Abstract Say's Law has passed through various conceptual frameworks. As the next logical step, this paper provides a rigorous restatement in structural axiomatic terms. The main reason is that previous attempts have been methodologically unsatisfactory. Standard economics rests on behavioral assumptions that are expressed as axioms. Axioms are indispensable to build up a theory that epitomizes formal and material consistency. The fatal flaw of the standard approach is that human behavior does not lend itself to axiomatization. Small wonder that the accustomed attempt to explain how the economy works met with scant success. This also battered the discussion about Say's Law.

This blog connects to the AXEC Project which applies a superior method of economic analysis. The following comments have been posted on selected blogs as catalysts for the ongoing Paradigm Shift. The comments are brought together here for information. The full debates are directly accessible via the Blog-References. Scrap the lot and start again―that is what a Paradigm Shift is all about. Time to make economics a science.

December 28, 2013

Say's Law: a rigorous restatement {48}

Abstract Say's Law has passed through various conceptual frameworks. As the next logical step, this paper provides a rigorous restatement in structural axiomatic terms. The main reason is that previous attempts have been methodologically unsatisfactory. Standard economics rests on behavioral assumptions that are expressed as axioms. Axioms are indispensable to build up a theory that epitomizes formal and material consistency. The fatal flaw of the standard approach is that human behavior does not lend itself to axiomatization. Small wonder that the accustomed attempt to explain how the economy works met with scant success. This also battered the discussion about Say's Law.

November 22, 2013

Debunking squared {47}

Abstract Steve Keen has debunked a good part of standard economics. However, he has left standing the theory of profit. This is unfortunate because the theory of profit is the pivot of all theoretical economics. This tightly focused paper clarifies the factual relationship between profit and income, which should be helpful to put Keen's alternative to the standard approach on sound foundations.

November 16, 2013

The Ideal Economy: A Prototype {46}

October 23, 2013

Redemption and depression {45}

Abstract According to prevailing methodological criteria, standard economics is definitively refuted. Joan Robinson's wake-up call “Scrap the lot and start again” has therefore lost nothing of its original freshness and urgency. Yet, how can the restart succeed? This inquiry builds on structural axioms. First, conceptual consistency is assured and the confusion about profit and income is dissolved. The question of interest is then how a recession or depression develops as a result of the normal functioning of the monetary economy. This involves the identification of positive feedback. A very effective mechanism consists of the circular interaction of profit and distributed profit.

October 14, 2013

Heterodoxy: promising or hopeless?

Blog-Reference

Edward Fullbrook has undertaken the task of distilling from numerous contributions to the Real-World Economics Review a synopsis of the core tenets of present-day Heterodoxy (2013, p. 129). This is a good thing. However, he, unfortunately, characterizes a motley of opinions as NPE, New Paradigm Economics. There is at the moment nothing that deserves the title of a heterodox paradigm in the sense of Kuhn. What is more, Kuhn has argued: “that there are no, nor can there be any, paradigms in the social sciences.”

What we have before us resembles more a manifesto than anything else. The first item in the compilation, pluralism, confirms this impression.

A paradigm/theory/model makes assertions about the world (is deterministic, consists of atoms, expands inflationary, etcetera) or parts of it (society consists of antagonistic classes, of utility-maximizing individuals, is ruled by an invisible hand, etcetera) and implicitly or explicitly insists that this view is the correct one. A paradigm/theory/model without a truth claim is a contradiction in terms.

Hence pluralism is a meta-claim that cannot be used by any specific paradigm. Heterodoxy is not the arbiter and by no means in the position to decide that, for example, classical, Marxian, neoclassical, or Keynesian approaches are, in the name of pluralism, legitimate constituents of economics ― understood as a science. Just like astrology, geocentrism, or creationism cannot claim to be part of pluralistic physics or biology. Note that Dawkins refuses occasionally to discuss with creationists about evolution. Science constitutes itself by proper demarcation from nonscience (cf. Popper, 1980, p. 34).

Physics is pluralist at the cutting edge of research as long as the matter has not been settled according to accepted criteria (logical and material consistency, cf. Klant, 1994, p. 31). There is no pluralism, though, with regard to the Law of the Lever. To compare economics, which has not yet got hold of something analogous to the Law of the Lever, with cutting-edge physics is preposterous.

The defining characteristic of Heterodoxy is, trivially, the rejection of the neoclassical approach. The rejection is borne either by a well-founded conviction or at least the distinct feeling that there must be something better. Hence Heterodoxy epitomizes the promise to eventually come up with a superior alternative. This is what makes Heterodoxy attractive. In Lakatos' terms, Heterodoxy is to be understood as the progressive research program and Orthodoxy as the degenerating research program.

Heterodoxy, therefore, consists of a destructive and constructive part. However, both parts are not symmetric: “... there is more agreement on the defects of orthodox theory than there is on what theory is to replace it: but all agreed that the point of the criticism is to clear the ground for construction.” (Nell, 1980, p. 1)

Heterodoxy was very successful with debunking (cf. Fullbrook, 2004; Keen, 2011) but it cannot be said that it was equally successful with construction: “There is no alternative that is so obviously superior that it would justify everyone abandoning the current orthodoxy.” (Hausman, 1992, p. 255)

To explain this unacceptable state of theoretical affairs at least in part it is useful to study New Paradigm Economics in more detail. The methodological comment starts with a noncontroversial assertion: “Whether you can observe a thing or not depends on the theory which you use. It is theory which decides what can be observed.” (Einstein, quoted in Fullbrook, 2013, p. 130)

However, this consensus is immediately contradicted in Section 3 which claims that Heterodoxy “priorizes the empirical over apriorism.” Einstein was as clear as possible that this is the wrong priority: “... any attempt logically to derive the basic concepts and laws of mechanics from the ultimate data of experience is doomed to failure.” (1934, p. 166)

This is exactly what John Stuart Mill said long before with regard to economics: “Since, therefore, it is vain to hope that truth can be arrived at, either in Political Economy or in any other department of the social science, while we look at the facts in the concrete, clothed in all the complexity with which nature has surrounded them, and endeavour to elicit a general law by a process of induction from a comparison of details; there remains no other method than the à priori one or that of “abstract speculation”.” (Mill, 2004, p. 113-114)

Being an apriorist, Einstein of course never denied the crucial role of the empirical: “Experience can of course guide us in our choice of serviceable mathematical concepts; it cannot possibly be the source from which they are derived; experience of course remains the sole criterion of the serviceability of a mathematical construction for physics, but the truly creative principle resides in mathematics. In a certain sense, therefore, I hold it to be true that pure thought is competent to comprehend the real, as the ancients dreamed.” (1934, p. 167)

Is there any indication that physicists will abandon the deductive method in the future and instead turn to pluralism? “Some day, when physics is complete and we know all the laws, we may be able to start with some axioms, and no doubt somebody will figure out a particular way of doing it so that everything else can be deduced.” (Feynman, 1992, p. 50)

Was Einstein blind to the pitfalls and limitations of the deductive method which indeed have paralyzed the neoclassical approach? “If then it is the case that the axiomatic basis of theoretical physics cannot be an inference from experience, but must be free invention, have we any right to hope that we shall find the correct way?” (Einstein, 1934, p. 167)

Economists have yet to find the correct way. This is not attributable to the deductive method as such but to its clumsy application.

As always when they are clueless, economists turn to physics (Mirowski, 1995), and always they miss the point. Heterodox economists are no exception: “... progress entails a movement away from faith-based to empirical-based economics” (quote from Fullbrook, 2013, p. 130).

My impression from the NPE compilation is that Edward Fullbrook is currently too occupied with a rather hopeless rearguard of Heterodoxy. “Many people have a passionate hatred of abstraction, chiefly, I think, because of its intellectual difficulty; but as they do not wish to give this reason, they invent all sorts of others that sound grand. They say that all reality is concrete and that in making abstractions we are leaving out the essential. ... Those who argue in this way are, in fact, concerned with matters quite other than those that concern science.” (Russel, 1961, p. 626)

In economics, those other matters have been political agenda-pushing. This holds for both Orthodoxy and Heterodoxy.

