Comment on Lars Syll on ‘Deductivism — the original sin of ‘modern’ economics’

Blog-Reference

“The tension between deductive and inductive modes of scientific inquiry is at least as old as written history.” (Clower and Howitt, 1997, p. 21)

In economics, this tension has often been misinterpreted as an alternative: “Is it better to start deductively from axioms or inductively from facts? When the time comes to choose between internal consistency and consistency with observations, which side should we take?” (Blinder, 1987, p. 135)

Wrong question! There is nothing to choose from! Science is defined by both material and formal consistency. It was already clear to Bacon that science moves forward on two legs, that is, by the alternating interaction of facts and axioms: “There remains simple experience; which, if taken as it comes, is called accident, if sought for, experiment. The true method of experience first lights the candle [hypothesis], and then by means of the candle shows the way [arranges and delimits the experiment]; commencing as it does with experience duly ordered and digested, not bungling or erratic, and from it deducing axioms [theories], and from established axioms again new experiments.” (Novum Organum, 1620; cited in Wikipedia)

For economics, Schumpeter has settled the question: “... there is not and cannot be any fundamental opposition between ‘theory’ and ‘fact finding,’ let alone between deduction and induction.” (1994, p. 45)

Why, then, is there still a discussion between Orthodoxy and Heterodoxy about deduction and induction? Because both have not really got the point.

Orthodoxy explicitly lays down its premises: “As with any Lakatosian research program, the neo-Walrasian program is characterized by its hard core, heuristics, and protective belts. Without asserting that the following characterization is definitive, I have argued that the program is organized around the following propositions: HC1 economic agents have preferences over outcomes; HC2 agents individually optimize subject to constraints; HC3 agent choice is manifest in interrelated markets; HC4 agents have full relevant knowledge; HC5 observable outcomes are coordinated, and must be discussed with reference to equilibrium states.

By definition, the hard-core propositions are taken to be true and irrefutable by those who adhere to the program. ‘Taken to be true’ means that the hard-core functions like axioms for a geometry, maintained for the duration of study of that geometry.” (Weintraub, 1985, p. 147)

Where does the fundamental error/mistake of Orthodoxy come in? Quite simple: HC2, HC4, and HC5 are inadmissible as axioms.

Where does the error/mistake of Heterodoxy come in? Quite simple: Instead of replacing the defect orthodox axioms with correct heterodox axioms Heterodoxy argues against the axiomatic-deductive method as such.

By giving the silly behavioral assumption of constrained optimization the status of an axiom Orthodoxy triggered in Heterodoxy the outsized Pavlovian reflex to abhor axiomatization as such. This, unfortunately, amounts to methodological self-mutilation.

The original sin of modern economics is that Orthodoxy got the axiomatic foundations wrong and Heterodoxy has none at all. By no stretch of the imagination has economics solved the ‘central problem of depression-prevention’. The manifest failure of economics is not explicable by Deductivism but is the result of pervasive methodological incompetence.

Egmont Kakarot-Handtke

References

Blinder, A. S. (1987). Keynes, Lucas, and Scientific Progress. American Economic Review, 77(2): 130–136. URL

Clower, R. W., and Howitt, P. (1997). Foundations of Economics. In A. d’Autume, and J. Cartelier (Eds.), Is Economics Becoming a Hard Science?, pp. 17–34. Cheltenham, Brookfield: Edward Elgar.

Schumpeter, J. A. (1994). History of Economic Analysis. New York, NY: Oxford University Press.

Weintraub, E. R. (1985). Joan Robinson’s Critique of Equilibrium: An Appraisal. American Economic Review, Papers and Proceedings, 75(2): 146–149. URL

For details on axiomatization in general and the set of structural axioms, in particular, see cross-references Axiomatization.

This blog connects to the AXEC Project which applies a superior method of economic analysis. The following comments have been posted on selected blogs as catalysts for the ongoing Paradigm Shift. The comments are brought together here for information. The full debates are directly accessible via the Blog-References. Scrap the lot and start again―that is what a Paradigm Shift is all about. Time to make economics a science.

September 30, 2015

Exponentially growing garbage

Comment on Asad Zaman on ‘Capitalism in the 21st Century’

Blog-Reference

You ask: “Why is there so much inequality, and why does it continue to rise? Piketty’s answer is brilliantly simple: r > g. The ‘r’ is the rate of return to wealth. This is the profit that the wealthy can make when they invest. The ‘g’ is the growth rate of the economy, currently around 3.3 percent, globally.” (See intro)

Did it ever occur to you that this argument has the same logical structure as Malthus's, that is if the population grows faster than food production eventually some people will die of hunger? Likewise, the Club of Rome famously argued, that if the depletion of a resource runs faster than its natural renewal humanity eventually looks into an empty barrel.

Clearly, the logic of positive/negative growth rates, of which compound interest is only the simplest case, is impeccable. Ultimately, it is a suggestive tautology that explains nothing. This holds also for Piketty’s r > g.

The trivial content of the diverging growth rates argument is that the whole thing ends up either at 0 or 100 percent, depending on whether the net growth rate is negative or positive. This is an easy mathematical exercise and not an economic theory.

For an explanation of growing wealth inequality, one first needs an understanding of profit and interest and how they interact in the monetary economy (2011). The fact of the matter is that neither Orthodoxy nor Heterodoxy has this understanding because the profit theory, and by consequence distribution theory as a whole, has been false since Adam Smith (2014b). Piketty is no exception.

Then you ask “A more important question for us to consider ... HOW can we, as heterodox economists — be instrumental in bringing about positive change?”

The answer depends on whether Heterodoxy is defined as a political or scientific enterprise. The consequence is pretty obvious: in the first case one has to take political action, and in the second case the action consists in the overdue paradigm shift, that is, economic theory has to be reconstructed from the ground up (2014a). Kuhn famously described this as scientific revolution and it is well known since Bacon how the interaction of facts and axioms works.

“There remains simple experience; which, if taken as it comes, is called accident, if sought for, experiment. The true method of experience first lights the candle [hypothesis], and then by means of the candle shows the way [arranges and delimits the experiment]; commencing as it does with experience duly ordered and digested, not bungling or erratic, and from it deducing axioms [theories], and from established axioms again new experiments.” (Novum Organum, 1620; quoted in Wikipedia)

Economists have always mashed up politics and science. The result has been exponentially growing proto-scientific garbage. Until this day the representative economist cannot tell the difference between profit and income. Because of this, not much more than confused blather can ever be expected from economists.

So ‘how can economists be instrumental in bringing about positive change?’ What about getting out of economics for good?

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2011). The Emergence of Profit and Interest in the Monetary Circuit. SSRN Working Paper Series, 1973952: 1–22. URL

Kakarot-Handtke, E. (2014a). Objective Principles of Economics. SSRN Working Paper Series, 2418851: 1–19. URL

Kakarot-Handtke, E. (2014b). The Profit Theory is False Since Adam Smith. What About the True Distribution Theory? SSRN Working Paper Series, 2511741: 1–23. URL

For details of the big picture see cross-references Incompetence.

Blog-Reference

You ask: “Why is there so much inequality, and why does it continue to rise? Piketty’s answer is brilliantly simple: r > g. The ‘r’ is the rate of return to wealth. This is the profit that the wealthy can make when they invest. The ‘g’ is the growth rate of the economy, currently around 3.3 percent, globally.” (See intro)

Did it ever occur to you that this argument has the same logical structure as Malthus's, that is if the population grows faster than food production eventually some people will die of hunger? Likewise, the Club of Rome famously argued, that if the depletion of a resource runs faster than its natural renewal humanity eventually looks into an empty barrel.

Clearly, the logic of positive/negative growth rates, of which compound interest is only the simplest case, is impeccable. Ultimately, it is a suggestive tautology that explains nothing. This holds also for Piketty’s r > g.

The trivial content of the diverging growth rates argument is that the whole thing ends up either at 0 or 100 percent, depending on whether the net growth rate is negative or positive. This is an easy mathematical exercise and not an economic theory.

