Blog-Reference

Stephanie Kelton explains how the economy works. For laypersons, the point to grasp is that government spending comes before taxation:

“1. Congress approves the spending, and the money gets spent (S)

2. The government collects some of that money in the form of taxes (T)

3. If 1>2, Treasury allows the difference to be swapped for government bonds (B).”

The point is, of course, that it does NOT matter much whether (S) comes before (T) or vice versa, this is merely a question of cash management, the point is whether total spending (S) is greater, equal, or less than total taxes (T) in the period under consideration, i.e. whether one has a government deficit, a zero balance, or a surplus at the end of the current budget period.

The crucial point is NOT that the government can make money appear out of nowhere like magic, which has always been trivial; the crucial point is what happens in the economy. Stephanie Kelton does not tell us, most probably because she has no idea.

What the layperson cannot see is that MMT has NO sound scientific foundations. The MMT models are based on Keynesian macroeconomics, which was refuted long ago. #1 Because it is defective, the MMT macro has to be fully replaced.

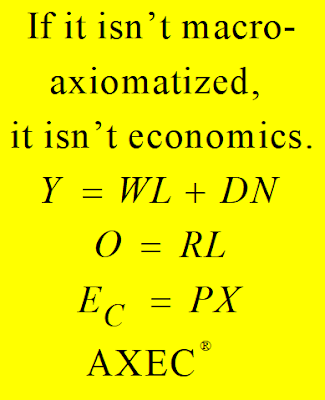

As the correct analytical starting point, the pure production-consumption economy is defined with this set of macro axioms: (A0) The objectively given and most elementary configuration of the economy consists of the household and the business sector, which in turn consists initially of one giant fully integrated firm. (A1) Yw=WL wage income Yw is equal to wage rate W times working hours. L, (A2) O=RL output O is equal to productivity R times working hours L, (A3) C=PX consumption expenditure C is equal to price P times quantity bought/sold X.

Under the conditions of market-clearing X=O and budget-balancing C=Yw, the price is given by P=C/X=W/R, i.e., the market-clearing price is in the initial period equal to unit wage costs. This is the most elementary form of the macroeconomic Law of Supply and Demand. For the graphical representation, see Figure 1. #2

Monetary profit for the economy as a whole is defined as Qm≡C−Yw, and monetary saving as Sm≡Yw−C. It always holds Qm+Sm=0 or Qm≡−Sm, in other words, the business sector’s surplus = profit (deficit = loss) equals the household sector’s deficit = dissaving (surplus = saving). This is the most elementary form of the macroeconomic Profit Law. Under the condition of budget balancing, total monetary profit is zero.

Now, the government decides that in the next period, every American should get a pony. So, government expenditures in period 1 are Cg1, and taxes T are zero. The government runs a deficit, the money comes from the Central Bank, i.e., is created out of nothing.

It is assumed for simplicity that the business sector doubles initial employment L0, i.e. L1=2L0. The wage rate W remains unchanged, and therefore total wage income doubles, i.e. Yw1=W2L0. Under the condition of budget balancing, the household sector’s consumption expenditures, too, double Ch1=Yw1=2WL0.

So, total expenditures are Ch1+Cg1=2Ch0+Cg1, that is, are more than double the expenditures in the initial period. On the other hand, output exactly doubles O1=RL1=R2L0. The market-clearing price is now P1=C1/X1=(2Ch0+Cg1)/2X0=P0+Cg1/2X0, that is, the market-clearing price rises while employment and output double. This is a one-shot increase and has NOTHING to do with inflation. The price increase affects the redistribution of real output between the household and the government sector.

The profit of the business sector was zero in the initial period and is now positive, i.e. Qm=Cg1, i.e., equal to the budget deficit. It always holds Public Deficit = Private Profit. This configuration can go on for an indefinite time with public debt vis-a-vis the central bank rising continuously and with the business sector’s pile of cash rising continuously and with the number of ponies rising continuousl,y and with price stability. Quite obviously, nobody has any reason to complain. In Stephanie Kelton’s words: “Just imagine how high those poll numbers would climb if everyone understood how easy it would be for Congress to pony up.”

