very definition of an economic concept is usually subject to a substantial margin of ambiguity. An axiomatized theory substitutes for an ambiguous economic concept a mathematical object that is subject to entirely definite rules of reasoning.” (Debreu, quoted in Ingrao et al., 1990, p. 287)

Let us face the facts: on the methodological point, the Neoclassicals are definitively superior. Keynesianism and axiomatization are a contradiction in terms. The Post Keynesians explicitly defend 'incoherent Babylonian babble' with their silly slogan “It is better to be vaguely right than precisely wrong” (for details see 2013, p. 96).

Time for Heterodoxy to stop wordplay with collision of parallels and collusion of capitalists and to start an intellectual revolution of their own. If Heterodoxy means something scientific then you have to put heterodox axioms against orthodox axioms or, as Keynes advertised, get up and move from Euclidean axioms to non-Euclidean axioms. This is a tough formal exercise.

Egmont Kakarot-Handtke

References

Chick, V. (1998). On Knowing One’s Place: The Role of Formalism in Economics. Economic Journal, 108(451): 1859–1869. URL

Ingrao, B., and Israel, G. (1990). The Invisible Hand. Economic Equilibrium in the History of Science. Cambridge, London: MIT Press.

Kakarot-Handtke, E. (2013a). Crisis and Methodology: Some Heterodox Misunderstandings. real-world economics review, 63: 98–117. URL

Kakarot-Handtke, E. (2013b). Why Post Keynesianism is Not Yet a Science. Economic Analysis and Policy, 43(1): 97–106. URL

Keynes, J. M. (1973). The General Theory of Employment Interest and Money. The Collected Writings of John Maynard Keynes Vol. VII. London, Basingstoke: Macmillan.

Blog-Reference

There are two kinds of revolutions, political and scientific, and you are in the wrong movie. The Keynesian Revolution was intended as a scientific revolution: “But, if my explanations are right, it is my fellow economists, not the general public, whom I must first convince. At this stage of the argument the general public, though welcome at the debate, are only eavesdroppers at an attempt by an economist to bring to an issue the deep divergences of opinion between fellow economists which have for the time being almost destroyed the practical influence of economic theory, and will, until they are resolved, continue to do so.” (Keynes, 1973, p. xxi)

Political revolutions are usually not started by politely throwing the public out of the auditorium.

Keynes and his contemporaries witnessed two scientific revolutions. In physics, Einstein put forth the theory of relativity, in mathematics Hilbert put forth the axiomatic method. Both scientific revolutions were recognized by their contemporaries as such. Keynes, like most economists before him, tried to profit from the prestige and triumph of the real sciences to sell a paltry piece of common sense.

The physicists got the GENERAL Theory of Relativity, and Keynes titled his book the GENERAL Theory. The mathematicians got the non-Euclidean axioms, Keynes threw over the second postulate of the classical doctrine [The utility of the wage ...] and declared this as akin to throwing over Euclid's axiom of parallels (Keynes, 1973, p. 17).

Keynes' talk of generality and axioms was sales talk for his fellow economists. He understood the axiomatic method but he did not apply it, quite the contrary: “There is, however, no absolute need to start with axioms, let alone particular ones, or even with abstraction. There is a role for historical generalisation, which relies on one of the most important logical tools, pattern recognition (metaphor, analogy); and a role for argument from first principles. Both of these procedures are part of what Keynes called ‘human logic’ in contrast to ‘formal logic.’” (Keynes, quoted in Chick, 1998, p. 1860)

Keynes never intended to leave the realm of common sense (aka human logic) “where nothing is clear and everything is possible” (see Section 3 of my paper in Real-World Economics Review, Issue No. 63, 2013).

It was the Neoclassicals who recognized that there is a real problem and tried to get out of the perennial verbiage of Political Economy: “The very definition of an economic concept is usually subject to a substantial margin of ambiguity. An axiomatized theory substitutes for an ambiguous economic concept a mathematical object that is subject to entirely definite rules of reasoning.” (Debreu, quoted in Ingrao et al., 1990, p. 287)

Let us face the facts: on the methodological point, the Neoclassicals are definitively superior. Keynesianism and axiomatization are a contradiction in terms. The Post Keynesians explicitly defend 'incoherent Babylonian babble' with their silly slogan “It is better to be vaguely right than precisely wrong” (for details see 2013, p. 96).

Time for Heterodoxy to stop wordplay with collision of parallels and collusion of capitalists and to start an intellectual revolution of their own. If Heterodoxy means something scientific then you have to put heterodox axioms against orthodox axioms or, as Keynes advertised, get up and move from Euclidean axioms to non-Euclidean axioms. This is a tough formal exercise.

Egmont Kakarot-Handtke

References

Chick, V. (1998). On Knowing One’s Place: The Role of Formalism in Economics. Economic Journal, 108(451): 1859–1869. URL

Ingrao, B., and Israel, G. (1990). The Invisible Hand. Economic Equilibrium in the History of Science. Cambridge, London: MIT Press.