For an explanation of growing wealth inequality, one first needs an understanding of profit and interest and how they interact in the monetary economy (2011). The fact of the matter is that neither Orthodoxy nor Heterodoxy has this understanding because the profit theory, and by consequence distribution theory as a whole, has been false since Adam Smith (2014b). Piketty is no exception.

Then you ask “A more important question for us to consider ... HOW can we, as heterodox economists — be instrumental in bringing about positive change?”

The answer depends on whether Heterodoxy is defined as a political or scientific enterprise. The consequence is pretty obvious: in the first case one has to take political action, and in the second case the action consists in the overdue paradigm shift, that is, economic theory has to be reconstructed from the ground up (2014a). Kuhn famously described this as scientific revolution and it is well known since Bacon how the interaction of facts and axioms works.

“There remains simple experience; which, if taken as it comes, is called accident, if sought for, experiment. The true method of experience first lights the candle [hypothesis], and then by means of the candle shows the way [arranges and delimits the experiment]; commencing as it does with experience duly ordered and digested, not bungling or erratic, and from it deducing axioms [theories], and from established axioms again new experiments.” (Novum Organum, 1620; quoted in Wikipedia)

Economists have always mashed up politics and science. The result has been exponentially growing proto-scientific garbage. Until this day the representative economist cannot tell the difference between profit and income. Because of this, not much more than confused blather can ever be expected from economists.

So ‘how can economists be instrumental in bringing about positive change?’ What about getting out of economics for good?

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2011). The Emergence of Profit and Interest in the Monetary Circuit. SSRN Working Paper Series, 1973952: 1–22. URL

Kakarot-Handtke, E. (2014a). Objective Principles of Economics. SSRN Working Paper Series, 2418851: 1–19. URL

Kakarot-Handtke, E. (2014b). The Profit Theory is False Since Adam Smith. What About the True Distribution Theory? SSRN Working Paper Series, 2511741: 1–23. URL

For details of the big picture see cross-references Incompetence.

September 28, 2015

Nowhere land

Comment on Merijn Knibbe on ‘The return of ‘land’ in macroeconomic discourse. Wonkish’

Blog-Reference

(i) The misrepresentation of land in economic theory started already with Ricardo's concept of rent (2011b). The deeper problem is that economists never understood what profit is. Therefore, because profit theory has been false from the very beginning, the concept of rent has been misleading, and distribution theory had no foundation whatsoever since the classics (2014). Neoclassics only worsened the situation.

(ii) In order to integrate land into the theory of market interaction, the distinction between primary and secondary markets is essential (2011a). Both types run on entirely different principles. The standard supply-demand-equilibrium analysis is not applicable, to begin with.

(iii) With the distinction between primary and secondary markets comes the distinction between monetary profit and nonmonetary profit. What is also needed is the distinction between monetary and nonmonetary saving. The latter applies in the case of changes in asset values which affect the household sector's net worth directly.

(iv) For the definition of property and the possible use of land for ‘painless’ taxation see (2015).

(v) For the relationship between financing, asset valuation, rate of interest, and profit see (2012).

Note in addition:

— The familiar well-behaved production function is a nonentity. Therefore, all models that contain one are worthless. From this follows that neoclassical production and distribution theory has always been unacceptable.

— As far as land/real estate is used as collateral it does not appear on a bank’s balance sheet. Price changes indirectly influence the riskiness of a loan which, however, becomes effective only in the case of default.

In sum: the treatment of land in the history of economic thought is indeed unassailable proof for the scientific incompetence of economists.

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2011a). Primary and Secondary Markets. SSRN Working Paper Series, 1917012: 1–26. URL

Kakarot-Handtke, E. (2011b). When Ricardo Saw Profit, He Called it Rent: On the Vice of Parochial Realism. SSRN Working Paper Series, 1932119: 1–19. URL

Kakarot-Handtke, E. (2012). Make a Bubble, Take a Free Lunch, Break a Bank. SSRN Working Paper Series, 2167234: 1–35. URL

Kakarot-Handtke, E. (2014). The Profit Theory is False Since Adam Smith. What About the True Distribution Theory? SSRN Working Paper Series, 2511741: 1–23. URL

Kakarot-Handtke, E. (2015). Essentials of Constructive Heterodoxy: Institutions. SSRN Working Paper Series, 2598721: 1–18. URL

Blog-Reference

(i) The misrepresentation of land in economic theory started already with Ricardo's concept of rent (2011b). The deeper problem is that economists never understood what profit is. Therefore, because profit theory has been false from the very beginning, the concept of rent has been misleading, and distribution theory had no foundation whatsoever since the classics (2014). Neoclassics only worsened the situation.

(ii) In order to integrate land into the theory of market interaction, the distinction between primary and secondary markets is essential (2011a). Both types run on entirely different principles. The standard supply-demand-equilibrium analysis is not applicable, to begin with.

(iii) With the distinction between primary and secondary markets comes the distinction between monetary profit and nonmonetary profit. What is also needed is the distinction between monetary and nonmonetary saving. The latter applies in the case of changes in asset values which affect the household sector's net worth directly.

(iv) For the definition of property and the possible use of land for ‘painless’ taxation see (2015).

(v) For the relationship between financing, asset valuation, rate of interest, and profit see (2012).

Note in addition:

— The familiar well-behaved production function is a nonentity. Therefore, all models that contain one are worthless. From this follows that neoclassical production and distribution theory has always been unacceptable.

— As far as land/real estate is used as collateral it does not appear on a bank’s balance sheet. Price changes indirectly influence the riskiness of a loan which, however, becomes effective only in the case of default.

In sum: the treatment of land in the history of economic thought is indeed unassailable proof for the scientific incompetence of economists.

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2011a). Primary and Secondary Markets. SSRN Working Paper Series, 1917012: 1–26. URL

Kakarot-Handtke, E. (2011b). When Ricardo Saw Profit, He Called it Rent: On the Vice of Parochial Realism. SSRN Working Paper Series, 1932119: 1–19. URL

Kakarot-Handtke, E. (2012). Make a Bubble, Take a Free Lunch, Break a Bank. SSRN Working Paper Series, 2167234: 1–35. URL

Kakarot-Handtke, E. (2014). The Profit Theory is False Since Adam Smith. What About the True Distribution Theory? SSRN Working Paper Series, 2511741: 1–23. URL

Kakarot-Handtke, E. (2015). Essentials of Constructive Heterodoxy: Institutions. SSRN Working Paper Series, 2598721: 1–18. URL

September 26, 2015

Doomed and damned

Comment on Peter Radford on ‘Beating dead horse?’

Blog-Reference

There are political and theoretical economics and the differences between the two are crystal clear.

(i) The goal of political economics is to push an agenda, and the goal of theoretical economics is to explain how the actual economy works.

(ii) In political economics anything goes; in theoretical economics, scientific standards are observed.

(iii) Science is methodologically well-defined by the criteria of material and formal consistency.

(iv) Political economics is a honeypot for morons and is accordingly defined by the rules of Circus Maximus.

Almost all of economics is political economics or what Feynman aptly called cargo cult science.#1

You argue: “Yes Krugman can be annoying with his emphasis on his version of the Hicks version of Keynes. But if it serves to get a vital message across to a public largely unaware of the internecine struggles within economics, so what?” (See intro)

Annoyance is not exactly a scientific criterion. The real problem is that Krugman’s arguments have no valid theoretical foundation (2014b; 2014a). The difference between a run-of-the-mill journalist and Krugman is that the latter seemingly speaks in the name of science. Because economics is a failed science this is a flagrant abuse of the authority of genuine science which depends for more than 2300 years on rigorous logical and empirical proof. It has never been the task of science to ‘get a vital message across.’

The ethics of science implies the acceptance of logical/empirical falsification. No such thing ever happened in economics.

“In economics we should strive to proceed, wherever we can, exactly according to the standards of the other, more advanced, sciences, where it is not possible, once an issue has been decided, to continue to write about it as if nothing had happened.” (Morgenstern, 1941, pp. 369-370)

“... suppose they [the economists] did reject all theories that were empirically falsified ... Nothing would be left standing; there would be no economics.” (Hands, 2001, p. 404)

What is the result of manifest scientific incompetence?: “The entire enterprise seems stuck in trenches lobbing diatribe back and forth determinedly with no side going much ground if any at all.” And what is the best thing to do next? “When we are stuck in the trenches we have to keep slogging away. Because to stop is be defeated.” (See intro)

This, in a nutshell, is the perverted methodology of political economics: never accept logical/empirical refutation because it is tantamount to political defeat. And this fully explains the ridiculous performance of economics for more than 200 years.

