Blog-Reference and Blog-Reference

Matias Vernengo correctly observes: “The theory of value and distribution is at the heart of economics. … However, most economists have no clue about it, about the centrality of value.”

Then he summarizes the main approaches:

• “Let me start with the authors of the surplus approach. In fact, a bit earlier with the economists that would eventually be known as Mercantilists (if you can talk about a school). If we are allowed to generalize and simplify, the latter believed that the wealth of nations depended essentially on maintaining trade surpluses and accumulating precious metals. Profits were essentially the result of buying cheap and selling dear, or profits upon alienation, which indicates that, for Mercantilists, profits were generated in the exchange process.”

• “Classical political economy authors, starting with William Petty, emphasize the determination of profits in the process of production, as a residual of output, once the conditions for the reproduction of the productive system were satisfied. So profits are not the result of selling high and buying low, something that could result from the mere fluctuation of market prices, but from the ability to produce beyond what was needed for the simple material reproduction of society. … So the normal rate of profit is needed to determine prices, and prices are needed to determine the normal rate of profit. This was well understood by both Ricardo and Marx.”

• “In other words, for a coherent theory of output, accumulation, international trade, technological change and more (taxation, etc.) you need a theory of value and distribution. That is also the case in the mainstream. Marginalism developed in the last quarter of the 19th century, both as a result of the lack of analytical solution in that period for the problems of the LTV and as a reaction to radical revival of the theory (Marxism). The important distinction is that while classical political economy authors dealt only with objective factors, and considered demand as given when determined value and distribution, marginalism incorporated subjective preferences as central for the explanation of long term normal prices, and prices and quantities were determined simultaneously.”

Let us make it short here: the theory of value/profit/distribution is false since Adam Smith.#1, #2 However, Matias Vernengo, too, has no clue about what profit is and how the monetary economy works.

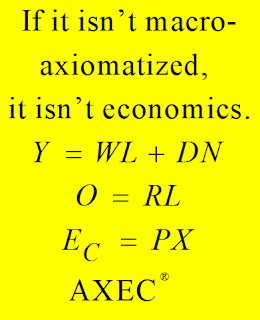

The elementary production-consumption economy is defined with this set of macroeconomic axioms: (A0) The economy consists of the household and the business sector which, in turn, consists initially of one giant fully integrated firm. (A1) Yw=WL wage income Yw is equal to wage rate W times working hours. L, (A2) O=RL output O is equal to productivity R times working hours L, (A3) C=PX consumption expenditure C is equal to price P times quantity bought/sold X.

Under the conditions of market-clearing X=O and budget-balancing C=Yw in each period, the price as the dependent variable is given by P=W/R (1a). The price is determined by the wage rate W, which takes the role of the nominal numéraire, and the productivity R. The elementary production-consumption economy is shown on Wikimedia.#2

The macroeconomic Law of Supply and Demand (1a) implies W/P=R (1b), i.e. the real wage is always equal to the productivity no matter how the wage rate W is set. Labor gets the whole product.

The focus is here on the nominal/monetary balances. For the time being, real balances are excluded, i.e. it holds X=O. The condition of budget-balancing, i.e. C=Yw, is now skipped. The monetary saving/dissaving of the household sector is defined as S≡Yw−C. The monetary profit/loss of the business sector is defined as Q≡C−Yw. Ergo Q≡−S.

The balances add up to zero. The mirror image of household sector saving S is business sector loss −Q. The mirror image of household sector dissaving (-S) is business sector profit Q. Q≡−S is the elementary version of the macroeconomic Profit Law.