Egmont Kakarot-Handtke

References

Einstein, A. (1934). On the Method of Theoretical Physics. Philosophy of Science, 1(2): 163–169. URL

Feynman, R. P. (1992). The Character of Physical Law. London: Penguin.

Fullbrook, E. (Ed.) (2004). A Guide to What’s Wrong With Economics. London: Anthem.

Fullbrook, E. (2013). New Paradigm in Economics. real-world economics review, 65: 129–131. URL

Hausman, D. M. (1992). The Inexact and Separate Science of Economics. Cambridge: Cambridge University Press.

Keen, S. (2011). Debunking Economics. London, New York: Zed Books, rev. edition.

Klant, J. J. (1994). The Nature of Economic Thought. Aldershot, Brookfield: Edward Elgar.

Mill, J. S. (2004). Essays on Some Unsettled Questions of Political Economy, chapter On the Definition of Political Economy; and the Method of Investigation Proper to It, 93–125. Electronic Classic Series PA 18202: Pennsylvania State University. URL

Mirowski, P. (1995). More Heat than Light. Cambridge: Cambridge University Press.

Nell, E. J. (1980). Growth, Profits, and Property, chapter Cracks in the Neoclassical Mirror: On the Break-Up of a Vision, 1–16. Cambridge, New York, Melbourne: Cambridge University Press.

Popper, K. R. (1980). The Logic of Scientific Discovery. London, Melbourne, Sydney: Hutchison, 10th edition.

Russel, B. (1961). The Basic Writings of Bertrand Russel, chapter Limitations of Scientific Method, 620–627. London: Routledge.

Related 'Heterodoxy ― an axiomatic failure just like Orthodoxy' and 'Microfoundations have been dead for 150+ years: high time to move on' and 'Economics ― the science that never was' and 'The canonical macroeconomic model'. For details of the big picture see cross-references Heterodoxy and cross-references Constructive Heterodoxy.

October 12, 2013

The structural price mechanism {44}

Abstract Standard economics rests on behavioral assumptions that are formally expressed as axioms. With the help of additional assumptions like perfect competition and equilibrium, a price vector is established that displays a host of desired properties. This approach is tightly stuck in a cul-de-sac. Conceptual rigor demands to discard the subjective-behavioral axioms and to take objective-structural axioms as the point of departure. The present paper reconstructs the price system in structural axiomatic terms for the most elementary economic configuration. The generalization of the structural price mechanism supplants the collapsed Walrasian and Keynesian attempts to formulate a consistent price and value theory.

July 27, 2013

Understanding Profit and the Markets: The Canonical Model {43}

July 24, 2013

Clueless

Blog-Reference

July 18, 2013

Economics and systems theory

Blog-Reference

The idea that systems theory could be useful in economics is not as novel as you might think. In fact, it provides the strongest backup for the claim of neoclassicals that what they do is science: “General systems theory (G.S.T.), of which general equilibrium theory is but a specification to certain economic problems, has existed for many years. … G.S.T., then, looks for, and finds, many structural similarities among fields of scientific analysis. To the extent that G.S.T. is a constructive approach to inquiry, general equilibrium theory in economics becomes rooted not just in the particular tradition that have generated the multi-fold extensions of the Arrow-Debreu-McKenzie [ADM] model, but in the very structural unities of science itself. To attack general equilibrium theory in economics as a legitimate model of reasoning is to simultaneously deny homeostatic reasoning to psychologists and morphogenetic analysis to the biologist. To argue that G.S.T. is inapplicable to economics is to negate claims that economics is a science.” (Weintraub, 1979, pp. 71-72)

To propagate systems theory seems not to be the way to a fundamental Paradigm Shift, rather to improve neoclassical systems theory, i.e. to more descriptive realism.

Apart from this, I would like to support your appeal to take systems theory seriously: “Concepts of equilibrium, homeostasis, adjustment, etc., are suitable for the maintenance of systems, but inadequate for the phenomena of change, differentiation, evolution, negentropy, production of improbable states, creativity, building-up of tensions, self-realization, emergence, etc;” (von Bertalanffy, 1969, p. 23)

Systems theorists realized this long ago but equibrilists are still behind the curve.

Egmont Kakarot-Handtke

References

von Bertalanffy, L. (1969). General Systems Theory. New York: Braziller.

Weintraub, E. R. (1979). Microfoundations. Cambridge, London, New York, etc.: Cambridge University Press.

July 17, 2013

Keynes, Hayek, Kant

Blog-Reference

In the glorious days of economics, the great thinker Hayek was quipped by the great thinker Keynes: “... a remorseless logician can end up in Bedlam.” (Keynes, cited in Moggridge 1976, p. 36)

Economists in those days already were confused confusers (2013). This is not a lament but a statement of fact. Neither Keynes nor Hayek had a clear idea of the foundational concepts of income and profit. That's easy to prove.

We perfectly agree with Kant’s dictum: “Theory without empirical content is hollow. Empirical observations without [good & falsifiable] theory are directionless.”

Theory, though, starts with axioms, as Kant would have told you also.

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2013). Confused Confusers: How to Stop Thinking Like an Economist and Start Thinking Like a Scientist. SSRN Working Paper Series, 2207598: 1–16. URL

Moggridge, D. E. (1976). Keynes. London, Basingstoke: Macmillan.

July 16, 2013

Anything goes — for a while (II)

Blog-Reference

The analytical starting point determines the course of a theoretical investigation and ultimately the productiveness of an approach. The Classics took production and accumulation as their point of departure, the Neoclassicals exchange. Exchange implies behavioral assumptions and notions like rationality, optimization, and equilibrium. This approach has led into a blind alley. Why?

“For if orthodox economics is at fault, the error is to be found not in the superstructure, which has been erected with great care for logical consistency, but in a lack of clearness and of generality in the premises.” (Keynes, 1973, p. xxi)

To change a theory, therefore, means to change its premises or, in Keynes’ words, to ‘throw over’ the axioms. One can take this figuratively or literally. I take it literally and this means that the subjective-behavioral axioms of standard economics are fully replaced by objective-structural axioms. In Keynes' metaphor: we move from Euclidean to non-Euclidean axioms. To recall, Keynes preserved part of the foundational assumptions of orthodoxy. This halfway construction is unsatisfactory.

(2a) Axiomatization is indispensable because the methodological anything-goes mentality among economists is the proximate reason for the proto-scientific condition of theoretical economics. Because of conceptual sloppiness, neither orthodoxy nor heterodoxy has a clear idea of the fundamental economic concepts of income and profit. Doing economics without a clear idea of income and profit is like doing physics without a clear idea of force and mass — it cannot yield practical results, and it has not.

(2b) I have demonstrated that Keynes' formal basis is a limiting case of the structural axiom set. This means that there is no contradiction between the two formalisms, the latter is only more general (see Set and Subset, 2011, Sec. 20).

(2c) This implies that the concept of saving is also more general. Total saving is given axiomatically as monetary and nonmonetary saving. Monetary saving is identical to Keynes' definition. Nonmonetary saving is identical to Friedman's notion (see Primary and Secondary Markets, 2011, Sec. 4.2). The structural axiomatic approach consistently integrates Keynes and Friedman, although only with regard to consumption/saving.

(2d) The relation between monetary saving, liquidity, and interest rate has been dealt with in (2011, Sec. 9). The structural axiom set formally underpins Keynes' conception of liquidity preference. The commonplace quantity theory is refuted.

(2e) A summary of the structural-systemic axiomatic theory of saving has been given in Settling the Theory of Saving (2013). The classical notion of saving/time preference, which reappears in DSGE, is refuted.

(2f) The structural axiom set consists exclusively of measurable variables and yields testable propositions.

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2011a). Keynes’ Missing Axioms. SSRN Working Paper Series, 1841408: 1–33. URL

Kakarot-Handtke, E. (2011b). Primary and Secondary Markets. SSRN Working Paper Series, 1917012: 1–26. URL

Kakarot-Handtke, E. (2011c). Reconstructing the Quantity Theory (I). SSRN Working Paper Series, 1895268: 1–26. URL

Kakarot-Handtke, E. (2013). Settling the Theory of Saving. SSRN Working Paper Series, 2220651: 1–23. URL

Keynes, J. M. (1973). The General Theory of Employment Interest and Money. The Collected Writings of John Maynard Keynes Vol. VII. London, Basingstoke: Macmillan. (1936).