It is remarkable that the word profit does not appear once in Stephanie Kelton’s op-ed, but the word pony eight times. Never were more ponies used to propagate a profit booster program for the one-percenters.#3

Egmont Kakarot-Handtke

#1 How Keynes got macro wrong and Allais got it right

#2 Wikimedia AXEC31 Elementary production-consumption economy

#3 For the full-spectrum refutation of MMT, see cross-references MMT

Related 'MMT: The one deadly error/fraud of Warren Mosler' and 'Selling public debt with Ricardo’s tear gland rhetoric' and 'Down with idiocy!' and 'Political economics: Who hijacks British Labour?' and 'MMT: Just another political fraud'.

***

REPLY to Matt Franko on Sep 30You say: “The govt bond accounting is Cash Basis (see US Daily Treasury Statement) while I don’t think the other terms in your equations are accounted for in Cash Basis ... they are accounted using a Modified Accrual Basis.”

The difference between Cash Basis and Accrual Basis plays no role in the present context. Monetary profit Qm is equal to the increase of the business sector’s deposits at the central bank, which, in turn, are equal to the increase of the government sector’s overdrafts at the central bank because both sides of the central bank’s balance sheet are ALWAYS equal (as everyone knows from their accounting course, except Matt Franko). If and when the government consolidates its debt by selling bonds or T-bills, or whatever to the business sector is independent of the development of the debt in a certain period. In the present context is important to realize that Public Deficit = Private Profit. It is of NO interest here if and how the deficit = increase of overdrafts is ultimately funded.#1, #2

Needless to emphasize that the household sector will be taxed somewhere in the future in order to pay back the government’s debt. So, the households get their ponies on credit without realizing it, while the business sector gets its profit for good. The payback part is entirely missing from the pony story. Stephanie Kelton’s wonderful proposal is like the auto dealer saying I give you this brand new car for free, please confirm my generosity with your signature at the end of this credit agreement.

Stephanie Kelton is a scientifically incompetent economist, and MMT is Trump University economics.

#1 Fixing the loanable funds blunder

#2 Reconstructing the Quantity Theory (I)

***

REPLY to Matt Franko on Oct 1Each government entity, each firm, and each bank around the world has incoming payments and outgoing payments. These are not synchronized, and therefore, there is a smart guy, let us call him the cash or liquidity manager or treasurer, whose main task is to maintain constant financial solvency.

Imagine the following situation. The cash manager knows that the government spends the amount G on ponies on Jan 1 and that taxes T are paid on Dec 31. It holds G=T. So, the cash manager has to take up credit for one year either from the banking system or by selling some short-term paper. Vice versa, the taxes come in on Jan 1 and the ponies are bought on Dec 31. So, the cash manager can buy some ultra-safe paper and hold it for one year. No cash manager in this world has any problem with handling both situations. At the end of the year, both cases amount to the SAME, except for the interest. The cash manager has NO long-term financing problem.

Things are different if T is less than G. If this happens year after year, government debt increases continuously, and the cash manager eventually starts to issue government bonds of different maturities and to roll them over again and again. The growing government debt is the problem that alarms people, and NOT the bridging of the short-term gaps between outgoing payments and incoming taxes.

The obvious mistake of Stephanie Kelton’s op-ed is to confound the two cases of short-term cash deficits and long-term budget deficits. Short-term cash deficits become budget deficits if T < G.

Why Stephanie Kelton forgets to mention that Public Deficit = Private Profit and that people have to pay for the ponies in the form of deferred budget surpluses, which are needed to eventually redeem the accumulated public debt, is a bit mysterious. But then, perhaps this is absolutely normal at Trump University.

***

REPLY to Calgacus on Oct 1You quote Wray, “money is a cross-balance sheet RELATIONSHIP”. Yes, trivially true and known since the Middle Ages, but MMTers are too stupid to do the accounting properly. For the proof, see #1, #2.