In political economics it suffices to repeat auto-suggestive mantras: “Austerity is still wrong. Inflation fears are still overblown. And Keynes is still right.” (See intro)

Neither falsification nor annoyance has ever stopped economists from promoting their junk: “It is juvenile to think that we need to stop saying the same things just because the public might get tired of listening.” (See intro)

Who cares that the same things have always been false?

Because of proven scientific incompetence, there is no future for Orthodoxy and traditional Heterodoxy. Krugman, Keynes (2011), Radford, and all the rest have been refuted. These people are not merely annoying, they are wrong on all counts. What can and must be done is to save science from the doomed and damned dead horse economists. Scientists of the world unite!

Egmont Kakarot-Handtke

References

Hands, D.W. (2001). Reflection without Rules. Economic Methodology and Contemporary Science Theory. Cambridge, New York, NY, etc: Cambridge University Press.

Kakarot-Handtke, E. (2011). Why Post Keynesianism is Not Yet a Science. SSRN Working Paper Series, 1966438: 1–20. URL

Kakarot-Handtke, E. (2014a). Loanable Funds vs. Endogenous Money: Krugman is Wrong, Keen is Right. SSRN Working Paper Series, 2389341: 1–17. URL

Kakarot-Handtke, E. (2014b). Mr. Keynes, Prof. Krugman, IS-LM, and the End of Economics as We Know It. SSRN Working Paper Series, 2392856: 1–19. URL

Morgenstern, O. (1941). Professor Hicks on Value and Capital. Journal of Political Economy, 49(3): 361–393. URL

#1 For details see Wikipedia

For details of the big picture see cross-references Proto-Science/Cargo Cult Science/Science.

Blog-Reference

There are political and theoretical economics and the differences between the two are crystal clear.

(i) The goal of political economics is to push an agenda, and the goal of theoretical economics is to explain how the actual economy works.

(ii) In political economics anything goes; in theoretical economics, scientific standards are observed.

(iii) Science is methodologically well-defined by the criteria of material and formal consistency.

(iv) Political economics is a honeypot for morons and is accordingly defined by the rules of Circus Maximus.

Almost all of economics is political economics or what Feynman aptly called cargo cult science.#1

You argue: “Yes Krugman can be annoying with his emphasis on his version of the Hicks version of Keynes. But if it serves to get a vital message across to a public largely unaware of the internecine struggles within economics, so what?” (See intro)

Annoyance is not exactly a scientific criterion. The real problem is that Krugman’s arguments have no valid theoretical foundation (2014b; 2014a). The difference between a run-of-the-mill journalist and Krugman is that the latter seemingly speaks in the name of science. Because economics is a failed science this is a flagrant abuse of the authority of genuine science which depends for more than 2300 years on rigorous logical and empirical proof. It has never been the task of science to ‘get a vital message across.’

The ethics of science implies the acceptance of logical/empirical falsification. No such thing ever happened in economics.

“In economics we should strive to proceed, wherever we can, exactly according to the standards of the other, more advanced, sciences, where it is not possible, once an issue has been decided, to continue to write about it as if nothing had happened.” (Morgenstern, 1941, pp. 369-370)

“... suppose they [the economists] did reject all theories that were empirically falsified ... Nothing would be left standing; there would be no economics.” (Hands, 2001, p. 404)

What is the result of manifest scientific incompetence?: “The entire enterprise seems stuck in trenches lobbing diatribe back and forth determinedly with no side going much ground if any at all.” And what is the best thing to do next? “When we are stuck in the trenches we have to keep slogging away. Because to stop is be defeated.” (See intro)

This, in a nutshell, is the perverted methodology of political economics: never accept logical/empirical refutation because it is tantamount to political defeat. And this fully explains the ridiculous performance of economics for more than 200 years.

In political economics it suffices to repeat auto-suggestive mantras: “Austerity is still wrong. Inflation fears are still overblown. And Keynes is still right.” (See intro)

Neither falsification nor annoyance has ever stopped economists from promoting their junk: “It is juvenile to think that we need to stop saying the same things just because the public might get tired of listening.” (See intro)

Who cares that the same things have always been false?

Because of proven scientific incompetence, there is no future for Orthodoxy and traditional Heterodoxy. Krugman, Keynes (2011), Radford, and all the rest have been refuted. These people are not merely annoying, they are wrong on all counts. What can and must be done is to save science from the doomed and damned dead horse economists. Scientists of the world unite!

Egmont Kakarot-Handtke

References

Hands, D.W. (2001). Reflection without Rules. Economic Methodology and Contemporary Science Theory. Cambridge, New York, NY, etc: Cambridge University Press.

Kakarot-Handtke, E. (2011). Why Post Keynesianism is Not Yet a Science. SSRN Working Paper Series, 1966438: 1–20. URL

Kakarot-Handtke, E. (2014a). Loanable Funds vs. Endogenous Money: Krugman is Wrong, Keen is Right. SSRN Working Paper Series, 2389341: 1–17. URL

Kakarot-Handtke, E. (2014b). Mr. Keynes, Prof. Krugman, IS-LM, and the End of Economics as We Know It. SSRN Working Paper Series, 2392856: 1–19. URL

Morgenstern, O. (1941). Professor Hicks on Value and Capital. Journal of Political Economy, 49(3): 361–393. URL

#1 For details see Wikipedia

For details of the big picture see cross-references Proto-Science/Cargo Cult Science/Science.

September 23, 2015

Heterodoxy, too, is proto-scientific garbage

Comment on Lars Syll on ‘What went wrong with economics?’

Blog-Reference and Blog-Reference and Blog-Reference on Jan 4, 2018, adapted to context

Science is defined by material and formal consistency. If a theory/model fails on one criterion it is scientifically worthless. With regard to formal consistency, there is no way around “... he who contradicts himself proves nothing” (Klant, 1988, p. 113). But formal consistency alone also proves nothing.

The actual state of economics is this: Orthodoxy has failed on both counts. Therefore, all hopes rest on Heterodoxy. The crucial question is, does Heterodoxy satisfy the indispensable methodological criteria? Let us have a look at Profit Theory.

The profit theories of Keynes, Kalecki, Minsky, Keen are different (Marx, Mises/Hayek, and others could be added). They cannot all be correct at the same time. As there is only one Law of the Lever, there can be only one objective Profit Law for the economy as a whole. This is not the case.

(i) Keynes: “His Collected Writings show that he wrestled to solve the Profit Puzzle up till the semi-final versions of his GT but in the end he gave up and discarded the draft chapter dealing with it.” (Tómasson et al., 2010, pp. 12-13, 16)

(ii) “Kalecki derived this relationship in an extremely concise, elegant and intuitive way. He starts by making simplifications which he later progressively eliminates. These assumptions are:

• Divide the whole economy into two groups: workers, who earn only wages and capitalists, who earn only profits.

• Workers do not save.

• The economy is closed (there is no international trade) and there is no public sector.

With these assumptions Kalecki derives the following accounting identity:

where P is the volume of gross profits (profits plus depreciation), W is the volume of total wages, Cp is capitalists consumption, Cw is workers consumption and I is the gross investment that has been made in the economy. Since we have supposed workers who do not save (that is, to say in the preceding equation), we can simplify the two terms and arrive at:

This is the famous profits equation, which says that profits are equal to the sum of investment and capitalist’s consumption.” (Wikipedia: Kalecki, 2015)

(iii) Minsky: “The simple equation 'profit equals investment' is the fundamental relation for a macroeconomics that aims to determine the behavior through time of a capitalist economy with a sophisticated, complex financial structure.” (2008, p. 161)

(iv) Keen: “Total income = Wages plus Profits” (2011, pp. 366, 146) and “... national income resolves itself into wages and profits” (2010, p. 12).