July 15, 2013

Anything goes — for a while (I)

Blog-Reference

Your post comes to the heart of the matter. Please allow me to answer it in two separate parts. The second part will follow within one or two days.

(1a) I am aware that you wrote an article about who is a Post Keynesian. By rephrasing Eichner's title [Why Economics is Not Yet a Science] I by no means intended to take a hand in that discussion. Whether Eichner is a Post Keynesian or not is tangential to the content of my paper Why Post Keynesianism is Not Yet a Science (2013).

(1b) My point of departure is the quote: “For Keynes, as for Post Keynesians the guiding motto is 'it is better to be roughly right than precisely wrong!'" (Davidson, 1984, p. 574). It is this motto that I attack because it provides the justification for conceptual carelessness and I am by no means the first to realize that intellectual sloppiness is the hallmark of both neoclassical and Keynesian economics:

“I think it is the lack of quite sharply defined concepts that the main difficulty lies, and not in any intrinsic difference between the fields of economics and other sciences.” (von Neumann, quoted in Mirowski, 2002, p. 146 fn. 49), see also Confused Confusers: How to Stop Thinking Like an Economist and Start Thinking Like a Scientist (2013).

(1c) The methodological anything-goes mentality is the main reason for the proto-scientific condition of theoretical economics.

(1d) The stated purpose of my paper is to demonstrate that conceptual and formal sloppiness leads to theoretical errors. It is well known that a theory that contains logical errors is worthless even if it makes good sense from a political point of view. To resume that Keynesianism is logically defective is not anti-Keynesian. The errors can be corrected and it can even be shown that some of Keynes' verbal statements that were hitherto hanging in the air are fortified by a correct formal underpinning. That is: axiomatization is healthy for Post Keynesianism.

(1e) I have demonstrated that a correct formalism would have saved the life of Post Keynesianism in the Phillips Curve debate, see Keynes Employment Function and the Gratuitous Phillips Curve Disaster (2012).

(1f) I think two of your statements deserve rigorous refutation:

• You can define anything you want but as a sage once said: “A rose by any other name will smell as sweet!”

• ... the two cited equations [Y=C+I, S=Y−C] are simply accounting identities — and by definition, they can not be false as long as one accepts the definitions. But I=S is merely an ex-post accounting identity and by itself is just as true for neoclassical economics as for anything else — including Marxian economics.

(1g) I have refuted the first statement in Keynes's Missing Axioms (2011, Sec. 17-20) and Why Post Keynesianism is Not Yet a Science (2013, Sec. VI-VIII)

(1h) I have refuted the second statement in The Common Error of Common Sense: An Essential Rectification of the Accounting Approach (2012).

For details see my forthcoming post.

Egmont Kakarot-Handtke

References

Davidson, P. (1984). Reviving Keynes’s Revolution. Journal of Post Keynesian Economics, 6(4): 561–575. URL

Kakarot-Handtke, E. (2011). Keynes’s Missing Axioms. SSRN Working Paper Series, 1841408: 1–33. URL

Kakarot-Handtke, E. (2012a). The Common Error of Common Sense: An Essential Rectification of the Accounting Approach. SSRN Working Paper Series, 2124415: 1–23. URL

Kakarot-Handtke, E. (2012b). Keynes’s Employment Function and the Gratuitous Phillips Curve Disaster. SSRN Working Paper Series, 2130421: 1–19. URL

Kakarot-Handtke, E. (2013a). Confused Confusers: How to Stop Thinking Like an Economist and Start Thinking Like a Scientist. SSRN Working Paper Series, 2207598: 1–16. URL

Kakarot-Handtke, E. (2013b). Why Post Keynesianism is Not Yet a Science. Economic Analysis and Policy, 43(1): 97–106. URL

Mirowski, P. (2002). Machine Dreams. Cambridge: Cambridge University Press.

July 14, 2013

Hopeless, but not serious

Blog-Reference

Perhaps we agree on the following.

The neoclassical approach is inadmissible. This needs no further elaboration because enlightened Neoclassicals have already abandoned it.

The Keynesian approach is inadmissible because it is formally defective. The proof has been given in (2013).

The heterodox camp has unearthed many flaws of standard economics but failed to develop an alternative that satisfies scientific standards, i.e. material and formal consistency.

Even Paul Schächterle's fresh theory of the labor market cannot give us much impetus because he overlooked that it is well-known textbook stuff (Samuelson and Nordhaus, 1998, p. 229, Fig. 13-4).

As an old Viennese saying goes: the situation is hopeless, but not serious.

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2013). Why Post Keynesianism is Not Yet a Science. Economic Analysis and Policy, 43(1): 97–106. URL

Samuelson, P. A., and Nordhaus, W. D. (1998). Economics. Boston, Burr Ridge, etc.: Irwin, McGraw-Hill, 16th edition.

July 13, 2013

Vaguely right could simply be vaguely wrong

Blog-Reference

(a) It is not the question of what I prefer or like; it is the question of what is a scientific proposition.

(b) It is important to distinguish between method and actual application. Spinoza used the axiomatic method to prove the existence of God. This, obviously, is a misapplication. This misapplication is no argument against the method. By defending the method, I do not defend the neoclassical axioms. That is a shortcut of your own making.

(c) If you prefer the vague right, you must already know what is right. However, there is no criterion to discriminate between vaguely right and vaguely wrong. Finally, if you already know what is right, why are you content with vaguely right? The argument is silly because it presupposes what it tries to prove.

(d) The first rule of science is that there is no such thing as a pure and simple fact.

(e) You can look out of the window and say the sun rises. That's not science, that is common sense. As J. S. Mill put it: “People fancied they saw the sun rise and set, the stars revolve in circles round the pole. We now know that they saw no such thing; what they really saw was a set of appearances, equally reconcileable with the theory they held and with a totally different one. It seems strange that such an instance as this, ..., should not have opened the eyes of the bigots of common sense, and inspired them with a more modest distrust of the competency of mere ignorance to judge the conclusions of cultivated thought.” (Mill, 2006, p. 783). It certainly did not open the eyes of Paul Schächterle.

(f) If Malthus refreshes you, that's ok. Unfortunately, you are in the wrong movie. Science is not about wellness but about knowledge.

(g) Neither Malthus, nor Keynes, nor you, nor anybody else can grasp the essence of real economic movements and relations by looking out of the window: “Since, therefore, it is vain to hope that truth can be arrived at, either in Political Economy or in any other department of the social science, while we look at the facts in the concrete, clothed in all the complexity with which nature has surrounded them, and endeavour to elicit a general law by a process of induction from a comparison of details; there remains no other method than the à priori one, or that of ‘abstract speculation.’” (Mill, 2004, pp. 113-114)

Egmont Kakarot-Handtke

References

Mill, J. S. (2004). Essays on Some Unsettled Questions of Political Economy, chapter On the Definition of Political Economy; and the Method of Investigation Proper to It, 93–125. Electronic Classic Series PA 18202: Pennsylvania State University. URL

Mill, J. S. (2006). A System of Logic Ratiocinative and Inductive. Being a Connected View of the Principles of Evidence and the Methods of Scientific Investigation, Vol. 8 of Collected Works of John Stuart Mill. Indianapolis: Liberty Fund.

What Keynesian revolution?

Blog-Reference

There are two kinds of revolutions, political and scientific, and you are in the wrong movie. The Keynesian Revolution was intended as a scientific revolution: “But, if my explanations are right, it is my fellow economists, not the general public, whom I must first convince. At this stage of the argument the general public, though welcome at the debate, are only eavesdroppers at an attempt by an economist to bring to an issue the deep divergences of opinion between fellow economists which have for the time being almost destroyed the practical influence of economic theory, and will, until they are resolved, continue to do so.” (Keynes, 1973, p. xxi)

Political revolutions are usually not started by politely throwing the public out of the auditorium.

Keynes and his contemporaries witnessed two scientific revolutions. In physics, Einstein put forth the theory of relativity, in mathematics Hilbert put forth the axiomatic method. Both scientific revolutions were recognized by their contemporaries as such. Keynes, like most economists before him, tried to profit from the prestige and triumph of the real sciences to sell a paltry piece of common sense.