Kakarot-Handtke, E. (2013a). Crisis and Methodology: Some Heterodox Misunderstandings. real-world economics review, 63: 98–117. URL

Kakarot-Handtke, E. (2013b). Why Post Keynesianism is Not Yet a Science. Economic Analysis and Policy, 43(1): 97–106. URL

Keynes, J. M. (1973). The General Theory of Employment Interest and Money. The Collected Writings of John Maynard Keynes Vol. VII. London, Basingstoke: Macmillan.

For details of the big picture see cross-references Keynesianism.

July 12, 2013

Keynes, Euclid, and economic methodology

Comment on Fred Zaman on 'Rethinking Keynes’ non-Euclidian theory of the economy'

Blog-Reference

Since each economist starts from some premises, all economists apply — consciously or unconsciously, correctly or incorrectly — the axiomatic method. Keynes, of course, was aware of the history of economic thought: “To Senior belongs the signal honor of having been the first to make the attempt to state, consciously and explicitly, the postulates that are necessary and sufficient in order to build up … that little analytic apparatus commonly known as economic theory, or to put it differently, to provide for it an axiomatic basis.” (Schumpeter, 1994, p. 575)

Political economists start from implicit value judgments (the market system works better, capitalism is unjust, etc.) and then argue their case. These kinds of value judgments may emerge as the conclusion of the analysis, but it is inadmissible to put them into the premises. Theoretical economists accept that each theory has a kind of architecture and state their premises explicitly: “Everyone uses 'theory' in multifarious senses. ... But in discriminating usage, the term generally denotes a logical edifice.” (Georgescu-Roegen, 1966, p. 108)

The correct procedure, therefore, is as follows: “The attempt is made to collect all the assumptions, which are needed, but no more, to form the apex of the system. They are usually called the ‘axioms’ (or ‘postulates’, or ‘primitive propositions’; no claim of truth is implied in the term ‘axiom’ as here used). The axioms are chosen in such a way that all the other statements belonging to the theoretical system can be derived from the axioms by purely logical or mathematical transformations.” (Popper, 1980, p. 71)

Logical consistency is not something nice to have, it is essential for applicability: “They [economists] want to contribute to the solution of urgent practical problems. ... Of course, they also pursue the consistency of the theories they make, for he who contradicts himself proves nothing.” (Klant, 1988, pp. 112-113)

The crucial part of theory building is the choice of foundational propositions: “What are the propositions which may reasonably be received without proof? That there must be some such propositions all are agreed, since there cannot be an infinite series of proof, a chain suspended from nothing. But to determine what these propositions are, is the opus magnum of the more recondite mental philosophy.” (Mill, 2006, p. 746)

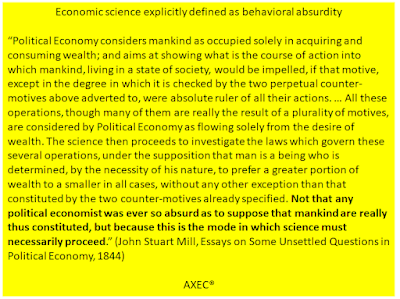

One of the fundamental propositions of standard economics is a behavioral assumption that, imprudently, has been selected as an axiom: “Central to the question of formalisation is the role of the rationality axioms. The internal goal, derived from a particular form of mathematics, of developing a closed, axiomatic, mathematically-expressed theoretical system which yielded equilibrium solutions required reductionist axioms of deterministic individual behaviour.” (Dow, 1997, p. 83)

The rationality axiom implies utility maximization and profit maximization. There are several reasons why the rationality assumption cannot be accepted as an axiom but one is sufficient, it lacks the ‘requisite self-evident generality’: “But a principle that is not universally true is false. Thus the rationality principle is false. I think there is no way out of this. ... Now if the rationality principle is false, then an explanation that consists of the conjunction of this principle and a model must also be false, even if the particular model is true.” (Popper, 1994, pp. 172-173)

The irony of the Keynesian Revolution, which, in the last instance, explains its failure, is that it retained the immediate derivatives of the false rationality axiom: “Two axioms of classical economics that Keynes kept, however, and with which keeping Davidson concurs, are (1) people are self-interested and try to protect their income and wealth; and that (2) firms try to maximize profits.” (see intro)

These axioms always come with a caveat in order to make it clear that economists are indeed hard-nosed realists: “Not that any political economist was ever so absurd as to suppose that mankind are really thus constituted, but because this is the mode in which science must necessarily proceed.” (J. S. Mill, 2004, p. 106)

Somehow, the Post Keynesians never perceived that something has gone wrong on the way from the Euclidean to the non-Euclidean axioms. For them, and for all those interested in the proper axiomatization of Keynes' theory, I have untangled the mess in Keynes's Missing Axioms (2011).

