Comment on Michael Roberts on ‘Ending the pandemic slump — a return to Keynes?’

Michael Roberts summarizes the situation: “The Great Lockdown has tipped the global economy into recession in 2020 on a scale not witnessed since the 1930s.” And “UNCTAD economists note … that the world economy was already heading for a slump before the pandemic hit.”

This leads quite naturally to the question: “What economic policies should be adopted to end this ‘lockdown slump’ and avoid or reduce the hit to the livelihoods of billions? That depends on the analysis of the causes of the slump itself.”

Right, good policy depends on true theory. The problem of economics as a science is this: “In order to tell the politicians and practitioners something about causes and best means, the economist needs the true theory or else he has not much more to offer than educated common sense or his personal opinion.” (Stigum)

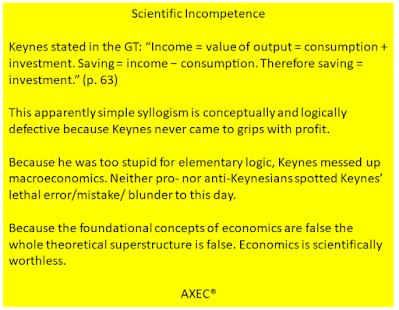

And here is the snag: to this day, economists do NOT have the true theory but many silly opinions. The major approaches — Walrasianism, Keynesianism, Marxianism, Austrianism, MMT — are mutually contradictory, axiomatically false, materially/formally inconsistent and all got the foundational economic concept of profit wrong. Economics is a failed science. As lousy scientists, economists are a hazard to their fellow citizens — not any different from quack doctors.#1

This has never hindered economists to give economic policy advice: “UNCTAD economists openly follow the Keynesian ‘explanation’ for the lost decade … since 2009. And their solution is a re-adoption of Keynesian policies to manage capitalism better. For UNCTAD, slumps start with a collapse in demand ie in investment spending and above all in household consumption.”

At this point, Michael Roberts begs to differ: “In a capitalist, profit-making, economy, it is profits and profitability that drive investment and when profitability drops, investment in the means of production and in labour will contract, leading to unemployment and loss of consumer incomes and demand.” And “Indeed, on occasion even Keynes recognised that profitability (which he called the ‘marginal efficiency of capital’) was an important factor in causing slumps.” As he said: “Unemployment … exists because employers have been deprived of profit. The loss of profit may be due to all sorts of causes. But, short of going over to Communism, there is no possible means of curing unemployment except by restoring to employers a proper margin of profit.”#2

And Michael Roberts continues: “You see, in the last 40 years, the share of profits in the national incomes of the major economies has risen at the expense of wages and so the crisis of capitalist production is ‘wage-led’ not ‘profit-led’.”

And then he finishes off UNCTAD: “There is no mention of profit or profitability in the whole of the long UNCTAD report. Instead we are asked to accept that slumps are caused by low wages and consumption and by low investment caused by a switch to financial speculation leading to ‘instability’.”

We can cut off the policy argument here because it is pointless. Obviously, there is something fatally wrong with the theoretical foundations and the concept of profit. The blunder is evident in the expression “share of profits in the national incomes”.

Because profit is NOT income (it is a difference of flows and not a flow like wage income) there is NO such thing as a “share of profits in the national incomes”.#3-#5

Because economists get the foundational economic concept of profit wrong the whole analytical superstructure of economics is false ― provably false. This means that economic policy NEVER has had sound scientific foundations. For 200+ years now political economics is nothing but brain-dead agenda-pushing. UNCTAD and Michael Roberts are no exception. Like the rest of the profession, both have no idea of what profit is.

Egmont Kakarot-Handtke

#2 Keynes, too, got profit theory badly wrong. See Ch. 13, The indelible scientific disgrace of economics, in Sovereign Economics

#3 The Profit Law for the 3-sector economy is given by Qm≡Yd+(I−Sm)+(G−T)

For more about iatrogenic economics, see AXECquery.

***

|

| Source: Michael Robert's Blog |

***

REPLY to Matt Franko on Oct 1

You say: “Yes... They have big problems recognizing Minuends, Subtrahends and Differences.”

Indeed, this is the Flow-Balance Inconsistency (not to be confused with the Stock-Flow Inconsistency). In simple terms, “they” are too stupid for the elementary algebra that underlies macroeconomics.#1, #2

The Flow-Balance Inconsistency makes that the whole of MMT is proto-scientific garbage ― only good for trolling and deceiving #WeThePeople.

#2 For more about the Humpty Dumpty Fallacy, see AXECquery.

***

AXEC172