The physicists got the GENERAL Theory of Relativity, and Keynes titled his book the GENERAL Theory. The mathematicians got the non-Euclidean axioms, Keynes threw over the second postulate of the classical doctrine [The utility of the wage ...] and declared this as akin to throwing over Euclid's axiom of parallels (Keynes, 1973, p. 17).

Keynes' talk of generality and axioms was sales talk for his fellow economists. He understood the axiomatic method but he did not apply it, quite the contrary: “There is, however, no absolute need to start with axioms, let alone particular ones, or even with abstraction. There is a role for historical generalisation, which relies on one of the most important logical tools, pattern recognition (metaphor, analogy); and a role for argument from first principles. Both of these procedures are part of what Keynes called ‘human logic’ in contrast to ‘formal logic.’” (Keynes, quoted in Chick, 1998, p. 1860)

Keynes never intended to leave the realm of common sense (aka human logic) “where nothing is clear and everything is possible” (see Section 3 of my paper in Real-World Economics Review, Issue No. 63, 2013).

It was the Neoclassicals who recognized that there is a real problem and tried to get out of the perennial verbiage of Political Economy: “The very definition of an economic concept is usually subject to a substantial margin of ambiguity. An axiomatized theory substitutes for an ambiguous economic concept a mathematical object that is subject to entirely definite rules of reasoning.” (Debreu, quoted in Ingrao et al., 1990, p. 287)

Let us face the facts: on the methodological point, the Neoclassicals are definitively superior. Keynesianism and axiomatization are a contradiction in terms. The Post Keynesians explicitly defend 'incoherent Babylonian babble' with their silly slogan “It is better to be vaguely right than precisely wrong” (for details see 2013, p. 96).

Time for Heterodoxy to stop wordplay with collision of parallels and collusion of capitalists and to start an intellectual revolution of their own. If Heterodoxy means something scientific then you have to put heterodox axioms against orthodox axioms or, as Keynes advertised, get up and move from Euclidean axioms to non-Euclidean axioms. This is a tough formal exercise.

Egmont Kakarot-Handtke

References

Chick, V. (1998). On Knowing One’s Place: The Role of Formalism in Economics. Economic Journal, 108(451): 1859–1869. URL

Ingrao, B., and Israel, G. (1990). The Invisible Hand. Economic Equilibrium in the History of Science. Cambridge, London: MIT Press.

Kakarot-Handtke, E. (2013a). Crisis and Methodology: Some Heterodox Misunderstandings. real-world economics review, 63: 98–117. URL

Kakarot-Handtke, E. (2013b). Why Post Keynesianism is Not Yet a Science. Economic Analysis and Policy, 43(1): 97–106. URL

Keynes, J. M. (1973). The General Theory of Employment Interest and Money. The Collected Writings of John Maynard Keynes Vol. VII. London, Basingstoke: Macmillan.

July 12, 2013

Keynes, Euclid, and economic methodology

Blog-Reference

Since each economist starts from some premises, all economists apply — consciously or unconsciously, correctly or incorrectly — the axiomatic method. Keynes, of course, was aware of the history of economic thought: “To Senior belongs the signal honor of having been the first to make the attempt to state, consciously and explicitly, the postulates that are necessary and sufficient in order to build up … that little analytic apparatus commonly known as economic theory, or to put it differently, to provide for it an axiomatic basis.” (Schumpeter, 1994, p. 575)

Political economists start from implicit value judgments (the market system works better, capitalism is unjust, etc.) and then argue their case. These kinds of value judgments may emerge as the conclusion of the analysis, but it is inadmissible to put them into the premises. Theoretical economists accept that each theory has a kind of architecture and state their premises explicitly: “Everyone uses 'theory' in multifarious senses. ... But in discriminating usage, the term generally denotes a logical edifice.” (Georgescu-Roegen, 1966, p. 108)

The correct procedure, therefore, is as follows: “The attempt is made to collect all the assumptions, which are needed, but no more, to form the apex of the system. They are usually called the ‘axioms’ (or ‘postulates’, or ‘primitive propositions’; no claim of truth is implied in the term ‘axiom’ as here used). The axioms are chosen in such a way that all the other statements belonging to the theoretical system can be derived from the axioms by purely logical or mathematical transformations.” (Popper, 1980, p. 71)

Logical consistency is not something nice to have, it is essential for applicability: “They [economists] want to contribute to the solution of urgent practical problems. ... Of course, they also pursue the consistency of the theories they make, for he who contradicts himself proves nothing.” (Klant, 1988, pp. 112-113)

The crucial part of theory building is the choice of foundational propositions: “What are the propositions which may reasonably be received without proof? That there must be some such propositions all are agreed, since there cannot be an infinite series of proof, a chain suspended from nothing. But to determine what these propositions are, is the opus magnum of the more recondite mental philosophy.” (Mill, 2006, p. 746)

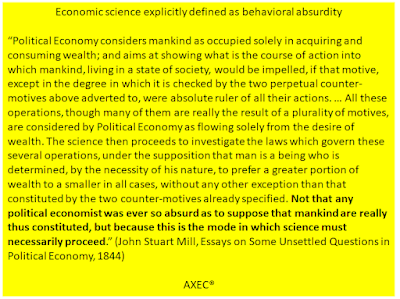

One of the fundamental propositions of standard economics is a behavioral assumption that, imprudently, has been selected as an axiom: “Central to the question of formalisation is the role of the rationality axioms. The internal goal, derived from a particular form of mathematics, of developing a closed, axiomatic, mathematically-expressed theoretical system which yielded equilibrium solutions required reductionist axioms of deterministic individual behaviour.” (Dow, 1997, p. 83)

The rationality axiom implies utility maximization and profit maximization. There are several reasons why the rationality assumption cannot be accepted as an axiom but one is sufficient, it lacks the ‘requisite self-evident generality’: “But a principle that is not universally true is false. Thus the rationality principle is false. I think there is no way out of this. ... Now if the rationality principle is false, then an explanation that consists of the conjunction of this principle and a model must also be false, even if the particular model is true.” (Popper, 1994, pp. 172-173)

The irony of the Keynesian Revolution, which, in the last instance, explains its failure, is that it retained the immediate derivatives of the false rationality axiom: “Two axioms of classical economics that Keynes kept, however, and with which keeping Davidson concurs, are (1) people are self-interested and try to protect their income and wealth; and that (2) firms try to maximize profits.” (see intro)

These axioms always come with a caveat to make it clear that economists are indeed hard-nosed realists: “Not that any political economist was ever so absurd as to suppose that mankind are really thus constituted, but because this is the mode in which science must necessarily proceed.” (J. S. Mill, 2004, p. 106)

Somehow, the Post Keynesians never perceived that something had gone wrong on the way from the Euclidean to the non-Euclidean axioms. For them, and for all those interested in the proper axiomatization of Keynes' theory, I have untangled the mess in Keynes's Missing Axioms (2011).

Egmont Kakarot-Handtke

References

Dow, S. C. (1997). Mainstream Economic Methodology. Cambridge Journal of Economics, 21: 73–93.

Georgescu-Roegen, N. (1966). Analytical Economics, chapter General Conclusions for the Economist, 92–129. Cambridge: Harvard University Press.

Kakarot-Handtke, E. (2011). Keynes’s Missing Axioms. SSRN Working Paper Series, 1841408: 1–33. URL

Klant, J. J. (1988). The Natural Order. In N. de Marchi (Ed.), The Popperian Legacy in Economics, 87–117. Cambridge: Cambridge University Press.

Mill, J. S. (2004). Essays on Some Unsettled Questions of Political Economy, chapter On the Definition of Political Economy; and the Method of Investigation Proper to It., 93–125. Electronic Classic Series PA 18202: Pennsylvania State University. URL

Mill, J. S. (2006). Principles of Political Economy With Some of Their Applications to Social Philosophy, Volume 3, Books III-V of Collected Works of John Stuart Mill. Indianapolis: Liberty Fund. URL

Popper, K. R. (1980). The Logic of Scientific Discovery. London, Melbourne, Sydney: Hutchison, 10th edition.

Popper, K. R. (1994). The Myth of the Framework. In Defence of Science and Rationality. London, New York: Routledge.