Egmont Kakarot-Handtke

References

Dow, S. C. (1997). Mainstream Economic Methodology. Cambridge Journal of Economics, 21: 73–93.

Georgescu-Roegen, N. (1966). Analytical Economics, chapter General Conclusions for the Economist, 92–129. Cambridge: Harvard University Press.

Kakarot-Handtke, E. (2011). Keynes’s Missing Axioms. SSRN Working Paper Series, 1841408: 1–33. URL

Klant, J. J. (1988). The Natural Order. In N. de Marchi (Ed.), The Popperian Legacy in Economics, 87–117. Cambridge: Cambridge University Press.

Mill, J. S. (2004). Essays on Some Unsettled Questions of Political Economy, chapter On the Definition of Political Economy; and the Method of Investigation Proper to It., 93–125. Electronic Classic Series PA 18202: Pennsylvania State University. URL

Mill, J. S. (2006). Principles of Political Economy With Some of Their Applications to Social Philosophy, Volume 3, Books III-V of Collected Works of John Stuart Mill. Indianapolis: Liberty Fund. URL

Popper, K. R. (1980). The Logic of Scientific Discovery. London, Melbourne, Sydney: Hutchison, 10th edition.

Popper, K. R. (1994). The Myth of the Framework. In Defence of Science and Rationality. London, New York: Routledge.

Schumpeter, J. A. (1994). History of Economic Analysis. New York: Oxford University Press.

Blog-Reference

Since each economist starts from some premises, all economists apply — consciously or unconsciously, correctly or incorrectly — the axiomatic method. Keynes, of course, was aware of the history of economic thought: “To Senior belongs the signal honor of having been the first to make the attempt to state, consciously and explicitly, the postulates that are necessary and sufficient in order to build up … that little analytic apparatus commonly known as economic theory, or to put it differently, to provide for it an axiomatic basis.” (Schumpeter, 1994, p. 575)

Political economists start from implicit value judgments (the market system works better, capitalism is unjust, etc.) and then argue their case. These kinds of value judgments may emerge as the conclusion of the analysis, but it is inadmissible to put them into the premises. Theoretical economists accept that each theory has a kind of architecture and state their premises explicitly: “Everyone uses 'theory' in multifarious senses. ... But in discriminating usage, the term generally denotes a logical edifice.” (Georgescu-Roegen, 1966, p. 108)

The correct procedure, therefore, is as follows: “The attempt is made to collect all the assumptions, which are needed, but no more, to form the apex of the system. They are usually called the ‘axioms’ (or ‘postulates’, or ‘primitive propositions’; no claim of truth is implied in the term ‘axiom’ as here used). The axioms are chosen in such a way that all the other statements belonging to the theoretical system can be derived from the axioms by purely logical or mathematical transformations.” (Popper, 1980, p. 71)

Logical consistency is not something nice to have, it is essential for applicability: “They [economists] want to contribute to the solution of urgent practical problems. ... Of course, they also pursue the consistency of the theories they make, for he who contradicts himself proves nothing.” (Klant, 1988, pp. 112-113)

The crucial part of theory building is the choice of foundational propositions: “What are the propositions which may reasonably be received without proof? That there must be some such propositions all are agreed, since there cannot be an infinite series of proof, a chain suspended from nothing. But to determine what these propositions are, is the opus magnum of the more recondite mental philosophy.” (Mill, 2006, p. 746)

One of the fundamental propositions of standard economics is a behavioral assumption that, imprudently, has been selected as an axiom: “Central to the question of formalisation is the role of the rationality axioms. The internal goal, derived from a particular form of mathematics, of developing a closed, axiomatic, mathematically-expressed theoretical system which yielded equilibrium solutions required reductionist axioms of deterministic individual behaviour.” (Dow, 1997, p. 83)

The rationality axiom implies utility maximization and profit maximization. There are several reasons why the rationality assumption cannot be accepted as an axiom but one is sufficient, it lacks the ‘requisite self-evident generality’: “But a principle that is not universally true is false. Thus the rationality principle is false. I think there is no way out of this. ... Now if the rationality principle is false, then an explanation that consists of the conjunction of this principle and a model must also be false, even if the particular model is true.” (Popper, 1994, pp. 172-173)

The irony of the Keynesian Revolution, which, in the last instance, explains its failure, is that it retained the immediate derivatives of the false rationality axiom: “Two axioms of classical economics that Keynes kept, however, and with which keeping Davidson concurs, are (1) people are self-interested and try to protect their income and wealth; and that (2) firms try to maximize profits.” (see intro)

These axioms always come with a caveat in order to make it clear that economists are indeed hard-nosed realists: “Not that any political economist was ever so absurd as to suppose that mankind are really thus constituted, but because this is the mode in which science must necessarily proceed.” (J. S. Mill, 2004, p. 106)

Somehow, the Post Keynesians never perceived that something has gone wrong on the way from the Euclidean to the non-Euclidean axioms. For them, and for all those interested in the proper axiomatization of Keynes' theory, I have untangled the mess in Keynes's Missing Axioms (2011).

