Blog-Reference

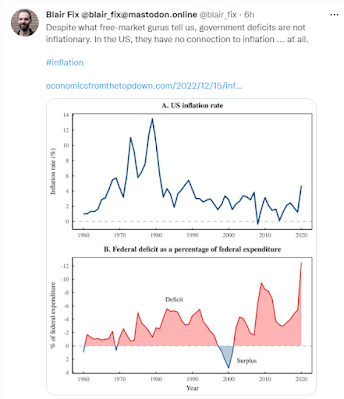

The quasi-automatic Pavlovian argument against MMT is that ‘sustained reliance on printing money to finance deficits can lead to escalating price inflation’.#1 This view is based on the commonplace Quantity Theory, which is provably false.#2

MMT has gone to great lengths to demonstrate that the inflation fear is unfounded. What the layperson cannot see, though, is that not only Orthodoxy but MMT, too, has NO sound scientific foundations. The MMT policy proposals are based on Keynesian macroeconomics which has been refuted long ago.#3, #4 Both Walrasian microfoundations and Keynesian macrofoundations are provably false and have to be fully replaced.

As the correct analytical starting point, the pure production-consumption economy is defined with this set of macro axioms: (A0) The objectively given and most elementary configuration of the economy consists of the household and the business sector which in turn consists initially of one giant fully integrated firm. (A1) Yw=WL wage income Yw is equal to wage rate W times working hours. L, (A2) O=RL output O is equal to productivity R times working hours L, (A3) C=PX consumption expenditure C is equal to price P times quantity bought/sold X.

Under the conditions of market-clearing X=O and budget-balancing C=Yw, the price is given by P=C/X=W/R, i.e. the market-clearing price is in the initial period equal to unit wage costs. This is the most elementary form of the macroeconomic Law of Supply and Demand. For the graphical representation see Figure 1.#5

The market-clearing price is determined by the wage rate W, which takes the role of the nominal numéraire, and the productivity. The quantity of money is NOT among the price determinants. This puts the commonplace Quantity Theory FOREVER to rest.

Monetary profit for the economy as a whole is defined as Qm≡C−Yw and monetary saving as Sm≡Yw−C. It always holds Qm+Sm=0, in other words, the business sector’s surplus = profit (deficit = loss) equals the household sector’s deficit = dissaving (surplus = saving). This is the most elementary form of the macroeconomic Profit Law. Under the condition of budget balancing, total monetary profit is zero.

Now, the sovereign government decides to run a budget deficit in the next period. Government spending is given with Cg and taxes T are initially zero. Total expenditures are now C1=Ch+Cg and this yields a price hike: P1=C1/X=(Ch+Cg)/X=P0+Cg/X with market-clearing X=O. If deficit spending is exactly repeated period after period the price remains at the elevated level but there is NO inflation. No matter how long the government sector’s debt increases by Cg, there is NO further price increase.

Monetary profit for the economy as a whole is now given by Qm1≡(Ch+Cg)−Yw. Because of the household sector’s budget-balancing, i.e. Ch=Yw, profit is Qm1=Cg. It always holds Public Deficit = Private Profit.

The amount Cg = government budget deficit comes from the central bank, i.e. is created out of nothing. The two sides of the central bank’s balance sheet, overdrafts, and deposits, rise by the same amount. The combined transaction pattern of the household and government sector is shown in Figure 2.#6

Through deficit spending, the business sector’s pile of money rises continuously and is, at the end of the period, equal to profit which in turn is equal to the deficit Cg. The newly created money ends in the ‘cash box’ of the business sector, i.e. government sector’s overdrafts = business sector’s deposits.

This can go on for an indefinite time with the quantity of money = deposits at the central bank rising continuously ― but with no further price increase.

It is assumed now that the government consolidates its overdrafts by selling bonds to the business sector. The quantity of money in Figure 2 drops back to zero exactly at period-end. Thus, the newly created money = deposits of the business sector are mopped up. The government sector’s debt rises period after period and the business sector’s stock of bonds, too, as an exact mirror image. This can go on for an indefinite time with no inflation.

The problem arises at another corner. The bonds bear interest and in order to pay the interest, the government has to raise taxes. For simplicity, it is assumed that taxes T are exactly equal to total interest and interest payments starting in period 2.

The net income of the wage income receivers is Yw−T. Under the condition of budget balancing, consumption expenditure fall, i.e. Ch2=Yw−T. This causes the market-clearing price to fall, i.e. P2=C2/X=(Ch2+Cg)/X=(Yw−T+Cg)/X. The tax T has a deflationary effect under the condition that employment is kept constant for a while.