Ramifications: (i) The business sector’s revenues can only be greater than costs if, in the simplest of all possible cases, consumption expenditures are greater than wage income. (ii) In order that profit comes into existence for the first time in the elementary production-consumption economy, the household sector must run a deficit at least in one period. This presupposes the existence of a credit-creating entity. (iii) Profit is, in the most elementary case, determined by the increase and decrease of the household sector’s debt. There is a close relation between profit/loss and the expansion/contraction of debt for the economy as a whole. (iv) Wage income is the factor remuneration of labor input. Profit is not a factor income. Since capital is nonexistent in the elementary production-consumption economy profit is not functionally attributable to capital. (v) There is no relation at all between profit, capital, marginal or average productivity. (vi) The value of output is, in the general case, different from the sum of factor incomes. This is the defining property of the monetary economy. (vii) Profit is a factor-independent residual and qualitatively different from wage income. Therefore, it is an elementary mistake to maintain that total income is the sum of wages and profits.

In brief, to this day, Walrasians, Keynesians, Marxians, Austrians, MMTers, and Matias Vernengo have no clue about profit and as a consequence about value and distribution. They will all be buried at the darkest corner of the Flat-Earth Cemetery.

Egmont Kakarot-Handtke

* Naked Keynesianism

#1 The Profit Theory is False Since Adam Smith. What About the True Distribution Theory?

#2 Economics ― nothing but claptrap, twaddle, drivel, slip-slop, wish-wash, waffle, and proto-scientific garbage

#3 Wikimedia AXEC31 Elementary production-consumption economy

Related 'The Logic of Value and the Value of Logic'.

***

REPLY to André on Jul 23You say: “Price is not directly related to costs, be it wages or any other costs. A theory that relies on relations between prices and costs is lacking, to put it mildly.”

Observing one firm and then generalizing for the economy as a whole is called the Fallacy of Composition. This fallacy is the main reason why economics is proto-scientific garbage to this day.

Take, for a start, the most elementary case that the households fully spend their wage income on consumption, i.e. C=Yw, and that there are two products. Under the condition of market clearing and W1=W2=W, the prices are given by P1=W/R1 and P2=W/R2. The profits in both firms are zero, i.e. Q1≡C1―Yw1=0, Q2≡C2―Yw2=0, C=C1+C2, Yw=Yw1+Yw2, C=Yw, Q=Q1+Q2=0.

For relative prices, i.e. the exchange relation, holds P1/P2=R2/R1 in the most elementary case. The exchange relation between the two goods is determined by the objectively given productivities.

Now firm 1 increases the price P1. The households pay more for good 1 but keep total consumption expenditures unchanged, i.e. C=Yw, so they spend less on good 2. P2 falls under the condition of market-clearing. As a result, firm 1 now makes a profit and firm 2 makes a loss and the total profit of the business sector Q is zero as before.

Alternatively. Firm 1 increases the price P1. The households pay more for good 1 but keep expenditures on good 2 constant, that is, total consumption expenditures C are now greater than wage income Yw. In other words, the household sector deficit-spends or dissaves. In this case, the profit of the business sector as a whole Q is greater than zero. It holds Q≡−S, i.e. total profit of the business sector is equal to total dissaving of the household sector. The balances of the two sectors add up to zero, i.e. Q+S=0. One may call this the Law of the Conservation of Value.

One cannot do Price Theory and Value Theory without taking the macroeconomic balances equation into account.#1 OK, you can because you are a scientifically incompetent blatherer, to put it mildly.

#1 The Pure Logic of Value, Profit, Interest

***

REPLY to André on Jul 23You say: “Price is not necessarily related to costs, and this is a fact. If you ignore facts, you are just like a mainstream economist - ie, no scientist at all.”

Indeed, price is not necessarily related to costs. This is a well-known triviality. I treat this case in the section that starts with “Now firm 1 increases the price P1.” and in the section that starts with “Alternatively. Firm 1 increases the price P1.”

So, the point at issue is that you make a trivial statement about the price-setting capacity of a single firm. This is not “realism” but dumb partial analysis. The Walrasians can be criticized for many things but their point is valid that Marshallian partial analysis is worthless and has to be replaced by total analysis because of the interdependence of markets.

The interdependence of markets is a reality. It is nowhere to be found in your trivial examples. You simply do not get the essential point of price/value theory, to put it mildly.

***

#PointOfProof

Jul 24

post still missing

post still missing