It is quite obvious that heterodox economists, like their orthodox counterparts, have NO idea of what profit is (2014). Hence, they fail to capture the essence of the market economy. Because of this, economists have nothing to offer in the way of scientifically founded advice.

“In order to tell the politicians and practitioners something about causes and best means, the economist needs the true theory or else he has not much more to offer than educated common sense or his personal opinion.” (Stigum, 1991, p. 30)

The true theory satisfies the criteria of material/formal consistency. All that Orthodoxy and Heterodoxy have currently to offer are contradicting opinions; neither came ever to grips with science, with profit, and with the working of the economy we happen to live in.

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2014). The Profit Theory is False Since Adam Smith. What About the True Distribution Theory? SSRN Working Paper Series, 2511741: 1–23. URL

Kalecki, M. (2015). The Profit Equation. Wikipedia. URL

Keen, S. (2010). Solving the Paradox of Monetary Profits. Economics E-Journal, 4(2010-31). URL

Keen, S. (2011). Debunking Economics. London, New York: Zed Books, rev. edition.

Klant, J. J. (1988). The Natural Order. In N. de Marchi (Ed.), The Popperian Legacy in Economics, 87–117. Cambridge: Cambridge University Press.

Minsky, H. P. (2008). Stabilizing an Unstable Economy. New York, Chicago, San Francisco: McGraw Hill, 2nd edition.

Stigum, B. P. (1991). Toward a Formal Science of Economics: The Axiomatic Method in Economics and Econometrics. Cambridge: MIT Press.

Tómasson, G., and Bezemer, D. J. (2010). What is the Source of Profit and Interest? A Classical Conundrum Reconsidered. MPRA Paper, 20557: 1–34. URL

Preceding Economics is an abysmal failure of reason.

Related 'PsySoc — the scourge of economics' and 'Economics: ‘a tale told by an idiot, full of sound and fury’?' For details of the big picture see cross-references Profit in particular 'Keynesianism as ultimate profit machine' and cross-references Heterodoxy.

You say: “The approach, I think, is simply to determine that economics is a defunct discipline like alchemy.”

The problem with incompetent folks and mainstream basher like Lars Syll and you is that traditional Heterodoxy has failed for 150+ years to develop a suitable alternative to the maximization-and-equilibrium phantasm: “... we may say that ... the omnipresence of a certain point of view is not a sign of excellence or an indication that the truth or part of the truth has at last been found. It is, rather, the indication of a failure of reason to find suitable alternatives which might be used to transcend an accidental intermediate stage of our knowledge.” (Feyerabend)

As Nell put it: “As will become evident, there is more agreement on the defects of orthodox theory than there is on what theory is to replace it: but all agreed that the point of the criticism is to clear the ground for construction.”

Neither Lars Syll nor you have ever constructed anything of scientific value.#1, #2, #3

#1 Say hello to Lars Syll, Keynes’ last parrot

#2 Don Lars and the axiomatic windmill

#3 The stupidity of Heterodoxy is the life insurance of Orthodoxy

Blog-Reference and Blog-Reference and Blog-Reference on Jan 4, 2018, adapted to context

Science is defined by material and formal consistency. If a theory/model fails on one criterion it is scientifically worthless. With regard to formal consistency, there is no way around “... he who contradicts himself proves nothing” (Klant, 1988, p. 113). But formal consistency alone also proves nothing.

The actual state of economics is this: Orthodoxy has failed on both counts. Therefore, all hopes rest on Heterodoxy. The crucial question is, does Heterodoxy satisfy the indispensable methodological criteria? Let us have a look at Profit Theory.

The profit theories of Keynes, Kalecki, Minsky, Keen are different (Marx, Mises/Hayek, and others could be added). They cannot all be correct at the same time. As there is only one Law of the Lever, there can be only one objective Profit Law for the economy as a whole. This is not the case.

(i) Keynes: “His Collected Writings show that he wrestled to solve the Profit Puzzle up till the semi-final versions of his GT but in the end he gave up and discarded the draft chapter dealing with it.” (Tómasson et al., 2010, pp. 12-13, 16)

(ii) “Kalecki derived this relationship in an extremely concise, elegant and intuitive way. He starts by making simplifications which he later progressively eliminates. These assumptions are:

• Divide the whole economy into two groups: workers, who earn only wages and capitalists, who earn only profits.

• Workers do not save.

• The economy is closed (there is no international trade) and there is no public sector.

With these assumptions Kalecki derives the following accounting identity:

where P is the volume of gross profits (profits plus depreciation), W is the volume of total wages, Cp is capitalists consumption, Cw is workers consumption and I is the gross investment that has been made in the economy. Since we have supposed workers who do not save (that is, to say in the preceding equation), we can simplify the two terms and arrive at:

This is the famous profits equation, which says that profits are equal to the sum of investment and capitalist’s consumption.” (Wikipedia: Kalecki, 2015)

(iii) Minsky: “The simple equation 'profit equals investment' is the fundamental relation for a macroeconomics that aims to determine the behavior through time of a capitalist economy with a sophisticated, complex financial structure.” (2008, p. 161)

(iv) Keen: “Total income = Wages plus Profits” (2011, pp. 366, 146) and “... national income resolves itself into wages and profits” (2010, p. 12).

It is quite obvious that heterodox economists, like their orthodox counterparts, have NO idea of what profit is (2014). Hence, they fail to capture the essence of the market economy. Because of this, economists have nothing to offer in the way of scientifically founded advice.

“In order to tell the politicians and practitioners something about causes and best means, the economist needs the true theory or else he has not much more to offer than educated common sense or his personal opinion.” (Stigum, 1991, p. 30)

The true theory satisfies the criteria of material/formal consistency. All that Orthodoxy and Heterodoxy have currently to offer are contradicting opinions; neither came ever to grips with science, with profit, and with the working of the economy we happen to live in.

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2014). The Profit Theory is False Since Adam Smith. What About the True Distribution Theory? SSRN Working Paper Series, 2511741: 1–23. URL

Kalecki, M. (2015). The Profit Equation. Wikipedia. URL

Keen, S. (2010). Solving the Paradox of Monetary Profits. Economics E-Journal, 4(2010-31). URL

Keen, S. (2011). Debunking Economics. London, New York: Zed Books, rev. edition.

Klant, J. J. (1988). The Natural Order. In N. de Marchi (Ed.), The Popperian Legacy in Economics, 87–117. Cambridge: Cambridge University Press.

Minsky, H. P. (2008). Stabilizing an Unstable Economy. New York, Chicago, San Francisco: McGraw Hill, 2nd edition.

Stigum, B. P. (1991). Toward a Formal Science of Economics: The Axiomatic Method in Economics and Econometrics. Cambridge: MIT Press.

Tómasson, G., and Bezemer, D. J. (2010). What is the Source of Profit and Interest? A Classical Conundrum Reconsidered. MPRA Paper, 20557: 1–34. URL

Preceding Economics is an abysmal failure of reason.

Related 'PsySoc — the scourge of economics' and 'Economics: ‘a tale told by an idiot, full of sound and fury’?' For details of the big picture see cross-references Profit in particular 'Keynesianism as ultimate profit machine' and cross-references Heterodoxy.

***

REPLY to Neil Wilson on Jan 5, 2018You say: “The approach, I think, is simply to determine that economics is a defunct discipline like alchemy.”

The problem with incompetent folks and mainstream basher like Lars Syll and you is that traditional Heterodoxy has failed for 150+ years to develop a suitable alternative to the maximization-and-equilibrium phantasm: “... we may say that ... the omnipresence of a certain point of view is not a sign of excellence or an indication that the truth or part of the truth has at last been found. It is, rather, the indication of a failure of reason to find suitable alternatives which might be used to transcend an accidental intermediate stage of our knowledge.” (Feyerabend)

As Nell put it: “As will become evident, there is more agreement on the defects of orthodox theory than there is on what theory is to replace it: but all agreed that the point of the criticism is to clear the ground for construction.”