Egmont Kakarot-Handtke

References

Dow, S. C. (1997). Mainstream Economic Methodology. Cambridge Journal of Economics, 21: 73–93.

Georgescu-Roegen, N. (1966). Analytical Economics, chapter General Conclusions for the Economist, 92–129. Cambridge: Harvard University Press.

Kakarot-Handtke, E. (2011). Keynes’s Missing Axioms. SSRN Working Paper Series, 1841408: 1–33. URL

Klant, J. J. (1988). The Natural Order. In N. de Marchi (Ed.), The Popperian Legacy in Economics, 87–117. Cambridge: Cambridge University Press.

Mill, J. S. (2004). Essays on Some Unsettled Questions of Political Economy, chapter On the Definition of Political Economy; and the Method of Investigation Proper to It., 93–125. Electronic Classic Series PA 18202: Pennsylvania State University. URL

Mill, J. S. (2006). Principles of Political Economy With Some of Their Applications to Social Philosophy, Volume 3, Books III-V of Collected Works of John Stuart Mill. Indianapolis: Liberty Fund. URL

Popper, K. R. (1980). The Logic of Scientific Discovery. London, Melbourne, Sydney: Hutchison, 10th edition.

Popper, K. R. (1994). The Myth of the Framework. In Defence of Science and Rationality. London, New York: Routledge.

Schumpeter, J. A. (1994). History of Economic Analysis. New York: Oxford University Press.

Opinion vs Knowledge

Comment on Edward Fullbrook on 'Dr. X'

Blog-Reference

Campaigning for a good cause, whatever it is, is politics. Politics is the opposite of science. As one can glean from the history of Political Economy, the good/bad discussion has achieved nothing of scientific value and only hampered the true/false discussion of theoretical economics. This is why economics is still at the pre-scientific stage: “The position I now favor is that economics is a pre-science, rather like astronomy before Copernicus, Brahe and Galileo. I still hold out hope of better behavior in the future, but given the travesties of logic and anti-empiricism that have been committed in its name, it would be an insult to the other sciences to give economics even a tentative membership of that field.” (Keen, 2011, p. 158)

The bad scientist cranks out opinions, and the good scientist contributes to knowledge.

Egmont Kakarot-Handtke

References

Keen, S. (2011). Debunking Economics. London, New York: Zed Books, rev. edition.

Blog-Reference

Campaigning for a good cause, whatever it is, is politics. Politics is the opposite of science. As one can glean from the history of Political Economy, the good/bad discussion has achieved nothing of scientific value and only hampered the true/false discussion of theoretical economics. This is why economics is still at the pre-scientific stage: “The position I now favor is that economics is a pre-science, rather like astronomy before Copernicus, Brahe and Galileo. I still hold out hope of better behavior in the future, but given the travesties of logic and anti-empiricism that have been committed in its name, it would be an insult to the other sciences to give economics even a tentative membership of that field.” (Keen, 2011, p. 158)

The bad scientist cranks out opinions, and the good scientist contributes to knowledge.

Egmont Kakarot-Handtke

References

Keen, S. (2011). Debunking Economics. London, New York: Zed Books, rev. edition.

July 10, 2013

Economics is NOT a science of behavior (I)

Comment on Edward Fullbrook on 'Doctor X, “pure shit” and the Royal Society’s motto'

Blog-Reference

You say that trust is important for the functioning of the market system. I agree. So does standard economics. To verify this, please go to Google Scholar and enter ‘trust’ and ‘transaction costs.’

Standard economics will tell you that trust lowers transaction costs and therefore makes a significant contribution to profit maximization. You and neoclassical economics are in full harmony.

It is not the task of theoretical economics to see how religious or civic communities function. This is the task of sociology and psychology. It is the task of theoretical economics to explain how the economic system works. This is something quite different.

As Hudík put it: “The purpose of this paper is to criticise the notion that economics is a science of behaviour or that a science of behaviour is fundamental to economics. This plausible and, as I believe, mistaken idea has sometimes been called (methodological) psychologism, and I follow here this terminology. In opposition to psychologism I put forward the notion of economics as a study of spontaneous order independent of any behavioural science. My argument is based on the important contributions of Hayek and Popper. If it is correct, then all the attempts to derive an adequate model of economic behaviour (as practised, for example, by the representatives of ‘behavioural’ or ‘psychological economics’) are misconceived.” (2011, p. 147)

Egmont Kakarot-Handtke

References

Hudík, M. (2011). Why Economics is Not a Science of Behaviour. Journal of Economic Methodology, 18(2): 147–162.