Schumpeter, J. A. (1994). History of Economic Analysis. New York: Oxford University Press.

Opinion vs Knowledge

Blog-Reference

Campaigning for a good cause, whatever it is, is politics. Politics is the opposite of science. As one can glean from the history of Political Economy, the good/bad discussion has achieved nothing of scientific value and only hampered the true/false discussion of theoretical economics. This is why economics is still at the pre-scientific stage: “The position I now favor is that economics is a pre-science, rather like astronomy before Copernicus, Brahe and Galileo. I still hold out hope of better behavior in the future, but given the travesties of logic and anti-empiricism that have been committed in its name, it would be an insult to the other sciences to give economics even a tentative membership of that field.” (Keen, 2011, p. 158)

The bad scientist cranks out opinions, and the good scientist contributes to knowledge.

Egmont Kakarot-Handtke

References

Keen, S. (2011). Debunking Economics. London, New York: Zed Books, rev. edition.

July 10, 2013

Economics is NOT a science of behavior (I)

Blog-Reference

You say that trust is important for the functioning of the market system. I agree. So does standard economics. To verify this, please go to Google Scholar and enter ‘trust’ and ‘transaction costs.’

Standard economics will tell you that trust lowers transaction costs and therefore makes a significant contribution to profit maximization. You and neoclassical economics are in full harmony.

It is not the task of theoretical economics to see how religious or civic communities function. This is the task of sociology and psychology. It is the task of theoretical economics to explain how the economic system works. This is something quite different.

As Hudík put it: “The purpose of this paper is to criticise the notion that economics is a science of behaviour or that a science of behaviour is fundamental to economics. This plausible and, as I believe, mistaken idea has sometimes been called (methodological) psychologism, and I follow here this terminology. In opposition to psychologism I put forward the notion of economics as a study of spontaneous order independent of any behavioural science. My argument is based on the important contributions of Hayek and Popper. If it is correct, then all the attempts to derive an adequate model of economic behaviour (as practised, for example, by the representatives of ‘behavioural’ or ‘psychological economics’) are misconceived.” (2011, p. 147)

Egmont Kakarot-Handtke

References

Hudík, M. (2011). Why Economics is Not a Science of Behaviour. Journal of Economic Methodology, 18(2): 147–162.

Related 'Economics is NOT a science of behavior (II)' and 'Economics is NOT a science of behavior (III)' and 'Economics is NOT a science of behavior (IV)' and 'Economics is not a science, not a religion, but proto-scientific garbage' and 'A social science is NOT a science but a sitcom' and cross-references Not a Science of Behavior

July 9, 2013

Alternatives are welcome

Blog-Reference

If you think that standard economics produces “pure shit” (this thread's implicit consensus) then you are at a loss to explain why the German Historical School did not do better in the last 100 years than it actually did. Humboldt would not have approved of this performance.

As a matter of fact, it is quite simple to get the Neoclassicals out of academia: “There is no evidence to suggest that economists abandon degenerating programs in the absence of a progressive alternative. We do not, in the face of falsified theories in the belt of a program, abandon that program until there is an alternative program with theories that are themselves corroborated.” (Weintraub, 1985, p. 148)

“... if you think you can do better with a non-neoclassical model ..., then you are quite welcome to try.” (Boland, 1992, p. 19)

GHT has its merits but it is not the progressive alternative.

Egmont Kakarot-Handtke

References

Boland, L. A. (1992). The Principles of Economics. Some Lies My Teacher Told Me. London, New York: Routledge.

Weintraub, E. R. (1985). Joan Robinson’s Critique of Equilibrium: An Appraisal. American Economic Review, Papers and Proceedings, 75(2): 146–149. URL

July 8, 2013

Historians don't get it

Blog-Reference

As a historian and defender of the idiographic method you actually face this trouble: “... the Dutch historian Peter Geyl ... wrote a brilliant book about Napoleon, amounting to the result that there are a dozen or so different interpretations ― we may safely say, models ― of Napoleon's character and career within academic history, all based upon “fact” (the Napoleonic period happens to be one of the best documented) and all flatly contradicting each other. Roughly speaking, they range from Napoleon as the brutal tyrant and egoistic enemy of human freedom to Napoleon the wise planer of a unified Europe; ... (von Bertalanffy, 1969, pp. 110-111)

As I put it in #62: “Verstehen [understanding] cannot lead to much more than to a gossip model of the world.”

At this point, we can borrow something really helpful from the natural sciences.

The flying autumn leaf and the falling cannonball both belong to the physical realm. The physicists completely ignore the leaf. Why? You can watch as many leaves as you please, but you will, at best, arrive at the “historical law” that all leaves sooner or later fall to the ground. That's not wrong, of course. It is realistic, it is inductive, it has been tested, and we all can agree upon it. Very complex, hum hum, we need further research. We know that Galileo found the law of the falling bodies by throwing cannonballs from the tower of Pisa (he may actually have performed this as a pure thought experiment).

By focusing on the rather boring cannonball and ignoring the wonderful trajectory of the red leaf in the autumn sunshine, Galileo came closer to reality than the realists, who never forget to bemoan the poverty of quantities and to praise the richness of qualities. Ignorance/Modesty is a good research strategy. This does not entail that one denies the existence of flying autumn leaves; it entails only that one cannot expect to learn much from them.

Historians who claim that, on principle, one cannot find something like laws in the economy may be right. We cannot know in advance. What we know is that there are NO behavioral laws like utility maximization. But this does not exclude other types that can be discovered. G. B. Shaw may have had historians at the back of his mind when he quipped: “People who say it cannot be done should not interrupt those who are doing it.”

Egmont Kakarot-Handtke

References

von Bertalanffy, L. (1969). General Systems Theory. New York: Braziller.

July 5, 2013

Demarcation

Blog-Reference

Myth, well told, is still the most convincing way to explain how the world and humankind came to be in their present form. To recall, Zeus was the god of sky and thunder. He oversaw the universe, assigned the various gods their roles, and was known for his erotic escapades. Zeus was emotional, and spontaneous and had a lot of trouble with other gods, goddesses, and humans. At Prometheus, for example, he was angry for three things: being tricked on sacrifices, stealing fire for Man, and refusing to tell him which of his children would dethrone him. To handle his problems, Zeus regularly fell back to chicanery, force, and violence (for details see Wikipedia). Purified from all religious connotations this is the stuff soap operas are made of until today. Let us call this the gossip model of the world.

The ancient Greeks regarded myths as ‘true stories’ and distinguished them from fables as ‘false stories’. Xenophanes made his contemporaries aware that their ‘true stories’ were what is now called a projection (Popper, 1994, p. 39).

With this, the problem of demarcation arose for the first time. And it was easily solved. The pre-Socratics rejected any mythological explanations of the world because they saw that everything could be explained by the actions of gods which meant on closer inspection: nothing. This methodological insight set science on its track.

Popper, for one, put the demarcation criterion to work. He rejected psychoanalysis because it could explain everything even why it did not work as intended. He rejected Marxism because it could explain post factum why the Revolution happened in a less advanced country instead of in the most advanced, which should have happened according to Marx's best-known prediction.

It might seem that the original demarcation is a matter of history. This is not so. When Dawkins refuses to discuss with a creationist, we are back at the fundamental methodological decision that constituted science. Demarcation is a question that reappears continuously in new settings.

Economics faces the following alternative. If it wants to be accepted as science it has to stick to the rules. The rules are quite simple: material and logical consistency (Klant, 1994, p. 31). No excuses (complexity, Duhem-Quine, etcetera), no pork sausage (inexact, separate). If economics cannot deliver on principle, as Robert Locke maintains, it has to join the Geisteswissenschaften and try its luck with Verstehen (see Drechsler's article). Verstehen, however, cannot lead to much more than a gossip model of the world. People like this kind of stuff, but that's not science. Everybody can understand why Zeus throws the thunderbolt, but no way leads from there to the lightning rod.

Egmont Kakarot-Handtke

References

Klant, J. J. (1994). The Nature of Economic Thought. Aldershot, Brookfield: Edward Elgar.

Popper, K. R. (1994). The Myth of the Framework. In Defence of Science and Rationality. London, New York: Routledge.

July 3, 2013

Where is profit?