It is the most remarkable feature of MMT that macro profit does not appear in the balance equations. By consequence, MMTers miss the most important “cross-balance sheet relationship”, that is, Government Deficit = Profit of the business sector. The fact is that MMTers got profit theory wrong, and this is disqualifying for every economist. #3

Accounting is elementary mathematics, and one needs no Theoretical Computer Scientists to do it. The signature of arithmetic consists of addition, multiplication, and successor function symbols, the equality and less-than relation symbols, and a constant symbol for 0. (Wikipedia) That’s all, but MMTers fail already at the level of elementary logic.

You say “The government does not need a cash manager because the job of the government is to be financially INsolvent.” The cash manager of the government coordinates and bridges the gaps between outgoing and incoming payments. As long as the budget is balanced, i.e. G=T, the job of the government’s cash manager is essentially the same as the non-government’s cash manager. Their deficits = overdrafts at the credit side of the central bank’s balance sheet create uno actu deposits at the debit side = money. The only difference between the non-government cash manager and the government’s cash manager is that the central bank cannot limit the deficit creation = money creation of the latter. The point is, though, that the newly created money lands one-to-one as profit on the accounts of the business sector. Take all the technicalities of cash management away, then MMT’s pony program turns out to be a profit booster program. It seems that some Wall Street folks understand this better than Stephanie Kelton.

At the end of the whole exercise, a sub-group of the general public is left with some ponies, and all of the general public is indirectly left with the government’s debt. Whether the debt takes the form of overdrafts-deposits (= money) at the central bank or assets-liabilities in the form of bonds is a separate issue. Overdrafts-deposits (= money) is the most convenient and cheapest form of government debt.

The accumulated debt can be carried over for an indefinite time, but this makes it only invisible but not disappear. The household sector is ― indirectly via the government ― left with the debt, and the business sector is left with profit, which is held either in cash = deposits at the central bank/banking sector or in government paper. Government paper is Triple-A quality and carries interest, which makes the folks in the business/banking sector even happier.

As long as the debt is revolved, all is fine. Interest for the public debt is reliably taken from the household sector and transferred to the bond-holding business/banking sector. But the market economy breaks down as soon as the household sector starts to redeem private or/and public debt, which must happen eventually because this is the very nature of debt. #4

What Stephanie Kelton is ― knowingly or unknowingly does not matter ― actually doing under the banner of social programs is to boost the profit of the business/banking sector and to postpone the breakdown of the economy. In political terms, this is what the MMT dog & pony act in the LA Times is all about. MMT is just another example of the scientifically degenerate state of economics.

#1 Rectification of MMT macro accounting

#2 A tale of three accountants

#3 Why economists don’t know what profit is

#4 Mathematical Proof of the Breakdown of Capitalism

***

REPLY to Matt Franko on Oct 1You say: “G−T does not equal the net amount of Treasuries issued... G is Accrual, and T is Accrual... Treasury issuance is Cash...”

Roughly speaking, G and T are the sums of transactions that take place during one period on the Income Statement/Profit-Loss Accounts, while the buying and selling of government securities are transactions that are recorded on the balance sheet.

G and T are flows, while cash and the amounts of diverse government securities are stocks. The difference of flows Δ=G−T of the government sector changes the stock of money by Δ.

All this has NOTHING to do with the difference between Accrual Basis and Cash Basis Accounting. For the interrelationship between macro flows, their balances, and stocks, see #1, #2. For the basics of National Accounting, see Wikipedia.#3

#1 Essentials of Constructive Heterodoxy: Money, Credit, Interest

#2 Essentials of Constructive Heterodoxy: Financial Markets

#3 Wikipedia “National accounts broadly present output, expenditure, and income activities of the economic actors (households, corporations, government) in an economy, including their relations with other countries’ economies, and their wealth (net worth). They present both flows (measured over a period) and stocks (measured at the end of a period), ensuring that the flows are reconciled with the stocks.”

Related 'MMT: Just political heat, no scientific light' and 'The profit effect of a Job Guarantee'