Related 'Economics is NOT a science of behavior (II)' and 'Economics is NOT a science of behavior (III)' and 'Economics is NOT a science of behavior (IV)' and 'Economics is not a science, not a religion, but proto-scientific garbage' and 'A social science is NOT a science but a sitcom' and cross-references Not a Science of Behavior

Blog-Reference

You say that trust is important for the functioning of the market system. I agree. So does standard economics. To verify this, please go to Google Scholar and enter ‘trust’ and ‘transaction costs.’

Standard economics will tell you that trust lowers transaction costs and therefore makes a significant contribution to profit maximization. You and neoclassical economics are in full harmony.

It is not the task of theoretical economics to see how religious or civic communities function. This is the task of sociology and psychology. It is the task of theoretical economics to explain how the economic system works. This is something quite different.

As Hudík put it: “The purpose of this paper is to criticise the notion that economics is a science of behaviour or that a science of behaviour is fundamental to economics. This plausible and, as I believe, mistaken idea has sometimes been called (methodological) psychologism, and I follow here this terminology. In opposition to psychologism I put forward the notion of economics as a study of spontaneous order independent of any behavioural science. My argument is based on the important contributions of Hayek and Popper. If it is correct, then all the attempts to derive an adequate model of economic behaviour (as practised, for example, by the representatives of ‘behavioural’ or ‘psychological economics’) are misconceived.” (2011, p. 147)

Egmont Kakarot-Handtke

References

Hudík, M. (2011). Why Economics is Not a Science of Behaviour. Journal of Economic Methodology, 18(2): 147–162.

Related 'Economics is NOT a science of behavior (II)' and 'Economics is NOT a science of behavior (III)' and 'Economics is NOT a science of behavior (IV)' and 'Economics is not a science, not a religion, but proto-scientific garbage' and 'A social science is NOT a science but a sitcom' and cross-references Not a Science of Behavior

July 9, 2013

Alternatives are welcome

Comment on Edward Fullbrook on 'Dr. X'

Blog-Reference

If you think that standard economics produces “pure shit” (this thread's implicit consensus) then you are at a loss to explain why the German Historical School did not do better in the last 100 years than it actually did. Humboldt would not have approved of this performance.

As a matter of fact, it is quite simple to get the neoclassicals out of academia: “There is no evidence to suggest that economists abandon degenerating programs in the absence of a progressive alternative. We do not, in the face of falsified theories in the belt of a program, abandon that program until there is an alternative program with theories that are themselves corroborated.” (Weintraub, 1985, p. 148)

“... if you think you can do better with a non-neoclassical model ..., then you are quite welcome to try.” (Boland, 1992, p. 19)

GHT has its merits but it is not the progressive alternative.

Egmont Kakarot-Handtke

References

Boland, L. A. (1992). The Principles of Economics. Some Lies my Teacher Told Me. London, New York: Routledge.

Weintraub, E. R. (1985). Joan Robinson’s Critique of Equilibrium: An Appraisal. American Economic Review, Papers and Proceedings, 75(2): 146–149. URL

Blog-Reference

If you think that standard economics produces “pure shit” (this thread's implicit consensus) then you are at a loss to explain why the German Historical School did not do better in the last 100 years than it actually did. Humboldt would not have approved of this performance.

As a matter of fact, it is quite simple to get the neoclassicals out of academia: “There is no evidence to suggest that economists abandon degenerating programs in the absence of a progressive alternative. We do not, in the face of falsified theories in the belt of a program, abandon that program until there is an alternative program with theories that are themselves corroborated.” (Weintraub, 1985, p. 148)

“... if you think you can do better with a non-neoclassical model ..., then you are quite welcome to try.” (Boland, 1992, p. 19)

GHT has its merits but it is not the progressive alternative.

Egmont Kakarot-Handtke

References

Boland, L. A. (1992). The Principles of Economics. Some Lies my Teacher Told Me. London, New York: Routledge.

Weintraub, E. R. (1985). Joan Robinson’s Critique of Equilibrium: An Appraisal. American Economic Review, Papers and Proceedings, 75(2): 146–149. URL

July 8, 2013

Historians don't get it

Comment on Edward Fullbrook on 'Dr. X'

Blog-Reference

As a historian and defender of the idiographic method you actually face this trouble: “... the Dutch historian Peter Geyl ... wrote a brilliant book about Napoleon, amounting to the result that there are a dozen or so different interpretations ― we may safely say, models ― of Napoleon's character and career within academic history, all based upon “fact” (the Napoleonic period happens to be one of the best documented) and all flatly contradicting each other. Roughly speaking, they range from Napoleon as the brutal tyrant and egoistic enemy of human freedom to Napoleon the wise planer of a unified Europe; ... (von Bertalanffy, 1969, pp. 110-111)

As I put it in #62: “Verstehen [understanding] cannot lead to much more than to a gossip model of the world.”

At this point, we can borrow something really helpful from the natural sciences.

