Comment on Blair Fix on ‘Energizing exchange: Learning from econophysics’ mistakes’

Macroeconomics is provably false since Keynes.#1 The correct macrofoundations are given with this set of axioms: (A0) The objectively given and most elementary configuration of the economy consists of the household and the business sector which in turn consists initially of one giant fully integrated firm. (A1) Yw=WL wage income Yw is equal to wage rate W times working hours. L, (A2) O=RL output O is equal to productivity R times working hours L, (A3) Ec=PX consumption expenditure Ec is equal to price P times quantity bought/sold X.

Under the conditions of market-clearing X=O and budget-balancing Ec=Yw in each period, the price as dependent variable is given by P=W/R, i.e., the market-clearing price is equal to unit wage costs. This is the most elementary form of the macroeconomic Law of Supply and Demand. For the graphical representation, see AXEC31a

The macroeconomic price is determined by the wage rate W, which takes the role of the nominal numéraire, and the productivity R. The quantity of money is NOT among the price determinants.

Monetary profit for the economy as a whole is defined as Qm≡Ec−Yw and monetary saving as Sm≡Yw−Ec. It always holds that the sectoral balances add up to zero, i.e. Qm+Sm=0. In other words, the business sector’s deficit=loss equals the household sector’s surplus=saving and vice versa, the business sector’s surplus=profit equals the household sector’s deficit=dissaving. This is the most elementary form of the macroeconomic Profit Law. Under the condition of budget-balancing Ec=Yw, monetary profit is zero.

What is needed next is two things (i) a Central Bank which creates money on its balance sheet in the form of deposits, and (ii), a legal system that declares the Central Bank’s deposits as legal tender. These conditions define a fiat money system without commercial banks as intermediaries.

Deposit money is needed by the business sector to pay the workers who receive the wage income Yw per period. The need is only temporary because the business sector gets the money back if the workers fully spend their income, i.e. if Ec=Yw.

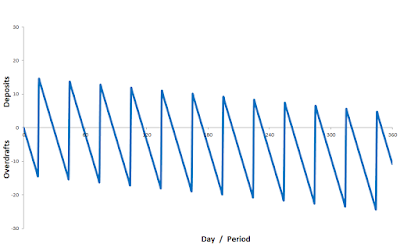

Overdrafts are needed by the household sector for consumption expenditures if the households want to spend before they get their wage income. This time sequence is no problem for the Central Bank because the temporary overdrafts vanish with wage payments.

For the case of a balanced budget C=Yw, the idealized transaction sequence of deposits/overdrafts of the household sector at the Central Bank over the course of one period is shown on AXEC98:

The household sector’s deposits/overdrafts are zero at the beginning and end of the period. The business sector’s transaction pattern is the exact mirror image. Money, that is, deposits at the Central Bank, is continually created and destroyed during the period under consideration. There is NO such thing as a fixed quantity of money. The central bank plays an accommodative role and simply supports the autonomous market transactions between the household and the business sector.

From this follows the average stock of transaction money as M=κYw, with κ determined by the transaction pattern. In other words, the average stock of money M is determined by the autonomous transactions of the household and business sector and created out of nothing by the Central Bank. The economy never runs out of money.

The transaction equation reads M=κYw=κEc=κPRL in the case of budget balancing and market clearing, and this yields the commonplace correlation between the average stock of money M and price P for a given employment level L and productivity R, except for the fact that M is the dependent variable. If P doubles, M doubles, and P doubles if W doubles, with the real variables L and R fixed.

Inflation ensues under the conditions of market-clearing and budget-balancing if the wage rate rises faster than the productivity, and deflation ensues in the opposite case. Under the condition of L and R constant, one always gets the commonplace correlation between the average stock of money M and price P, with the causality running from P to M.

For the general case, the elementary macroeconomic price formula states P=ρEW/R with ρE≡Ec/Yw. ρE>1 represents deficit-spending, and this implies that a period deficit produces a one-off price hike. So, if ρE=1 in the initial period and ρE=2 in the next period, then the price doubles.

The transaction equation reads for the general case M=κ sup {Yw, Ec} or M=κ sup {1, ρE}Yw and this means that if Ec is greater than Yw then Ec determines the quantity of transaction money. So, if Ec doubles, i.e., ρE=2, then M doubles. In this case, the old Quantity Theory correlation between P and M reappears.

However, this does NOT lead to inflation as a process over multiple periods. If ρE=2 again in the next period, then the price P remains at the elevated level but does not rise further. So, the continuous deficit spending of the household sector does NOT cause inflation. (Only successive increases of the expenditure ratio ρE lead to successive price hikes.)

However, the average stock of transaction money increases continuously.#2 The transaction pattern in the case of continuous dissaving is shown on AXEC99

As a mirror image, the deposits of the business sector at the Central Bank increase continuously because the profit of the business sector is equal to the dissaving/deficit-spending of the household sector. So, the average quantity of money in the system increases continuously but the price remains stable at the elevated level for a given ρE. There is NO proportionality between M and P and this means that the commonplace Quantity Theory is refuted.

Egmont Kakarot-Handtke

Additional link: Michael D. Bordo and Mickey D. Levy, Do Enlarged Fiscal Deficits Cause inflation: The Historical Record