The profit of the business sector was zero in the initial period, i.e. Qm=C−Yw=0 because of C=Yw, and is now Qm2=C2+T−Yw. The business sector now receives interest which is here equal to the household sector’s taxes T. Because of C2=(Yw−T)+Yg this yields again Qm=Yg. So, total profit remains unchanged but the profit from selling the output goes down. This effect of the falling price is exactly compensated by interest revenues. This can go on for a while. Problems arise when the profit from normal business operations approaches zero and total profit consists alone of interest revenues.

This, in turn, depends on the development of the interest rate. If it is constant interest payments on bonds increase with the continuously growing public sector’s debt. The necessary increase in taxes eventually drives profit from normal production to zero. This, in conjunction with deflation, is the real hazard of growing public debt and NOT inflation. It is no wild guess to assume that business will react to falling operating profits by curtailing employment. The problems can be pushed into the indefinite future with a parallel reduction of the interest rate on the public debt, preferably to zero. The central bank can support this process by buying bonds and thus increasing the liquidity in the system. This has NO effect on the price P.

As long as the debt is revolved, everything is fine. Interest for the public debt is taken from the household sector via taxes and transferred to the bond-holding business/banking sector. The ensuing deflation and the decline of profit from consumption good production ― NOT inflation ― is the real damage of MMT's economic policy. The orthodox critique has always been way beside the point. There is nothing to choose from, both Orthodoxy and MMT are failed approaches.

Egmont Kakarot-Handtke

#1 Cited from Scott T. Fullwiler, Interest Rates and Fiscal Sustainability, p. 3

#2 Forget Friedman, forget the Quantity Theory

#3 How Keynes got macro wrong and Allais got it right

#4 For the full-spectrum refutation of MMT see cross-references MMT

#5 Figure 1 Wikimedia AXEC31 Elementary production-consumption economy

#6 Figure 2 Wikimedia AXEC100 Transaction pattern, household sector, dissaving

Related 'MMT: Redistribution as wellness program' and 'Why is MMT so false?' and 'MMT: Just political heat, no scientific light' and 'MMT: Money-making for the one-percenters' and 'The profit effect of a Job Guarantee' and 'NAIRU and economists’ lethal swampiness' and 'Forget Friedman, forget the Quantity Theory' and 'How some MMTers got inflation wrong' and 'Inflation: back to basics' and 'Links on Inflation'.

***

REPLY to Salsabob on Oct 5(i) You say: “What you do get correct is the potential consequence of price increases from increased deficit spending. Congratulations, you have discovered MMT’s inflationary constraint …”

There is NO such thing as an inflationary constraint. Both Orthodoxy AND MMT get the inflation issue wrong.#1 Both Orthodoxy AND MMT is proto-scientific garbage. Both Orthodoxy AND MMT are refuted according to the scientific standards of material and formal consistency.

(ii) You say: “Every MMTer will spend substantial energy chastising federal debt/deficit hysteria and the budget constraint mythology, but give only lip service to the inflationary constraint…. What most will say is that they are just economists, or that MMT needs to be pure, an operational description, a school of economic thought; must remain aloof of policy and politics …”

There are political economics and theoretical economics. The main differences are: (a) The goal of political economics is to successfully push an agenda, and the goal of theoretical economics is to successfully explain how the actual economy works. (b) In political economics anything goes; in theoretical economics, the scientific standards of material and formal consistency are observed.#2

Theoretical economics (= science) has been body-snatched by political economists (= agenda pushers). Political economics has produced NOTHING of scientific value in the last 200+ years. MMT is part of political economics. More precisely, MMT advances the cause of the one-percenters under various populist social pretexts of which Stephanie Kelton's Pony for every American is the most recent example. MMT policy proposals have NO scientific foundations at all.#2

(iii) MMT is scientifically unacceptable. MMTers are scientifically incompetent. MMT is refuted on all counts.#3 The only thing MMTers can do for human progress is to get out of the way.

#1 Gov-Deficits do NOT cause inflation

#2 MMT: scientific incompetence or political fraud?

#3 For details see cross-references MMT

***

REPLY to Salsabob on Oct 6You cite me: "MMT has gone to great lengths to demonstrate that the inflation fear is unfounded."

You say: “Can you provide an actual quote from an actual well-known MMTer (or actually any MMTer) that inflation is NOT the penultimate constraint to their basic notion that there could be much more central government spending?”

In his multi-part series Modern monetary theory and inflation Bill Mitchell concludes: “First, unemployment is always a greater problem than inflation in almost any dimension you want to define it and which are calibrated by metrics that different ideological persuasions agree on – such as lost GDP. There is nothing ideological in the statement that the losses from unemployment dwarf those associated with inflation. Even mainstream textbooks struggle to come up with large estimates of the costs of inflation that they itemise.”

By and large, MMT says, as long as there is unemployment, inflation is not a problem. It may become eventually the penultimate constraint. But this is not the burning issue.

So, perhaps I should have been more explicit: “… that the inflation fear is unfounded under the prevailing conditions.”

***

Twitter Dec 12, 2022

Twitter/X Dec 1, 2023