Neither Lars Syll nor you have ever constructed anything of scientific value.#1, #2, #3

#1 Say hello to Lars Syll, Keynes’ last parrot

#2 Don Lars and the axiomatic windmill

#3 The stupidity of Heterodoxy is the life insurance of Orthodoxy

eMoney

Comment and correction on ‘As Predicted BOE Head Economist and Time 100 Most Influential Suggests E-Dollar Concept’

Blog-Reference

The concept of E-Money/eMoney has been developed in 1986. See the article ‘Geld ist Information: volkswirtschaftliche Aspeke der Bankautomation’, that is, ‘Money is Information: economic aspects of bank automation’. Reference here.

Note:

(i) The persons mentioned in the title are 29 years late.

(ii) I am the copyright holder for the concept of E-Money.

(iii) Check the reference and correct the post.

Egmont Kakarot-Handtke

Comment and more information

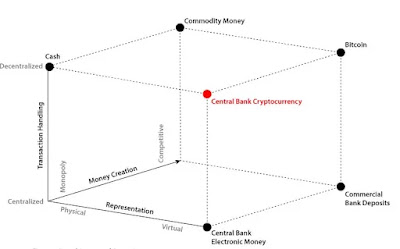

I agree with you that the concept of E-Money has developed rapidly in the last years and that it has acquired lately a very specific meaning as ‘exchange rate between paper currency and currency held in the bank’.

My article was about the general case of a full replacement of bank money, notes, and coins by E-Money, with E-Money managed by a central bank. As a consequence, the question of an exchange rate between the monies did not arise, to begin with. The case of private issuance of E-Money was not considered at all, here Bitcoin deserves the credits. In brief, my original concept was that E-Money is the logical next step in the evolution of money from tokens like shells, over Babylonian tablets, gold and silver coins, IOUs, over banknotes, to deposits/overdrafts. Thus, economically, E-Money is the pure and ultimate form of money while all other forms are more or less awkward historical forerunners.

Now, the concrete form of money is one thing, its role as a means of payment and store of value in a monetary economy is quite another thing. So E-Money is de facto only a small part of a comprehensive theory of money, which in turn is a small part of the true economic theory which is supposed to explain how the economy we happen to live in works. For all practical purposes, in contrast, the concrete institutional implementation of E-Money is of primary importance.

The general economic theory has been worked out in a series of papers that are available at the open-access repository SSRN. What is of heightened interest in economics are, of course, the structural defects of the market system as a whole and of the monetary order in particular. If you are interested in more details about this wonkish stuff see for a start Major Defects of the Market Economy.

As far as the current special topic of E-Money as a piece of a large jigsaw puzzle is concerned your post is accurate.

Related 'Reconstructing the Quantity Theory (I)'

Blog-Reference

The concept of E-Money/eMoney has been developed in 1986. See the article ‘Geld ist Information: volkswirtschaftliche Aspeke der Bankautomation’, that is, ‘Money is Information: economic aspects of bank automation’. Reference here.

Note:

(i) The persons mentioned in the title are 29 years late.

(ii) I am the copyright holder for the concept of E-Money.

(iii) Check the reference and correct the post.

Egmont Kakarot-Handtke

***

Comment and more information

I agree with you that the concept of E-Money has developed rapidly in the last years and that it has acquired lately a very specific meaning as ‘exchange rate between paper currency and currency held in the bank’.

My article was about the general case of a full replacement of bank money, notes, and coins by E-Money, with E-Money managed by a central bank. As a consequence, the question of an exchange rate between the monies did not arise, to begin with. The case of private issuance of E-Money was not considered at all, here Bitcoin deserves the credits. In brief, my original concept was that E-Money is the logical next step in the evolution of money from tokens like shells, over Babylonian tablets, gold and silver coins, IOUs, over banknotes, to deposits/overdrafts. Thus, economically, E-Money is the pure and ultimate form of money while all other forms are more or less awkward historical forerunners.

Now, the concrete form of money is one thing, its role as a means of payment and store of value in a monetary economy is quite another thing. So E-Money is de facto only a small part of a comprehensive theory of money, which in turn is a small part of the true economic theory which is supposed to explain how the economy we happen to live in works. For all practical purposes, in contrast, the concrete institutional implementation of E-Money is of primary importance.

The general economic theory has been worked out in a series of papers that are available at the open-access repository SSRN. What is of heightened interest in economics are, of course, the structural defects of the market system as a whole and of the monetary order in particular. If you are interested in more details about this wonkish stuff see for a start Major Defects of the Market Economy.

As far as the current special topic of E-Money as a piece of a large jigsaw puzzle is concerned your post is accurate.

Related 'Reconstructing the Quantity Theory (I)'

***

Twitter/X Aug 22, 2023

Twitter/X Oct 25, 2023

September 22, 2015

The Coppola method: Adam Smith reincarnated?

Comment on Frances Coppola on ‘What is lending good for? The Frances Coppola view.’

Blog-Reference

“... Adam Smith ... disliked whatever went beyond plain common sense. He never moved above the heads of even the dullest readers. He led them on gently, encouraging them by trivialities and homely observations, making them feel comfortable all along.” (Schumpeter, 1994, p. 185)

Frances Coppola correctly identifies the problem: “[She] warns for a simplified view of the primary and secondary market: there are many and complicated micro-economic linkages which should not be ignored.” (See intro)

This, of course, is true but economic analysis does not consist of ‘trivialities and homely observations’ and a heap of examples. What is needed is a consistent big picture of all interconnections. Examples that are not embedded into a comprehensive analytical framework are worthless. This is what Whitehead called the fallacy of misplaced realism.

What is missing in Coppola’s micro-partial-approach is the interconnection of total saving/dissaving, changes in the stock of money/credit/debt, and total profit/loss for the economy as a whole. For the correct approach see (2011; 2013; 2014).

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2011). Primary and Secondary Markets. SSRN Working Paper Series, 1917012: 1–26. URL

Kakarot-Handtke, E. (2013). Settling the Theory of Saving. SSRN Working Paper Series, 2220651: 1–23. URL

Kakarot-Handtke, E. (2014). Loanable Funds vs. Endogenous Money: Krugman is Wrong, Keen is Right. SSRN Working Paper Series, 2389341: 1–17. URL

Schumpeter, J. A. (1994). History of Economic Analysis. New York: Oxford University Press

Blog-Reference

“... Adam Smith ... disliked whatever went beyond plain common sense. He never moved above the heads of even the dullest readers. He led them on gently, encouraging them by trivialities and homely observations, making them feel comfortable all along.” (Schumpeter, 1994, p. 185)

Frances Coppola correctly identifies the problem: “[She] warns for a simplified view of the primary and secondary market: there are many and complicated micro-economic linkages which should not be ignored.” (See intro)

This, of course, is true but economic analysis does not consist of ‘trivialities and homely observations’ and a heap of examples. What is needed is a consistent big picture of all interconnections. Examples that are not embedded into a comprehensive analytical framework are worthless. This is what Whitehead called the fallacy of misplaced realism.

What is missing in Coppola’s micro-partial-approach is the interconnection of total saving/dissaving, changes in the stock of money/credit/debt, and total profit/loss for the economy as a whole. For the correct approach see (2011; 2013; 2014).

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2011). Primary and Secondary Markets. SSRN Working Paper Series, 1917012: 1–26. URL

Kakarot-Handtke, E. (2013). Settling the Theory of Saving. SSRN Working Paper Series, 2220651: 1–23. URL

Kakarot-Handtke, E. (2014). Loanable Funds vs. Endogenous Money: Krugman is Wrong, Keen is Right. SSRN Working Paper Series, 2389341: 1–17. URL

Schumpeter, J. A. (1994). History of Economic Analysis. New York: Oxford University Press

PsySoc — the scourge of economics

Comment on David Ruccio on ‘The fundamental truth about American economic growth’

Blog-Reference

You quote a recent Science article: “... that we’re seeing right now, with the insurgent campaigns of Donald Trump and Bernie Sanders and elite hopes that they will just fade away, are ‘early skirmishes in a coming class war’.” (See intro)

It is not so much the prediction of a coming class war in the U.S. that is false but the explanation within the framework of economics.

The crucial point is that economics deals — in the first place — not with individual human behavior or society at large. This is the realm of Psychology, Sociology, Anthropology, History, Political Science, Philosophy, etcetera. Insofar as economics deals with behavioral assumptions like utility maximization, greed, power-grabbing, etcetera, it is a dilettantish variant of Psycho-Sociology or PsySoc.