The flying autumn leaf and the falling cannonball both belong to the physical realm. The physicists completely ignore the leaf. Why? You can watch as many leaves as you please but you will at best arrive at the “historical law” that all leaves sooner or later fall to the ground. That's not wrong, of course. It is realistic, it is inductive, it has been tested and we all can agree upon it. Very complex, hum hum, we need further research. We know that Galileo found the law of the falling bodies by throwing cannonballs from the tower of Pisa (he may actually have performed this as a pure thought experiment).

By focusing on the rather boring canon ball and ignoring the wonderful trajectory of the red leaf in the autumn sunshine Galileo came closer to reality than the realists who never forget to bemoan the poverty of quantities and to praise the richness of qualities. Ignorance/Modesty is a good research strategy. This does not entail that one denies the existence of flying autumn leaves, it entails only that one cannot expect to learn much from them.

Historians who claim that, on principle, one cannot find something like laws in the economy may be right. We cannot know in advance. What we know is that there are NO behavioral laws like utility maximization. But this does not exclude other types that can be discovered. G. B. Shaw may have had historians at the back of his mind when he quipped: “People who say it cannot be done should not interrupt those who are doing it.”

Egmont Kakarot-Handtke

References

von Bertalanffy, L. (1969). General Systems Theory. New York, NY: Braziller.

Blog-Reference

As a historian and defender of the idiographic method you actually face this trouble: “... the Dutch historian Peter Geyl ... wrote a brilliant book about Napoleon, amounting to the result that there are a dozen or so different interpretations ― we may safely say, models ― of Napoleon's character and career within academic history, all based upon “fact” (the Napoleonic period happens to be one of the best documented) and all flatly contradicting each other. Roughly speaking, they range from Napoleon as the brutal tyrant and egoistic enemy of human freedom to Napoleon the wise planer of a unified Europe; ... (von Bertalanffy, 1969, pp. 110-111)

As I put it in #62: “Verstehen [understanding] cannot lead to much more than to a gossip model of the world.”

At this point, we can borrow something really helpful from the natural sciences.

The flying autumn leaf and the falling cannonball both belong to the physical realm. The physicists completely ignore the leaf. Why? You can watch as many leaves as you please but you will at best arrive at the “historical law” that all leaves sooner or later fall to the ground. That's not wrong, of course. It is realistic, it is inductive, it has been tested and we all can agree upon it. Very complex, hum hum, we need further research. We know that Galileo found the law of the falling bodies by throwing cannonballs from the tower of Pisa (he may actually have performed this as a pure thought experiment).

By focusing on the rather boring canon ball and ignoring the wonderful trajectory of the red leaf in the autumn sunshine Galileo came closer to reality than the realists who never forget to bemoan the poverty of quantities and to praise the richness of qualities. Ignorance/Modesty is a good research strategy. This does not entail that one denies the existence of flying autumn leaves, it entails only that one cannot expect to learn much from them.

Historians who claim that, on principle, one cannot find something like laws in the economy may be right. We cannot know in advance. What we know is that there are NO behavioral laws like utility maximization. But this does not exclude other types that can be discovered. G. B. Shaw may have had historians at the back of his mind when he quipped: “People who say it cannot be done should not interrupt those who are doing it.”

Egmont Kakarot-Handtke

References

von Bertalanffy, L. (1969). General Systems Theory. New York, NY: Braziller.

July 5, 2013

Demarcation

Comment on Edward Fullbrook on 'Dr. X'

Blog-Reference

Myth, well told, is still the most convincing way to explain how the world and humankind came to be in their present form. To recall, Zeus was the god of sky and thunder. He oversaw the universe, assigned the various gods their roles, and was known for his erotic escapades. Zeus was emotional, spontaneous and had a lot of trouble with other gods, goddesses, and humans. At Prometheus, for example, he was angry for three things: being tricked on sacrifices, stealing fire for Man, and for refusing to tell him which of his children would dethrone him. To handle his problems, Zeus regularly fell back to chicanery, force, and violence (for details see Wikipedia). Purified from all religious connotations this is the stuff soap operas are made of until today. Let us call this the gossip model of the world.

The ancient Greeks regarded myths as ‘true stories’ and distinguished them from fables as ‘false stories’. Xenophanes made his contemporaries aware that their ‘true stories’ were what is now called a projection (Popper, 1994, p. 39).

With this, the problem of demarcation arose for the first time. And it was easily solved. The pre-Socratics rejected any mythological explanations of the world because they saw that everything could be explained by the actions of gods which meant on closer inspection: nothing. This methodological insight set science on its track.

Popper, for one, put the demarcation criterion to work. He rejected psychoanalysis because it could explain everything even why it did not work as intended. He rejected Marxism because it could explain post factum why the Revolution happened in a less advanced country instead of in the most advanced, which should have happened according to Marx's best-known prediction.