Blog-Reference

What a coincidence! You sum up: To say it with a Keynes quip: “It is better to be vaguely right than precisely wrong.” In #26 I referred Paul Davidson to a paper of mine which starts on p. 96 with the quote: “For Keynes as for Post Keynesians the guiding motto is ‘it is better to be roughly right than precisely wrong!’ (Davidson, 1984, p. 574).” The title of the paper is: Why Post Keynesianism is Not Yet a Science.

Let us start with a point that is beyond the slightest doubt. Keynes’ formal groundwork consisted in the main of two equations, i.e., Y=C+I and S=Y–C. (1973, p. 63). From this follows I=S immediately, and later the multiplier.

The first question is: Where is profit? How can Keynes present a formalization of the economy we happen to live in without mentioning profit? Keynes, of course, was fully aware that profit is the pivotal magnitude in the market system, and he defined on p. 23 that total income is the sum of factor costs and profit. The problem is that this definition does not harmonize with the formal groundwork above. Keynes knew this.

“His [Keynes's] Collected Writings show that he wrestled to solve the Profit Puzzle up till the semi-final versions of his GT but in the end he gave up and discarded the draft chapter dealing with it.” (Tómasson and Bezemer, 2010, pp. 12-13, 16)

My paper is a formal demonstration that the correct relation reads Qm≡I−Sm+Yd, i.e., total monetary profit in period t is given by the difference of the business sector’s investment expenditures and the household sector’s monetary saving plus distributed profits of the business sector. This implies that Keynes' I=S or the ex-ante/ex-post rationalization is untenable.‡

In sum, Keynes' profit theory is wrong, and because of this, the investment-equals-saving proposition is false. Now, there is no need to go any further, because: “Even if we cannot prove a theory or model is true, at the very minimum to be true it must be logically consistent.” (Boland, 2003, p. 24).

The General Theory is inconsistent, and Keynes's intellectual heirs never rectified it. Therefore, neither original Keynesianism nor its modern reincarnations or bastardizations can be accepted as a successor to neoclassics which has debunked itself recently.

How does Davidson comment on this fatal situation in #29? “You can define anything you want, but as a sage once said, ‘A rose by any other name will smell as sweet!’”

Economics could be a real science if economists were real scientists.

Egmont Kakarot-Handtke

References

Boland, L. A. (2003). The Foundations of Economic Method. A Popperian Perspective. London, New York: Routledge, 2nd edition.

Davidson, P. (1984). Reviving Keynes’s Revolution. Journal of Post Keynesian Economics, 6(4): 561–575. URL

Keynes, J. M. (1973). The General Theory of Employment Interest and Money. The Collected Writings of John Maynard Keynes Vol. VII. London, Basingstoke: Macmillan.

Tómasson, G., and Bezemer, D. J. (2010). What is the Source of Profit and Interest? A Classical Conundrum Reconsidered. MPRA Paper, 20557: 1–34. URL

The moral of the story (I)

Blog-Reference

ad #31

Here is the acknowledgment: “... theorists all over the world have become aware that anything based on this mock-up is unlikely to fly since it neglects some crucial aspects of the world, the recognition of which will force some drastic re-designing.” (Hahn, 1981, p. 1036)

This acknowledgment, however, does not help much: “The moral of the story is simply this: it takes a new theory, and not just the destructive exposure of assumptions or the collection of new facts, to beat an old theory.” (Blaug, 1998, p. 703)

There is no way around it, what is needed is a convincing alternative.

Heterodoxy does a good and indispensable job of debunking. However, there are two forms of debunking:

(a) debunking a theory

(b) debunking a person or a group.

We certainly agree that (b) is inadmissible in scientific discourse. With conspiracy theories and moralizing (post #33, #35, and others) Heterodoxy debunks itself. In addition, economics is not mainly about the job problems of economists.

ad # 30

Theory entails the ambition to explain how the economy works including all phenomena like price, real wage, distribution, full employment, growth, depression, inflation/deflation, financial meltdown, etc. In this sense, we speak of Classical, Marxian, Walrasian, or Keynesian theory. To explain correctly why the consumer buys strawberry yogurt instead of raspberry yogurt is certainly desirable but no alternative to neoclassical theory. A heap of correct partial models is not a theory.

“The most intellectually exciting question of our subject remains: is it true that the pursuit of private interest produces not chaos but coherence, and if so, how is it done?” (Hahn, 1984, p. 102)

“Even if we cannot prove a theory or model is true, at the very minimum to be true it must be logically consistent.” (Boland, 2003, p. 24)

Egmont Kakarot-Handtke

References

Blaug, M. (1998). Economic Theory in Retrospect. Cambridge: Cambridge University Press, 5th edition.

Hahn, F. H. (1981). Review: A Neoclassical Analysis of Macroeconomic Policy. Economic Journal, 91(364): 1036–1039. URL

Hahn, F. H. (1984). Equilibrium and Macroeconomics. Cambridge: MIT Press.

July 2, 2013

Beside the point

Blog-Reference

The Dr. X story is reminiscent of Joan Robinson: “Indeed, in the higher reaches of the profession, there was something of the atmosphere of the augurs touching their noses behind the altar. Amongst themselves, they admitted it was not really like that. But their pupils took it all literally. They formed an official opinion deeply influenced by the conception of equilibrium which could be relied upon to establish itself provided that no one tried to interfere.” (1972, p. 3)

Why are stories like these told and retold again? We know from history that conspiracy theories are stupid in the best case and harmful in all others. There is no excuse in the political realm to bring these kinds of arguments into circulation, much less so in scientific discourse. As Schumpeter put it:

“Remember: occasionally, it may be an interesting question to ask why a man says what he says; but whatever the answer, it does not tell us anything about whether what he says is true or false.” (Schumpeter, 1994, p. 11)

Yes, neoclassical economics is a failure. How can we be sure of it? Because neoclassicals themselves told us: “The enemies, on the other hand, have proved curiously ineffective and they have very often aimed their arrows at the wrong targets. Indeed, if it is the case that today General Equilibrium Theory is in some disarray, this is largely due to the work of General Equilibrium theorists, and not to any successful assault from outside.” (Hahn, 1980, p. 127)

Hence, neoclassicals stick to the scientific code of 'conjecture and refutation.' They have explicitly put forth hypotheses and followed their logic until the final conclusion of Sonnenschein-Mantel-Debreu.

It is well known that science is a trial-and-error process. Therefore, it is quite “legitimate” to put forth and defend a “wrong” theory because we cannot know in advance whether a theory is true or false.

The problem in economics is peculiar because we know that the standard theory, as codified in the textbooks, is wrong, but we have had no alternative until now. Heterodoxy has been occupied with debunking since Veblen. There is nothing wrong with this, but obviously, from this has not emerged a convincing alternative: “... we may say that the long-lasting success of our categories and the omnipresence of a certain point of view is not a sign of excellence or an indication that the truth or part of the truth has at last been found. It is, rather, the indication of a failure of reason to find suitable alternatives which might be used to transcend an accidental intermediate stage of our knowledge.” (Feyerabend, 2004, p. 72)

The provisional predominance of neoclassics in the classroom is neither due to scientific superiority nor to a conspiracy, but to a failure of reason to find a convincing alternative.

Egmont Kakarot-Handtke

References

Feyerabend, P. K. (2004). Problems of Empiricism. Cambridge: Cambridge University Press.

Hahn, F. H. (1980). General Equilibrium Theory. Public Interest. Special Issue: The Crisis in Economic Theory, 123–138.

Robinson, J. (1972). The Second Crisis of Economic Theory. American Economic Review, 62(1/2): 1–10. URL

Schumpeter, J. A. (1994). History of Economic Analysis. New York: Oxford University Press.

May 29, 2013

Profit is the key

Blog-Reference:

It is laudable to direct students away from irrelevant economic models.

Orthodox economics is irrelevant from Jevons to DSGE. The problem is that Heterodoxy from Veblen to Minsky is only slightly better. With a critical stance, it is easy to identify and avoid the worst blunders of standard theory. Davidson is a case in point. Of course, the ergodic hypothesis is inapplicable in economics. Keynes was right word-for-word in what he said about uncertainty (1937, p. 214). The point is that this was only revolutionary vis-à-vis the 'classical' economists. Outside this intellectually closed sphere, the argument is trivial. The next taxi driver can tell you that ‘the price of copper and the rate of interest twenty years hence’ is uncertain. If this is scientific progress, it is not terribly impressive. It is a sad fact that heterodox economists have a strong bias to draw the wrong conclusions from correct observations. This brings us to Minsky.