The authors of the Science article argue that it is wrong to explain the problems of the U.S. economy by ‘pathologizing the poor’ and that it is necessary to turn ‘attention to the pathologies of the rich.’ (See intro)

It should be pretty obvious that economic problems cannot be explained or solved by Psychology. It is known since the ancient Greeks that psychologism is the way stupid people explain the world, i.e. flashes of lightning fly from the sky because Zeus is angry. The pathology explanation is on the same scientific level as the Zeus explanation, that is, it is exactly at intellectual ground zero.

There is some irony in the fact that the most famous predictor of imminent class war had been very explicit about the vacuousness of psychologism: “To prevent possible misunderstanding, a word. I paint the capitalist and the landlord in no sense couleur de rose. But here individuals are dealt with only in so far as they are the personifications of economic categories, embodiments of particular class-relations and class-interests. My stand-point, from which the evolution of the economic formation of society is viewed as a process of natural history, can less than any other make the individual responsible for relations whose creature he socially remains, however much he may subjectively raise himself above them.” (Marx, 1906, M.9)

On closer inspection, however, Marx only replaced subjective psychologism with objective sociologism. Instead of pathological individuals we now have ‘embodiments of economic categories.’ This is somewhat better but still not good enough. What, then, is the real subject matter of economics?

As a first approximation, one can agree on the general characteristic that the economy is a complex system.

However, with the term system, one usually associates a structure with components that are non-human. In order to stress the obvious fact that humans are an essential component of the economic system, the market economy should be characterized more precisely as a complex hybrid human/system entity or SysHum.

The scientific method is straightforwardly applicable to the sys-component but not to the hum-component. While it is clear that the economy always has to be treated as an indivisible whole, for good methodological reasons the analysis has to start with the objectively given system components. The economic system has its own logic which is different from the behavioral logic of humans. Systemic logic is what Adam Smith called the Invisible Hand.

The history of the U.S. economy since around the 1920s could be retold quite realistically as tumbling from crisis to crisis with idiots, criminals, sociopaths, swindlers, fakers, etc. grabbing for power and money.

To do so, however, is not the proper task of Theoretical Economics. Economics has to explain how the actual economic system works and this implies explaining economic crises or an eventual breakdown by structural defects and not by psychological or social pathologies (2015; 2014). In other words, the pain comes from the broken leg and not from evil spirits. The economy breaks down because of the overall loss, and society breaks down for other reasons. These things have to be kept properly apart.

This said, is not to deny that Donald Trump could be the harbinger of the economic and intellectual breakdown of the U.S. To be quite clear, this is a serious problem of Political Science but by no stretch of the imagination of Theoretical Economics, which is science in marked contrast to Political Economics, which is — and that is the fundamental truth — folk-psychological garbage and brainless gossip.

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2014). Mathematical Proof of the Breakdown of Capitalism. SSRN Working Paper Series, 2375578: 1–21. URL

Kakarot-Handtke, E. (2015). Major Defects of the Market Economy. SSRN Working Paper Series, 2624350: 1–40. URL

Marx, K. (1906). Capital: A Critique of Political Economy, Vol. I. The Process of Capitalist Production. Library of Economics and Liberty. URL

Related 'Economics: ‘a tale told by an idiot, full of sound and fury’?' and 'Confounding sociology and economics' and 'The happy end of the social science delusion' and 'Economics: the honeypot for know-nothingers' and 'Love and hate in economics: the PsySoc shell game' and 'Hijackers, agenda pushers, PsySocs and other morons' and 'How to get out of the Econ 101 PsySoc woods' and 'Economics is NOT a social science' and 'Psychologism: how morons explain the world'. For details of the big picture see cross-references Not a Science of Behavior.

Blog-Reference

You quote a recent Science article: “... that we’re seeing right now, with the insurgent campaigns of Donald Trump and Bernie Sanders and elite hopes that they will just fade away, are ‘early skirmishes in a coming class war’.” (See intro)

It is not so much the prediction of a coming class war in the U.S. that is false but the explanation within the framework of economics.

The crucial point is that economics deals — in the first place — not with individual human behavior or society at large. This is the realm of Psychology, Sociology, Anthropology, History, Political Science, Philosophy, etcetera. Insofar as economics deals with behavioral assumptions like utility maximization, greed, power-grabbing, etcetera, it is a dilettantish variant of Psycho-Sociology or PsySoc.

The authors of the Science article argue that it is wrong to explain the problems of the U.S. economy by ‘pathologizing the poor’ and that it is necessary to turn ‘attention to the pathologies of the rich.’ (See intro)

It should be pretty obvious that economic problems cannot be explained or solved by Psychology. It is known since the ancient Greeks that psychologism is the way stupid people explain the world, i.e. flashes of lightning fly from the sky because Zeus is angry. The pathology explanation is on the same scientific level as the Zeus explanation, that is, it is exactly at intellectual ground zero.

There is some irony in the fact that the most famous predictor of imminent class war had been very explicit about the vacuousness of psychologism: “To prevent possible misunderstanding, a word. I paint the capitalist and the landlord in no sense couleur de rose. But here individuals are dealt with only in so far as they are the personifications of economic categories, embodiments of particular class-relations and class-interests. My stand-point, from which the evolution of the economic formation of society is viewed as a process of natural history, can less than any other make the individual responsible for relations whose creature he socially remains, however much he may subjectively raise himself above them.” (Marx, 1906, M.9)

On closer inspection, however, Marx only replaced subjective psychologism with objective sociologism. Instead of pathological individuals we now have ‘embodiments of economic categories.’ This is somewhat better but still not good enough. What, then, is the real subject matter of economics?

As a first approximation, one can agree on the general characteristic that the economy is a complex system.

However, with the term system, one usually associates a structure with components that are non-human. In order to stress the obvious fact that humans are an essential component of the economic system, the market economy should be characterized more precisely as a complex hybrid human/system entity or SysHum.

The scientific method is straightforwardly applicable to the sys-component but not to the hum-component. While it is clear that the economy always has to be treated as an indivisible whole, for good methodological reasons the analysis has to start with the objectively given system components. The economic system has its own logic which is different from the behavioral logic of humans. Systemic logic is what Adam Smith called the Invisible Hand.

The history of the U.S. economy since around the 1920s could be retold quite realistically as tumbling from crisis to crisis with idiots, criminals, sociopaths, swindlers, fakers, etc. grabbing for power and money.

To do so, however, is not the proper task of Theoretical Economics. Economics has to explain how the actual economic system works and this implies explaining economic crises or an eventual breakdown by structural defects and not by psychological or social pathologies (2015; 2014). In other words, the pain comes from the broken leg and not from evil spirits. The economy breaks down because of the overall loss, and society breaks down for other reasons. These things have to be kept properly apart.

This said, is not to deny that Donald Trump could be the harbinger of the economic and intellectual breakdown of the U.S. To be quite clear, this is a serious problem of Political Science but by no stretch of the imagination of Theoretical Economics, which is science in marked contrast to Political Economics, which is — and that is the fundamental truth — folk-psychological garbage and brainless gossip.

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2014). Mathematical Proof of the Breakdown of Capitalism. SSRN Working Paper Series, 2375578: 1–21. URL

Kakarot-Handtke, E. (2015). Major Defects of the Market Economy. SSRN Working Paper Series, 2624350: 1–40. URL

Marx, K. (1906). Capital: A Critique of Political Economy, Vol. I. The Process of Capitalist Production. Library of Economics and Liberty. URL

Related 'Economics: ‘a tale told by an idiot, full of sound and fury’?' and 'Confounding sociology and economics' and 'The happy end of the social science delusion' and 'Economics: the honeypot for know-nothingers' and 'Love and hate in economics: the PsySoc shell game' and 'Hijackers, agenda pushers, PsySocs and other morons' and 'How to get out of the Econ 101 PsySoc woods' and 'Economics is NOT a social science' and 'Psychologism: how morons explain the world'. For details of the big picture see cross-references Not a Science of Behavior.

September 21, 2015

Economics is an abysmal failure of reason

Comment on Peter Boettke/Lars Syll on ‘What went wrong with economics?’