It might seem that the original demarcation is a matter of history. This is not so. When Dawkins refuses to discuss with a creationist, we are back at the fundamental methodological decision that constituted science. Demarcation is a question that reappears continuously in new settings.

Economics faces the following alternative. If it wants to be accepted as science it has to stick to the rules. The rules are quite simple: material and logical consistency (Klant, 1994, p. 31). No excuses (complexity, Duhem-Quine, etcetera), no pork sausage (inexact, separate). If economics cannot deliver on principle, as Robert Locke maintains, it has to join the Geisteswissenschaften and try its luck with Verstehen (see Drechsler's article). Verstehen, however, cannot lead to much more than to a gossip model of the world. People like this kind of stuff, but that's not science. Everybody can understand why Zeus throws the thunderbolt, but no way leads from there to the lightning rod.

Egmont Kakarot-Handtke

References

Klant, J. J. (1994). The Nature of Economic Thought. Aldershot, Brookfield, VT: Edward Elgar.

Popper, K. R. (1994). The Myth of the Framework. In Defence of Science and Rationality. London, New York, NY: Routledge.

Blog-Reference

Myth, well told, is still the most convincing way to explain how the world and humankind came to be in their present form. To recall, Zeus was the god of sky and thunder. He oversaw the universe, assigned the various gods their roles, and was known for his erotic escapades. Zeus was emotional, spontaneous and had a lot of trouble with other gods, goddesses, and humans. At Prometheus, for example, he was angry for three things: being tricked on sacrifices, stealing fire for Man, and for refusing to tell him which of his children would dethrone him. To handle his problems, Zeus regularly fell back to chicanery, force, and violence (for details see Wikipedia). Purified from all religious connotations this is the stuff soap operas are made of until today. Let us call this the gossip model of the world.

The ancient Greeks regarded myths as ‘true stories’ and distinguished them from fables as ‘false stories’. Xenophanes made his contemporaries aware that their ‘true stories’ were what is now called a projection (Popper, 1994, p. 39).

With this, the problem of demarcation arose for the first time. And it was easily solved. The pre-Socratics rejected any mythological explanations of the world because they saw that everything could be explained by the actions of gods which meant on closer inspection: nothing. This methodological insight set science on its track.

Popper, for one, put the demarcation criterion to work. He rejected psychoanalysis because it could explain everything even why it did not work as intended. He rejected Marxism because it could explain post factum why the Revolution happened in a less advanced country instead of in the most advanced, which should have happened according to Marx's best-known prediction.

It might seem that the original demarcation is a matter of history. This is not so. When Dawkins refuses to discuss with a creationist, we are back at the fundamental methodological decision that constituted science. Demarcation is a question that reappears continuously in new settings.

Economics faces the following alternative. If it wants to be accepted as science it has to stick to the rules. The rules are quite simple: material and logical consistency (Klant, 1994, p. 31). No excuses (complexity, Duhem-Quine, etcetera), no pork sausage (inexact, separate). If economics cannot deliver on principle, as Robert Locke maintains, it has to join the Geisteswissenschaften and try its luck with Verstehen (see Drechsler's article). Verstehen, however, cannot lead to much more than to a gossip model of the world. People like this kind of stuff, but that's not science. Everybody can understand why Zeus throws the thunderbolt, but no way leads from there to the lightning rod.

Egmont Kakarot-Handtke

References

Klant, J. J. (1994). The Nature of Economic Thought. Aldershot, Brookfield, VT: Edward Elgar.

Popper, K. R. (1994). The Myth of the Framework. In Defence of Science and Rationality. London, New York, NY: Routledge.

July 3, 2013

Where is profit?

Comment on Edward Fullbrook on 'Dr. X'

Blog-Reference

What a coincidence! You sum up: To say it with a Keynes’ quip: “It is better to be vaguely right than precisely wrong.” In #26 I referred Paul Davidson to a paper of mine which starts on p. 96 with the quote: “For Keynes as for Post Keynesians the guiding motto is ‘it is better to be roughly right than precisely wrong!’ (Davidson, 1984, p. 574).” The title of the paper is: Why Post Keynesianism is Not Yet a Science.

Let us start with a point that is beyond the slightest doubt. Keynes’ formal groundwork consisted in the main of two equations, i.e. Y=C+I and S=Y–C. (1973, p. 63). From this follows immediately I=S, and later the multiplier.

The first question is: Where is profit? How can Keynes present a formalization of the economy we happen to live in without mentioning profit? Keynes, of course, was fully aware that profit is the pivotal magnitude in the market system and he has defined on p. 23 that total income is the sum of factor costs and profit. The problem is that this definition does not harmonize with the formal groundwork above. Keynes knew this.

