Blog-Reference

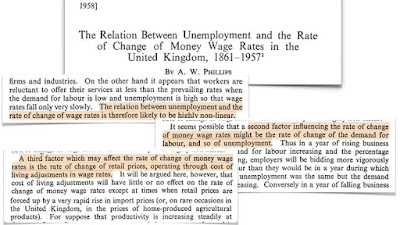

The original Phillips Curve was about the relation between the rate of unemployment and the rate of change of the wage rate (Phillips, 1958). Phillips studied more than a century's worth of data and established a stable inverse relation for the United Kingdom. Phillips' original curve was a remarkable empirical finding. It has to be emphasized that Phillips ‘had not made an explicit link between inflation and unemployment’. (Ormerod, 1994, p. 120)

The original curve was transformed by Samuelson/Solow with the simple formula: rate of inflation = rate of wage growth − rate of productivity growth (Samuelson and Nordhaus, 1998, p. 590). This formula, according to Samuelson an ‘important piece of inflation arithmetic’, says that price inflation runs in tandem with wage inflation and that both have basically the same effect on employment respectively the rate of unemployment. The difference between the original and the bastard Phillips Curve consisted of a 1 percent productivity growth. This naive calculation led to the far-reaching policy conclusion that there exists an exploitable trade-off between inflation and unemployment.

Needless to say this basic version experienced refinement, reinterpretation, and qualification in the sequel. It was completely overlooked in the ensuing filibuster, though, that, to begin with, Samuelson's arithmetic was fallacious.

The problem, however, runs much deeper. The Phillips Curve has always been discussed in terms of supply-demand-equilibrium on the labor market as if this were a correct formal representation. Things became worse with the introduction of expectations.

Fundamental to the Phillips Curve discussion is a host of behavioral assumptions. What has been overlooked is that the monetary economy has some objective structural properties. Whatever the agents think, plan, expect, or do, they cannot incapacitate structural laws.

The macroeconomic Employment Law takes the form of the structural-systemic Phillips Curve (2012, eq. (33) and Wikimedia AXEC36b):

It says:

Egmont Kakarot-Handtke

References

Davidson, P. (2009). The Keynes Solution. The Path to Global Economic Prosperity. New York: Palgrave Macmillan.

Kakarot-Handtke, E. (2012). Keynes’ Employment Function and the Gratuitous Phillips Curve Disaster. SSRN Working Paper Series, 2130421: 1–19. URL

Ormerod, P. (1994). The Death of Economics. London: Faber and Faber.

Phillips, A. W. (1958). The Relation Between Unemployment and the Rate of Change of Money Wage Rates in the United Kingdom, 1861-1957. Economica, 25: 283–299. URL

Samuelson, P. A., and Nordhaus, W. D. (1998). Economics. Boston, Burr Ridge, etc.: Irwin, McGraw-Hill, 16th edition.

Related 'Full employment through the price mechanism' and 'Mass unemployment: The joint failure of orthodox and heterodox economics' and 'NAIRU: an exhaustive dancing-angels-on-a-pinpoint blather' and 'Full employment, the Phillips Curve, and the end of Gaganomics' and 'NAIRU and the scientific incompetence of Orthodoxy and Heterodoxy' and 'The flat-earth realism of economists' and 'The father of modern economics and his imbecile kids' and 'How to overcome the manifest silliness of Econ 101 and save the economy' and 'No doubts about wage-led growth' and 'Demand-led and wage-led growth' and 'Go! ― test the Profit and Employment Law'. See also Lars Syll's blog here and here for wage-led growth. For details of the big picture see Links on the Phillips Curve and cross-references Employment/Phillips Curve.

- An increase in the average wage rate leads to higher employment, i.e. to a lower unemployment rate. This is in accordance with the correlation of Phillips' original study.

- A price increase is conducive to lower employment. This is in discordance with the Samuelson-Solow version of the Phillips Curve, that is, with the trade-off between unemployment and inflation. The stagflation of the 1970s is generally seen as an empirical refutation of the neoclassical synthesis version of the Phillips Curve. This refutation of ‘perverted’ Keynesian economics (Davidson, 2009, pp. 18-20) indirectly corroborates the structural-systemic Phillips Curve which explicitly predicts stagflation.

- Provided that wage rate, price, and distributed profit all change with the same rate (between zero and infinite percent in the simplified case) there is NO effect on employment at all. This is in accordance with the NAIRU and rational expectations interpretation of the Phillips Curve, i.e. in this case the Phillips Curve is vertical. The structural Phillips Curve explains verticality without recourse to expectations (rational or otherwise) or any other behavioral assumption.

Egmont Kakarot-Handtke

References

Davidson, P. (2009). The Keynes Solution. The Path to Global Economic Prosperity. New York: Palgrave Macmillan.

Kakarot-Handtke, E. (2012). Keynes’ Employment Function and the Gratuitous Phillips Curve Disaster. SSRN Working Paper Series, 2130421: 1–19. URL

Ormerod, P. (1994). The Death of Economics. London: Faber and Faber.

Phillips, A. W. (1958). The Relation Between Unemployment and the Rate of Change of Money Wage Rates in the United Kingdom, 1861-1957. Economica, 25: 283–299. URL

Samuelson, P. A., and Nordhaus, W. D. (1998). Economics. Boston, Burr Ridge, etc.: Irwin, McGraw-Hill, 16th edition.

Related 'Full employment through the price mechanism' and 'Mass unemployment: The joint failure of orthodox and heterodox economics' and 'NAIRU: an exhaustive dancing-angels-on-a-pinpoint blather' and 'Full employment, the Phillips Curve, and the end of Gaganomics' and 'NAIRU and the scientific incompetence of Orthodoxy and Heterodoxy' and 'The flat-earth realism of economists' and 'The father of modern economics and his imbecile kids' and 'How to overcome the manifest silliness of Econ 101 and save the economy' and 'No doubts about wage-led growth' and 'Demand-led and wage-led growth' and 'Go! ― test the Profit and Employment Law'. See also Lars Syll's blog here and here for wage-led growth. For details of the big picture see Links on the Phillips Curve and cross-references Employment/Phillips Curve.

For more on wage-led growth see AXECquery.

***

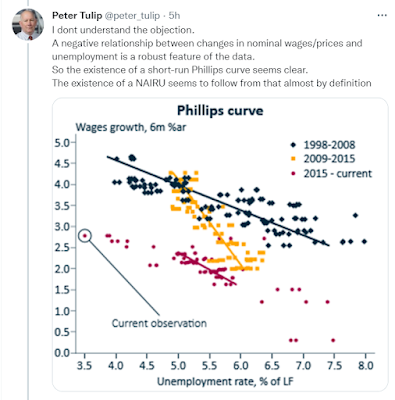

Twitter Mar 8, 2019 |

| Source: Twitter |

Twitter Oct 25, 2019

Twitter Feb 2, 2021

Twitter Oct 17, 2021

Twitter Jul 28, 2022

Twitter Oct 7, 2020

Twitter Nov 17, 2022 A question of causality

Twitter Dec 20, 2022 Note that wage increases and price increases do NOT work in the same direction but have OPPOSITE effects on employment/unemployment

Twitter/X Mai 5, 2025 Phillips' original relationship