Minsky (2008, p. 160) states correctly, “What determines profits? is a key question for understanding how our economy works.” Clearly, it is irresponsible to give economic advice without a proper understanding of profit. With his zero-profit economy, Walras demonstrated a complete lack of understanding. Therefore, he and the neo-Walrasians are out. However, the General Theory is also based on a false profit theory (Tómasson and Bezemer, 2010), which has not been rectified by the Post Keynesians (Kakarot-Handtke, 2013), (Desai, 2008, p. 10). Therefore, Keynesian models, including bastardizations like IS-LM, are out, too.

What about Minsky in particular? He tells us: “The simple equation 'profit equals investment' is the fundamental relation for macroeconomics that aims to determine the behavior through time of a capitalist economy with a sophisticated, complex financial structure.” (2008, p. 161)

Unfortunately, this simple equation covers only a limiting case. This is not much in absolute terms, but considerably more than what IS-LM, which is a zero-profit model, ever had to offer. Minsky, too, got macroeconomic profit wrong. The axiomatically correct formula for the elementary case reads Qm≡I−Sm Legend: Qm business sector's monetary profit, I investment expenditures, Sm household sector's monetary saving. Minsky implies Sm=0, IS-LM implies Qm=0. Macroeconomics has been proto-scientific garbage since Keynes.

It is a mission impossible these days to direct students to relevant economic models because there are none.

Egmont Kakarot-Handtke

References

Desai, M. (2008). Profit and Profit Theory. In S. N. Durlauf, and L. E. Blume (Eds.), The New Palgrave Dictionary of Economics Online, 1–11. Palgrave Macmillan, 2nd edition. URL

Kakarot-Handtke, E. (2013). Why Post Keynesianism is Not Yet a Science. Economic Analysis and Policy, 43(1): 97–106. URL

Keynes, J. M. (1937). The General Theory of Employment. Quarterly Journal of Economics, 51(2): 209–223. URL

Minsky, H. P. (2008). Stabilizing an Unstable Economy. New York, Chicago, San Francisco: McGraw-Hill, 2nd edition.

Tómasson, G., and Bezemer, D. J. (2010). What is the Source of Profit and Interest? A Classical Conundrum Reconsidered. MPRA Paper, 20557: 1–34. URL

May 19, 2013

Key Issues: Logic and platitude

Deductive logic is one pattern of rationality in reasoning, but it is not the only one; good reasoning in science typically yields conclusions that go beyond the logical entailments of deductive logic. (Suppe, 1977, p. 657)

The economists of the twentieth century, by pushing the neoclassical model to its logical conclusions, and thereby illuminating the absurdities of the world which they had created, have made an invaluable contribution to the economics of the coming century: they have set the agenda, work on which has already begun. (Stiglitz, 1991, p. 136)

For if orthodox economics is at fault, the error is to be found not in the superstructure, which has been erected with great care for logical consistency, but in a lack of clearness and of generality in the premises. (Keynes, 1973, p. xxi)

***

For Keynes as for Post Keynesians the guiding motto is "it is better to be roughly right than precisely wrong!" (Davidson, 1984, p. 574)

Marshall followed the maxim: Better to be ambigous and relevant than precise and irrelevant. (Colander, 1995, p. 283)

It is well known that John Maynard was born anew every morning; for this reason, his colleagues at Bretton Woods commented that he was too intelligent to be consistent. (Valentino, 1988, p. 239)

... a remorseless logician can end up in Bedlam. (Keynes, quoted in Moggridge, 1976, p. 36)

But Keynes, too, sometimes gave the impression of not having fully grasped the logic of his own system. (Laidler, 1999, p. 281)

Toutes ses [Keynes’s] deductions, à notre avis, manquent absolument de rigeur. ... L’intuition de Keynes lui a fait sentir où se trouvaient les difficultés, mais son insuffisance logique ne lui a pas permis de résoudre les problèmes que son intuition lui avait fait entrevoir. (Allais, 1993, p. 70)

Even if we cannot prove a theory or model is true, at the very minimum to be true it must be logically consistent. (Boland, 2003, p. 24)When we define the ambition of science as getting it precisely right, then the guiding motto of Post Keynesianism amounts to an invitation to ‘Babylonian incoherent babble’ and leads, predictably, to a loss of theoretical coherence. Confronted with the phony alternative relevance vs. rigor or truth vs. precision, the non-Keynesians opted for rigor: "Mathematical economics, it seems, had the great virtue of demonstrable irrelevance, which was morally preferable to spurious relevance." (Porter, 1994, p. 155)

... each chief step in science has been a lesson in logic. (Peirce, 1992, p. 111)

Research is in fact a continuous discussion of the consistency of theories: formal consistency insofar as the discussion relates to the logical cohesion of what is asserted in joint theories; material consistency insofar as the agreement of observations with theories is concerned. (Klant, 1994, p. 31)

Economists today do not wish to discuss the ‘truth’ of economic theories but only examine their logical validity. (Boland, 1992, p. 36)

Logical validity is indispensable. However, if the premises are false, the logical validity of the conclusions is pointless. Truth resides in the axioms, not in the deductive process. Because of a logical blind spot — the place one stands on is, for the moment, invisible — economists today cannot see that they operate with inadmissible axioms. Logical validity is indispensable but not sufficient.

And so — faithful to the theory's conceptual cornerstones and hoping against all hope that the unthinkable may still be achieved (i.e., a satisfactory theory of the price mechanism) — the tormented upholders of the validity of the paradigmatic core of economic equilibrium theory appear singularly reluctant to face the problem of comparing expectations and results and assessing the consistency of the theory. (Ingrao and Israel, 1990, p. 346)Formal consistency does not count for much if the axioms lack material consistency. Realism does not count for much if it cannot be properly formalized.

We are lost in a swamp, the morass of our ignorance. ... We have to find the roots and get ourselves out! ... Braids or bootstraps are necessary for two purposes: to pull ourselves out of the swamp and, afterwards, to keep our bits and pieces together in an orderly fashion. (Schmiechen, 2009, p. 11)Logical bootstrapping is what axiomatization is all about. Therefore, one has to jump to new premises to see the defects of the previous premises. There is no path between them. Axiom Sets are incommensurable; there is no synthesis and no continuity, the previous set is simply abandoned. In practical terms, this means: both Walrasians and Keynesians are left behind the curve for good. Both approaches can still fulfill a useful role as practical examples of how not to do science.

Allais, M. (1993). Les Fondements Comptable de la Macro-Économie. Paris: Presses Universitaires de France, 2nd edition.

Boland, L. A. (1992). The Principles of Economics. Some Lies My Teacher Told Me. London, New York: Routledge.

Boland, L. A. (2003). The Foundations of Economic Method. A Popperian Perspective. London, New York: Routledge, 2nd edition.

Colander, D. (1995). Marshallian General Equilibrium Analysis. Eastern Economic Journal, 21(3): 281–293. URL

Davidson, P. (1984). Reviving Keynes’s Revolution. Journal of Post Keynesian Economics, 6(4): 561–575. URL

Hudson, M. (2010). The Use and Abuse of Mathematical Economics. real-world economics review, (55): 2–22. URL

Ingrao, B., and Israel, G. (1990). The Invisible Hand. Economic Equilibrium in the History of Science. Cambridge, London: MIT Press.

Keynes, J. M. (1973). The General Theory of Employment Interest and Money. The Collected Writings of John Maynard Keynes Vol. VII. London: Macmillan.

Klant, J. J. (1994). The Nature of Economic Thought. Aldershot, Brookfield: Edward Elgar.

Laidler, D. (1999). Fabricating the Keynesian Revolution. Cambridge: Cambridge University Press.

Moggridge, D. E. (1976). Keynes. London, Basingstoke: Macmillan.

Peirce, C. S. (1992). The Fixation of Belief. In N. Houser, and C. Kloesel (Eds.), The Essential Peirce. Selected Philosophical Writings, Vol. 1,109–123. Bloomington: Indiana University Press, (1877).