“His [Keynes's] Collected Writings show that he wrestled to solve the Profit Puzzle up till the semi-final versions of his GT but in the end he gave up and discarded the draft chapter dealing with it.” (Tómasson and Bezemer, 2010, pp. 12-13, 16)

My paper is a formal demonstration that the correct relation reads Qm≡I−Sm+Yd, i.e. total monetary profit in period t is given by the difference of business sector’s investment expenditures and household sector’s monetary saving plus distributed profits of the business sector. This implies that Keynes' I=S or the ex-ante/ex-post rationalization is untenable.‡

In sum: Keynes' profit theory is wrong and because of this the investment-equals-saving proposition is false. Now, there is no need to go any further, because: “Even if we cannot prove a theory or model is true, at the very minimum to be true it must be logically consistent.” (Boland, 2003, p. 24).

The General Theory is inconsistent and Keynes' intellectual heirs never rectified it. Therefore, neither original Keynesianism nor its modern reincarnations or bastardizations can be accepted as a successor to neoclassics which has debunked itself recently.

How does Davidson comment on this fatal situation in #29? “You can define anything you want but as a sage once said ‘A rose by any other name will smell as sweet!’”

Economics could be real science if economists were real scientists.

Egmont Kakarot-Handtke

References

Boland, L. A. (2003). The Foundations of Economic Method. A Popperian Perspective. London, New York, NY: Routledge, 2nd edition.

Davidson, P. (1984). Reviving Keynes’s Revolution. Journal of Post Keynesian Economics, 6(4): 561–575. URL

Keynes, J. M. (1973). The General Theory of Employment Interest and Money. The Collected Writings of John Maynard Keynes Vol. VII. London, Basingstoke: Macmillan.

Tómasson, G., and Bezemer, D. J. (2010). What is the Source of Profit and

Interest? A Classical Conundrum Reconsidered. MPRA Paper, 20557: 1–34. URL

Blog-Reference

What a coincidence! You sum up: To say it with a Keynes’ quip: “It is better to be vaguely right than precisely wrong.” In #26 I referred Paul Davidson to a paper of mine which starts on p. 96 with the quote: “For Keynes as for Post Keynesians the guiding motto is ‘it is better to be roughly right than precisely wrong!’ (Davidson, 1984, p. 574).” The title of the paper is: Why Post Keynesianism is Not Yet a Science.

Let us start with a point that is beyond the slightest doubt. Keynes’ formal groundwork consisted in the main of two equations, i.e. Y=C+I and S=Y–C. (1973, p. 63). From this follows immediately I=S, and later the multiplier.

The first question is: Where is profit? How can Keynes present a formalization of the economy we happen to live in without mentioning profit? Keynes, of course, was fully aware that profit is the pivotal magnitude in the market system and he has defined on p. 23 that total income is the sum of factor costs and profit. The problem is that this definition does not harmonize with the formal groundwork above. Keynes knew this.

“His [Keynes's] Collected Writings show that he wrestled to solve the Profit Puzzle up till the semi-final versions of his GT but in the end he gave up and discarded the draft chapter dealing with it.” (Tómasson and Bezemer, 2010, pp. 12-13, 16)

My paper is a formal demonstration that the correct relation reads Qm≡I−Sm+Yd, i.e. total monetary profit in period t is given by the difference of business sector’s investment expenditures and household sector’s monetary saving plus distributed profits of the business sector. This implies that Keynes' I=S or the ex-ante/ex-post rationalization is untenable.‡

In sum: Keynes' profit theory is wrong and because of this the investment-equals-saving proposition is false. Now, there is no need to go any further, because: “Even if we cannot prove a theory or model is true, at the very minimum to be true it must be logically consistent.” (Boland, 2003, p. 24).

The General Theory is inconsistent and Keynes' intellectual heirs never rectified it. Therefore, neither original Keynesianism nor its modern reincarnations or bastardizations can be accepted as a successor to neoclassics which has debunked itself recently.

How does Davidson comment on this fatal situation in #29? “You can define anything you want but as a sage once said ‘A rose by any other name will smell as sweet!’”

Economics could be real science if economists were real scientists.

Egmont Kakarot-Handtke

References

Boland, L. A. (2003). The Foundations of Economic Method. A Popperian Perspective. London, New York, NY: Routledge, 2nd edition.

Davidson, P. (1984). Reviving Keynes’s Revolution. Journal of Post Keynesian Economics, 6(4): 561–575. URL

Keynes, J. M. (1973). The General Theory of Employment Interest and Money. The Collected Writings of John Maynard Keynes Vol. VII. London, Basingstoke: Macmillan.

Tómasson, G., and Bezemer, D. J. (2010). What is the Source of Profit and

Interest? A Classical Conundrum Reconsidered. MPRA Paper, 20557: 1–34. URL

***

‡ For an early forerunner of this equation see Gerhard Michael Ambrosi Carl Föhl on Economic Activity and Money, eq. 1.

The moral of the story (I)

Comment on Edward Fullbrook on 'Dr. X'

Blog-Reference

ad #31