Blog-Reference

There can be only one answer to this question: economists are scientifically incompetent. Since more than two centuries Orthodoxy is unacceptable because of material and formal inconsistency,#1 and Heterodoxy failed to produce a superior alternative: “... we may say that ... the omnipresence of a certain point of view is not a sign of excellence or an indication that the truth or part of the truth has at last been found. It is, rather, the indication of a failure of reason to find suitable alternatives which might be used to transcend an accidental intermediate stage of our knowledge.” (Feyerabend, 2004, p. 72)

Of course, ‘economies operate according to universal laws’ but they do not operate according to behavioral laws because something like a behavioral law does not exist, to begin with. Standard economics has been built upon the green cheese behavioral assumption of constrained optimization and from there onwards, all went wrong.

Economists never understood what science is all about and this is why they never secured correct premises. “To Plato’s question, ‘Granted that there are means of reasoning from premises to conclusions, who has the privilege of choosing the premises?’ the correct answer, I presume, is that anyone has this privilege who wishes to exercise it, but that everyone else has the privilege of deciding for himself what significance to attach to the conclusions, and that somewhere there lies the responsibility, through the choice of the appropriate premises, to see to it that judgment, information, and perhaps even faith, hope and charity, wield their due influence on the nature of economic thought.” (Viner, 1963, p.12)

The whole of economics is built upon inappropriate premises. What is needed is a paradigm shift, that is, a move from subjective behavioral premises to objective structural premises (2014).#2

Because of scientific incompetence, the present generation of economists has not gotten the point and will not get it. There is no hope, all that can be done is a dishonorable discharge of these people from science.

Egmont Kakarot-Handtke

References

Feyerabend, P. K. (2004). Problems of Empiricism. Cambridge: Cambridge University Press.

Kakarot-Handtke, E. (2014). Objective Principles of Economics. SSRN Working Paper Series, 2418851: 1–19. URL

Viner, J. (1963). The Economist in History. American Economic Review, 53(2): 1–22. URL

#1 Watch on Youtube Feynman on material consistency

#2 See cross-references Paradigm Shift

Blog-Reference

There can be only one answer to this question: economists are scientifically incompetent. Since more than two centuries Orthodoxy is unacceptable because of material and formal inconsistency,#1 and Heterodoxy failed to produce a superior alternative: “... we may say that ... the omnipresence of a certain point of view is not a sign of excellence or an indication that the truth or part of the truth has at last been found. It is, rather, the indication of a failure of reason to find suitable alternatives which might be used to transcend an accidental intermediate stage of our knowledge.” (Feyerabend, 2004, p. 72)

Of course, ‘economies operate according to universal laws’ but they do not operate according to behavioral laws because something like a behavioral law does not exist, to begin with. Standard economics has been built upon the green cheese behavioral assumption of constrained optimization and from there onwards, all went wrong.

Economists never understood what science is all about and this is why they never secured correct premises. “To Plato’s question, ‘Granted that there are means of reasoning from premises to conclusions, who has the privilege of choosing the premises?’ the correct answer, I presume, is that anyone has this privilege who wishes to exercise it, but that everyone else has the privilege of deciding for himself what significance to attach to the conclusions, and that somewhere there lies the responsibility, through the choice of the appropriate premises, to see to it that judgment, information, and perhaps even faith, hope and charity, wield their due influence on the nature of economic thought.” (Viner, 1963, p.12)

The whole of economics is built upon inappropriate premises. What is needed is a paradigm shift, that is, a move from subjective behavioral premises to objective structural premises (2014).#2

Because of scientific incompetence, the present generation of economists has not gotten the point and will not get it. There is no hope, all that can be done is a dishonorable discharge of these people from science.

Egmont Kakarot-Handtke

References

Feyerabend, P. K. (2004). Problems of Empiricism. Cambridge: Cambridge University Press.

Kakarot-Handtke, E. (2014). Objective Principles of Economics. SSRN Working Paper Series, 2418851: 1–19. URL

Viner, J. (1963). The Economist in History. American Economic Review, 53(2): 1–22. URL

#1 Watch on Youtube Feynman on material consistency

#2 See cross-references Paradigm Shift

September 19, 2015

Economists vs Economics

Comment on Dani Rodrik on ‘Economists vs. Economics’

Blog-Reference

The diversity of contradicting economic models is the very proof that economics is a failed science. Everybody knows by now that clueless model bricolage is simply a ridiculous exercise or what Feynman aptly called cargo cult science: “They're doing everything right. The form is perfect. ... But it doesn't work.” (Wikipedia)

Economists never grasped what science is all about. What the insiders of the profession think of their dilettantish constructs is just as irrelevant as what the busy producers of epicycles thought of their geocentric paradigm.

Science is defined by material and formal consistency. Economics fails on both counts. There is no way around Joan Robinson’s conclusion: Scrap the lot and start again.

Egmont Kakarot-Handtke

Blog-Reference

The diversity of contradicting economic models is the very proof that economics is a failed science. Everybody knows by now that clueless model bricolage is simply a ridiculous exercise or what Feynman aptly called cargo cult science: “They're doing everything right. The form is perfect. ... But it doesn't work.” (Wikipedia)

Economists never grasped what science is all about. What the insiders of the profession think of their dilettantish constructs is just as irrelevant as what the busy producers of epicycles thought of their geocentric paradigm.

Science is defined by material and formal consistency. Economics fails on both counts. There is no way around Joan Robinson’s conclusion: Scrap the lot and start again.

Egmont Kakarot-Handtke

Economics: ‘a tale told by an idiot, full of sound and fury’?

Comment on Dean Baker on ‘Biggest lesson from Financial Crisis: Wall Street gets what it wants’

Blog-Reference

You summarize: “The story of the decade of double-digit unemployment from which we were supposedly spared by the bailout depends on Congress sitting on its hands and doing nothing through the worst slump in 70 years. This is a political prediction, not an issue of economics.” (See intro)

Indeed, this is the crucial point: the first thing an economist must do is realize whether he deals with politics or economics.

The history of the U.S. economy since around the 1920s could be retold quite realistically as tumbling from crisis to crisis with idiots, criminals, sociopaths, swindlers, fakers, etc. grabbing for power and money, with Wall St, Fed, and the national institutions as main protagonists.

The first question is, should this history be told by an economist or better by a political scientist? The answer depends on our understanding of economics. There has always been political economics and theoretical economics.

Theoretical economics deals with THE ECONOMY in roughly the same way as physicists deal with NATURE. Strictly speaking, THE ECONOMY is the world economy as a whole and this is a rather abstract entity. Abstractions do not have such a large fan group.

Accordingly, the first difficulty of economics is that most people have a rather small event horizon. If they are at all interested in economic matters, myopic individuals want to learn from the economist not much more than whether the stock/property market goes up or down. Clearly, theoretical economics cannot meet these people’s expectations.

The second difficulty of economics is that many economists feel the urge to satisfy the expectations of a vastly more important target group than the buy-low-sell-high crowd. The classicals advertised their core competence unmistakably: “That Political Economy is a science which teaches, or professes to teach, in what manner a nation may be made rich. This notion of what constitutes the science, is in some degree countenanced by the title and arrangement which Adam Smith gave to his invaluable work." (Mill, 1874, V.7)

Note that the classicals definition of science departs somewhat from the genuine sciences. Note also that the focus is on ‘my’ concrete nation and not ‘the’ abstract world economy.

The third difficulty of economics is that the format of communication is predetermined by the operational specifics of the entertainment industry, that is, all communication must take the form of an interesting story or a sitcom controversy full of sound and fury. The all-decisive criterion in the realm of entertainment (including economics blogs) is like/dislike and not true/false as it is in science. Because of this, there is an irresistible bias to explain the functioning of the economy as machinations of weird/evil characters. With some inner logic economics then resembles more a psychiatric/criminal investigation than scientific research.

These three difficulties are sufficient to explain why economics never managed to rise above the level of proto-science. As Schumpeter put it “... economics is a big omnibus which contains many passengers of incommensurable interests and abilities.” (1994, p. 827) It seems that the passengers, while busily telling their Walrasian, Keynesian, Marxian, Austrian, etc. tales, are actually stranded in the middle of nowhere.