Porter, T. M. (1994). Rigor and Practicality: Rival Ideals of Quantification in Nineteenth-Century Economics. In P. Mirowski (Ed.), Natural Images in Economic Thought, 128–170. Cambridge: Cambridge University Press.

Schmiechen, M. (2009). Newton’s Principia and Related ‘Principles’ Revisited, volume 1. Norderstedt: Books on Demand, 2nd edition.

Stiglitz, J. E. (1991). Another Century of Economic Science. Economic Journal, 101(404): 134–141. URL

Suppe, F. (1977). Afterword. In F. Suppe (Ed.), The Structure of Scientific Theories, 615–730. Urbana, Chicago: University of Illinois Press.

Valentino, R. (1988). Discussion. In H. Hanusch (Ed.), Evolutionary Economics. Applications of Schumpeter’s Ideas, 238–249. Cambridge, New York, etc.: Cambridge University Press.

Related 'Why Post Keynesianism is Not Yet a Science URL' and 'Crisis and Methodology, Sec. 3 URL' and 'Objective Principles of Economics URL'.

© 2013 EKH, except original quotes

Key Issues: Profit

Dear representative economist, if you apply a conception of total monetary profit that is, in the elementary case, different from Qm≡EC−Y+DN ⇓, your theory is demonstrably false and therefore inappropriate for the solution of real-world problems. The definition of profit is not a matter of personal taste but of logical and material consistency. Ultimately, the selection of axioms determines analytical success or failure.

If you are a businessman, you know the particular profit determinants of your firm, but this does not give you the determinants of total profit for the business sector as a whole. The generalization of partial truths is prone to the Fallacy of Composition. From individual experience, no correct profit theory follows. Because of this, business people do not know better than average citizens how the economy works.

If you are a consultant or advisor and your background knowledge contains assertions like: the value of the product equals the value of factor incomes, total income is the sum of wages and profits, distributed profit is equal to profit, or saving equals investment, your advice is not based on state-of-the-art analysis and is, at best, useless.

If you are a student, you are expected to find out whether your teacher's theory is true or false, or incomplete. Growth of knowledge is what science is all about. The acceptance of basic tenets of conventional economics is indicative of a lack of scientific acumen. From a student who has accepted supply-demand-equilibrium as an explanation, not much is to be expected.

With regard to the formal foundations of a Paradigm, it is not the case that anything goes. John Stuart Mill clearly stated the key question:

What are the propositions which may reasonably be received without proof? That there must be some such propositions all are agreed, since there cannot be an infinite series of proof, a chain suspended from nothing. But to determine what these propositions are, is the opus magnum of the more recondite mental philosophy.

Neither Orthodoxy nor Heterodoxy has accomplished the opus magnum. Economics is still at the stage of a proto-science. A 'sequence of models' (Koopmans) is no substitute for a comprehensive theory that realizes both formal and material consistency.

By looking at a single firm, it seems that profit depends on (List A):

- exploitation of the workforce

- innovation

- risk-taking

- capital accumulation

- monopolistic practices

- market imperfections

- the combination of the factors of production

- wage rate and employment

- the talent of managers and the motivation of the workforce

- aggressive expansion at home and abroad

- bamboozling the consumer

- speculation, financial manipulation, fraud, cheating

- corruption, cronyism, gaming the system

- the loss of other firms.

These factors play a role when it comes to the distribution of profits between firms. But these factors cannot explain the profit of the business sector as a whole. The conventional view is that total profit must be zero in equilibrium under the condition of perfect competition. This is an analytical conclusion because one cannot directly observe this limiting case in the real world. The conclusion depends, as with every theory, logically upon the premises. Hence, it all depends on whether the axioms are true or false.

- by the relation of consumption expenditures to total income,

- by distributed profits in the period under consideration.

The first important conclusion of the macro-axiomatic analysis is that profit is a factor-independent residual and qualitatively different from wage income. Therefore, it is an elementary mistake to maintain that total income is the sum of wages and profits. The second conclusion is that there is a close relation between profit/loss and the expansion/contraction of credit for the economy as a whole. Therefore, it is an elementary mistake to identify profit with a physical surplus. The third conclusion is that there is no antagonism between total wages and total profits, and that the distribution of output has nothing at all to do with the behavioral concept of marginal productivity. The fourth conclusion is that innovation and efficiency are irrelevant for the profit of the business sector as a whole. It is a Fallacy of Composition to trivially generalize what can be observed in an individual firm. This applies to many other microeconomic observations.

The crucial point is that profit for the economy as a whole cannot be derived from the behavior of the individual firm. That is, the standard microeconomic approach cannot, as a matter of principle, deliver the correct profit theory. And when the profit theory is false, the other parts of a comprehensive approach are open to doubt. What is immediately obvious is that, as collateral damage, the familiar theories of income distribution and wealth distribution are wrong by logical implication.

A correct theory is the precondition of economic policy. This, of course, is not new: “We have long known that the conduct of economic policy requires the policy-maker to have a theory of how the economy works.” (D. Laidler). The conventional economist's combination of a sense of mission, flawed theory, and self-delusion is not of great help, if any.

Profit is the pivotal concept for the analysis of how the economy works. Without a correct profit theory, economics is vacuous. The conventional profit theory is logically indefensible. It is a unique fact of the history of economic thought that neither Classicals, nor Walrasians, nor Marshallians, nor Keynesians, nor Marxians, nor Institutionalists, nor Monetary Economists, nor Austrians, nor Sraffaians, nor Evolutionists, nor Game theorists, nor Econophysicists, nor RBCers, nor New Keynesians, nor New Classicals ever came to grips with profit. Hence, they 'fail to capture the essence'. There are many opinions but no scientific understanding of the market economy, neither on the national nor on the global level. Rational economic policy or the implementation of a rational economic order is, therefore, a priori impossible. Economists have no true conception of the most important phenomenon in their universe.Profit is a subject to which economists have addressed themselves for at least two hundred years, but without much success. For there is at the moment no general theory of profits which commands anything approaching universal acceptance either among academic economists or among men of affairs. (A. Wood)

His Collected Writings show that Keynes wrestled to solve the Profit Puzzle up till the semi-final versions of his General Theory but in the end he gave up and discarded the draft chapter dealing with it. (G. Tómasson and D. Bezemer)

A satisfactory theory of profits is still elusive. (M. Desai, New Palgrave Dictionary)

In the practical affairs of trade, industry and finance no concept is more fundamental or more familiar than profit. Yet to the questions what profit is, and by what causes it is shaped and determined, economic science has not as yet supplied answers which command general agreement. (R. G. Hawtrey)

"What determines profits?" is a key question for understanding how our economy works. (H. Minsky)

... one of the most convoluted and muddled areas in economic theory: the theory of profit. (P. Mirowski)

We need to know what profits have been, how they have been made, to what uses they have been put, ...: no light on these matters is shed by the analyses of value, of utility and disutility, that have preoccupied so many of us for so long. (C. Parry)

Much of what is usually offered as profit theory will be seen to be without merit. (M. Obrinsky)

But in my opinion contemporary profit theory is floundering in eclecticism and has lost touch with the major economic changes of the past twenty-five years. Until we have clearly established what it is we are talking about, what we say is not going to have much value. (P. Bernstein)

Profit theory has been largely concerned with specifying and isolating the 'function' for which profit is the 'reward.' This is scientifically irrelevant. (A. Murad)

Of all the traditional branches of economics, the theory of profits has had the greatest difficulty in attaining the "safe path of a science." Our knowledge of the causes determining value, or wages, is indeed incomplete; but in these fields we do not find, and have not found for some considerable time, that fundamental disagreement among competent writers about the mere direction of approach, or that utter failure of promising lines of inquiry to yield results of any great importance, which Kant declared to be the marks of a science still groping in the dark. (J. R. Hicks)

Nor do the modern variants add anything whatever on this score. For Debreu profits are simply a nonissue, while Arrow and Hahn make only passing reference to profits — and that only as a historical introduction. Whatever may be the usefulness of these idealized theoretical constructs, they cannot be said to throw any light on the profit issue; surely, therefore, they fail to capture the essence of a capitalist market economy. (M. Obrinsky)