What is the biggest lesson for Heterodoxy from the permanent failure of Orthodoxy? Quite simple: either Heterodoxy participates furthermore in political economics with storytelling or it produces the true theory of how THE ECONOMY works.

Note well that already Marx realized that economics is not about human behavior: “To prevent possible misunderstanding, a word. I paint the capitalist and the landlord in no sense couleur de rose. But here individuals are dealt with only in so far as they are the personifications of economic categories, embodiments of particular class-relations and class-interests. My stand-point, from which the evolution of the economic formation of society is viewed as a process of natural history, can less than any other make the individual responsible for relations whose creature he socially remains, however much he may subjectively raise himself above them.” (Marx, 1906, M.9)

The biggest lesson from the actual economic mess: economics is not about space-time-specific individual human defects but about the structural defects of the economic SYSTEM (2015).

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2015). Major Defects of the Market Economy. SSRN Working Paper Series, 2624350: 1–40. URL

Marx, K. (1906). Capital: A Critique of Political Economy, Vol. I. The Process of Capitalist Production. Library of Economics and Liberty. URL

Mill, J. S. (1874). Essays on Some Unsettled Questions of Political Economy. On the Definition of Political Economy; and on the Method of Investigation Proper To It. Library of Economics and Liberty. URL

Schumpeter, J. A. (1994). History of Economic Analysis. New York: Oxford University Press.

Blog-Reference

You summarize: “The story of the decade of double-digit unemployment from which we were supposedly spared by the bailout depends on Congress sitting on its hands and doing nothing through the worst slump in 70 years. This is a political prediction, not an issue of economics.” (See intro)

Indeed, this is the crucial point: the first thing an economist must do is realize whether he deals with politics or economics.

The history of the U.S. economy since around the 1920s could be retold quite realistically as tumbling from crisis to crisis with idiots, criminals, sociopaths, swindlers, fakers, etc. grabbing for power and money, with Wall St, Fed, and the national institutions as main protagonists.

The first question is, should this history be told by an economist or better by a political scientist? The answer depends on our understanding of economics. There has always been political economics and theoretical economics.

Theoretical economics deals with THE ECONOMY in roughly the same way as physicists deal with NATURE. Strictly speaking, THE ECONOMY is the world economy as a whole and this is a rather abstract entity. Abstractions do not have such a large fan group.

Accordingly, the first difficulty of economics is that most people have a rather small event horizon. If they are at all interested in economic matters, myopic individuals want to learn from the economist not much more than whether the stock/property market goes up or down. Clearly, theoretical economics cannot meet these people’s expectations.

The second difficulty of economics is that many economists feel the urge to satisfy the expectations of a vastly more important target group than the buy-low-sell-high crowd. The classicals advertised their core competence unmistakably: “That Political Economy is a science which teaches, or professes to teach, in what manner a nation may be made rich. This notion of what constitutes the science, is in some degree countenanced by the title and arrangement which Adam Smith gave to his invaluable work." (Mill, 1874, V.7)

Note that the classicals definition of science departs somewhat from the genuine sciences. Note also that the focus is on ‘my’ concrete nation and not ‘the’ abstract world economy.

The third difficulty of economics is that the format of communication is predetermined by the operational specifics of the entertainment industry, that is, all communication must take the form of an interesting story or a sitcom controversy full of sound and fury. The all-decisive criterion in the realm of entertainment (including economics blogs) is like/dislike and not true/false as it is in science. Because of this, there is an irresistible bias to explain the functioning of the economy as machinations of weird/evil characters. With some inner logic economics then resembles more a psychiatric/criminal investigation than scientific research.

These three difficulties are sufficient to explain why economics never managed to rise above the level of proto-science. As Schumpeter put it “... economics is a big omnibus which contains many passengers of incommensurable interests and abilities.” (1994, p. 827) It seems that the passengers, while busily telling their Walrasian, Keynesian, Marxian, Austrian, etc. tales, are actually stranded in the middle of nowhere.

What is the biggest lesson for Heterodoxy from the permanent failure of Orthodoxy? Quite simple: either Heterodoxy participates furthermore in political economics with storytelling or it produces the true theory of how THE ECONOMY works.

Note well that already Marx realized that economics is not about human behavior: “To prevent possible misunderstanding, a word. I paint the capitalist and the landlord in no sense couleur de rose. But here individuals are dealt with only in so far as they are the personifications of economic categories, embodiments of particular class-relations and class-interests. My stand-point, from which the evolution of the economic formation of society is viewed as a process of natural history, can less than any other make the individual responsible for relations whose creature he socially remains, however much he may subjectively raise himself above them.” (Marx, 1906, M.9)

The biggest lesson from the actual economic mess: economics is not about space-time-specific individual human defects but about the structural defects of the economic SYSTEM (2015).

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2015). Major Defects of the Market Economy. SSRN Working Paper Series, 2624350: 1–40. URL

Marx, K. (1906). Capital: A Critique of Political Economy, Vol. I. The Process of Capitalist Production. Library of Economics and Liberty. URL

Mill, J. S. (1874). Essays on Some Unsettled Questions of Political Economy. On the Definition of Political Economy; and on the Method of Investigation Proper To It. Library of Economics and Liberty. URL

Schumpeter, J. A. (1994). History of Economic Analysis. New York: Oxford University Press.

September 18, 2015

Predictably confused

Comment on Lars Syll on ‘Sir David Hendry on the inadequacies of DSGE models’

Blog-Reference

“The future is unpredictable.” (Feynman, 1992, p. 147) Four words! Compare this to what economists have uttered about this issue without getting one iota further. But wait, are physicists not famous for their accurate predictions? Could it be that economists have gotten something badly wrong?

Let us have a closer look. If you show a physicist an apple tree and ask him when every single apple will fall, then he will tell you that this kind of event is not predictable. But he can tell you something else. If an apple has started to fall then he can tell you exactly its location and velocity after t seconds. The physicist ‘predicts’ the coordinates with high precision and everyone can test them. (OK, you did not want to know this to begin with, and exactly these layman's expectations regularly cause irritations with science.)

Likewise: imagine somebody throws blindly three coins into a large sandbox. Clearly, the three coins form a random triangle and no one can predict its form and size. Yet, the mathematician can ‘predict’ with certainty that the sum of angles is 180 degrees (if the sandbox is Euclidean).

While the future is ‘unpredictable’ certain aspects may be ‘predictable’ with high precision. Therefore, we can agree with Keynes that “the price of copper and the rate of interest twenty years hence” is unpredictable without accepting his famous all-round capitulation “We simply do not know.” (Keynes, 1937, p. 214)

Example: an elementary consumption economy can be described by this deductively derived formula (AXEC06). This formula holds in every single period from the past to the future (2014, eq. (12)). In other words, we have a testable economic law. Test it twenty years hence and you will find out that it is true. Where, then, does the difficulty with prediction come in? The crucial point is that the variables that underly the four rhos are unpredictable random variables.

Perhaps it sounds a bit paradoxical: there are deterministic economic laws that hold ‘on the whole’ while the components vary at random or are even uncertain in Keynes's sense. So the concept of uncertainty can coexist with the concept of economic law. Hence, Keynesian uncertainty should not stop us from looking out for deterministic and testable economic laws. Attention, they are with absolute certainty not to be found where misguided Orthodoxy has looked for in the past!

The otherwise redundant DSGE debate shows that the representative economist is still a bit confused about the different aspects of prediction.

Egmont Kakarot-Handtke

References

Feynman, R. P. (1992). The Character of Physical Law. London: Penguin.

Kakarot-Handtke, E. (2014). The Synthesis of Economic Law, Evolution, and History. SSRN Working Paper Series, 2500696: 1–22. URL

Keynes, J. M. (1937). The General Theory of Employment. Quarterly Journal of Economics, 51(2): 209–223. URL

Blog-Reference

“The future is unpredictable.” (Feynman, 1992, p. 147) Four words! Compare this to what economists have uttered about this issue without getting one iota further. But wait, are physicists not famous for their accurate predictions? Could it be that economists have gotten something badly wrong?